According to Arthur Azizov, founder of B2 Ventures, a private “aliance” of crypto services and financial technology companies, traditional financial institutions are increasingly shaping the narrative of the crypto sector and are poised to make the most profitable from current trends.

Azizov told Cointelegraph that the market cycle is dominated by investment instruments such as institutional investors, Exchange-Taded Funds (ETFs), governments and Stablecoin issuers.

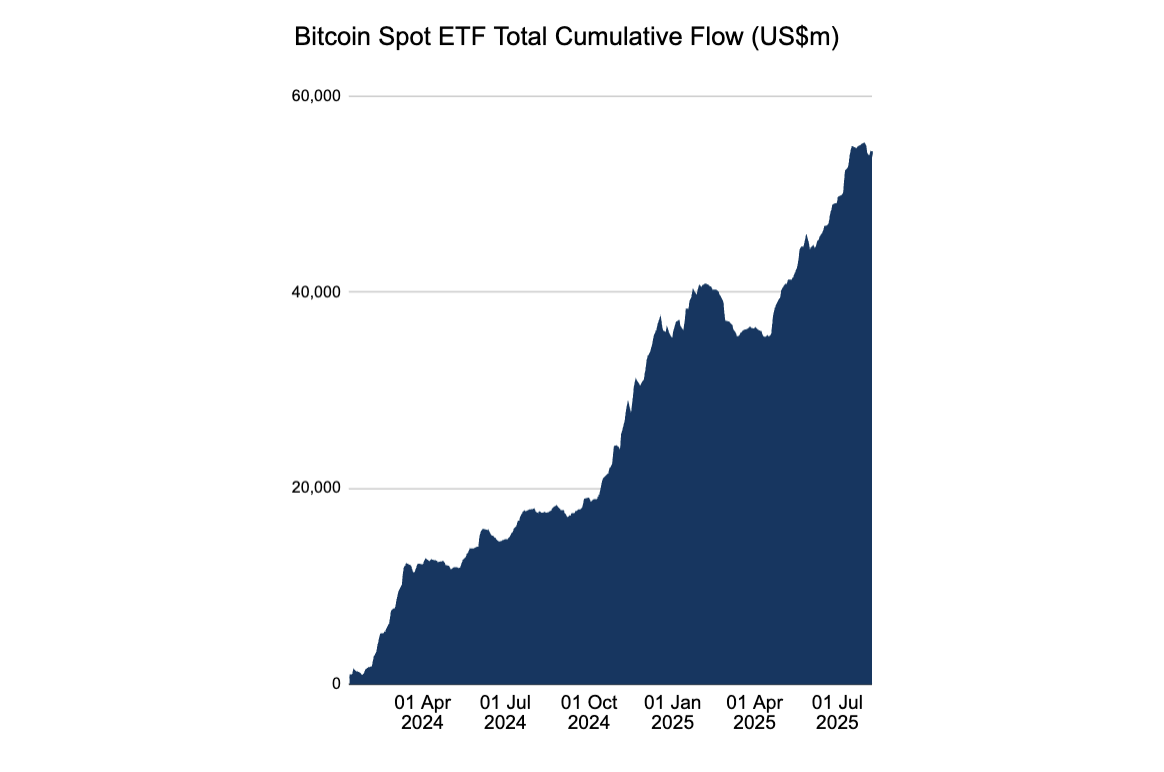

The total cumulative flow of Bitcoin ETFs shows that billions of dollars of capital have been sucked up into Bitcoin investment vehicles. sauce: Farside Investor

He also said that major banks will accelerate this trend in the near future. He said there is regulatory clarity to interact with the crypto once, and that it will be a “month problem” until these banks receive regulatory clarity and between the time it takes them to fire the Stable Coins. Azizov added:

“Banks have a considerable user base. They already have their own clients. Those clients are loyal to those banks. And it’s relatively easy for them to implement crypto into their operations.”

These institutions have already changed the landscape. In the future, it will change even more, and I will say it’s not good for small startups,” he continued.

The growing presence of crypto institutional investