The widespread power outage that recently plunged into the darkness of Portugal and Spain, shed light on the enduring value of cash during critical circumstances. The event also prompted questions about the truly decentralized nature of cryptocurrencies, given its reliance on centralized power infrastructure.

Beincrypto spoke with Certik, Brickken, Wanchain and Chain money representatives and learned what this means for the public’s trust in Crypto, and what the sector needs to provide financial services, even if centralized sales channels fail.

Digital finance will be suspended

The massive power turmoil last week left millions in the darkness of Spain and Portugal, knock-on effects on parts of France and Morocco.

According to a Baker Institute study, Spain lost about 15 gigawatts of capacity in just five seconds. This represents 60% of the country’s electricity demand. The suspension lasted about 18 hours.

Without the internet or electricity, daily financial products such as home banking services, digital wallets, and ATMs have become outdated.

“If the grid fails, the entire ecosystem behind these systems will go down. The mobile phone cannot connect, the ATM cannot shut down, and the internet-based wallets become inaccessible. At such a moment, the digital economy exposes power.

During those times, cash won the throne of preferential payments.

“This is why access to physical cache is important not only in developing countries, but also in developing countries, as seen during the recent outages in Europe. Digital systems, whether centralized or decentralized, ultimately rely on power and connections. Cash provides a reliable fallback in scenarios where digital tools fail.

The episode also raised questions about the ease of use of cryptography during times of crisis.

Is decentralisation in Crypto meaningless without access and power?

The demonstrated need for banknotes during infrastructure disruptions suggests that, despite being a modern financial innovation, Crypto is still out of reach of its predecessors in difficult situations.

Despite the central principles of decentralization, blockchain technology relies heavily on centralized infrastructure.

“For example, most blockchain nodes are hosted by a small number of centralized cloud providers like AWS. This not only creates a single point of failure, but also exposes the blockchain network to external control. Essentially, blockchain runs on the internet. Without blockchain, blockchain won’t work. Wanchain CEO Temujin Louie, who told Beincrypto, means that flaws and bugs in its client software can affect the entire network.

The same limitation applies to applications that manage crypto assets and process transactions.

“Blockchain could be decentralized, but access isn’t. Most users rely on internet service providers, central exchanges, and mobile devices. All of these are tied to the country’s power grid and communications systems. Without these utilities, the decentralized promise of crypto would actually be irrelevant to the average user.

Cryptocurrencies can inadvertently undermine public confidence in their capabilities by not acting as a true alternative financial solution when necessary.

Power outages as a test of public trust

If a traditional system becomes unstable due to an event such as a power outage, we assume that cryptocurrencies cannot provide accurate functional financial alternatives. In that case, there is a risk that the public will lose faith in their ability to become a viable and excellent financial system in the long run.

“Public trusts rely on perceived trust. If cryptography is considered to fail under stress, users may hesitate to resort to it. This is especially true for people who are not yet used to space.”

Trust in payment methods grows from ease of use, so if crypto wallets are not accessible in emergencies, individuals may be reluctant to use them as their primary payment methods.

Still, experiencing these issues can pave the way for future reinforcement.

“These events could highlight weaknesses that lead to better solutions. Just as early Internets had to overcome outages, Crypto is still evolving to meet real-world demands,” added D’Nofrio.

Existing features within Crypto technology already allow for some offline use, and by extending these, it could provide a clear direction for development.

Offline cryptographic potential provides a faint light of resilience

Certain existing cryptocurrency systems already incorporate several design features that reduce reliance on stable power grids.

“Some hardware wallets with long battery life and offline capabilities offer a glimpse of resilience, especially with peer-to-peer transfers,” says Newson.

D’Onofrio pointed out other available tools, but he revealed that it lacked the widespread adoption and ease of use required for widespread use.

“There are some interesting developments, such as satellite nodes, mesh networks, or ultra-low power wallets. These systems are working on more resilience, but have not yet been widely adopted. Currently, most crypto ecosystems still rely on traditional infrastructures.

Similar considerations have arisen when discussing the possibilities of decentralized physical infrastructure networks (depins) to reduce overall dependence on centralized power grids.

Can Depin make cryptographic networks more resilient?

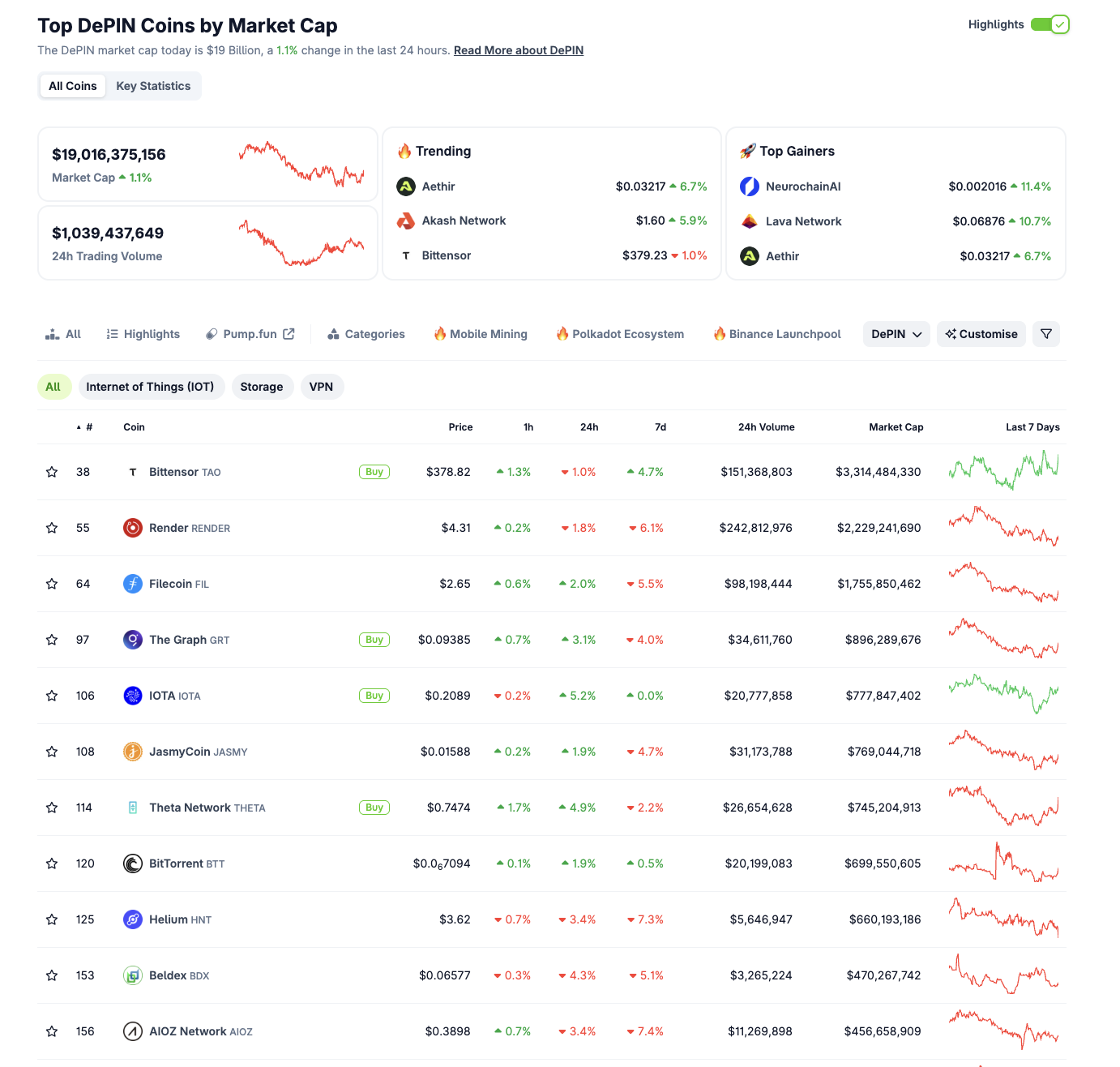

Dep gained significant traction in the crypto sector last year, last year, as it could use blockchain and token rewards to manage, own and operate infrastructure. Today, the Depin industry boasts a market capitalization of over $19 billion and trading volume of over $1 billion.

Top Depincoin by market capitalization. Source: Coingecko

These networks are increasingly promoting network connectivity and community-based access to power. Some experts have suggested that the technology may help mitigate the impact of outages affecting centralized distribution channels.

“In theory, territory could increase the resilience of the grid and potentially reduce the chances of a national blackout. They would introduce flexibility and programmaticity that would theoretically promote demand response programs and encourage them to adjust energy usage during peak times,” Louie noted.

At the same time, he pointed out that Depins alone cannot provide a complete solution to large-scale problems such as widespread power outages.

“However, it is too early to think of Depins as a comprehensive solution that can solve the country’s electricity stability problems on its own. Rather, it should help reduce grid stress and demonstrate the value of depins in a real world setting by focusing on target integration into existing grid infrastructure,” Louie added.

From his point of view, D’Onofrio said Depins could provide a more complete solution when combined with other tools that enhance local resilience to these threats.

“There is a possibility that there will be more integration with distributed infrastructure, such as community-run mesh networks and solar nodes. When combined with tools such as delayed broadcast wallets and peer-to-peer communication protocols, these systems can continue to be encrypted even if traditional services go down.

Despite that difference, crypto and traditional finance ultimately tackle many of the same underlying issues when operating amidst infrastructure disruptions.

Policy Solutions for a Resilient Digital Economy

Last week’s blackouts on the Iberian Peninsula highlighted the enduring importance of cash as a financial lifeline in a time of crisis. With the global economic system relying on digital finance, experts highlighted the need of policymakers to develop lasting solutions that ensure infrastructure resilience and emergency preparedness.

“Policymakers must treat infrastructure resilience as a bedrock in digital finance, including diversifying energy sources, supporting local microgrids, encouraging offline crypto solutions, and regulatory frameworks.

Going forward, the strength of the digital economy will be determined by its physical infrastructure, and by prioritizing it, it could position cryptos for long-term success.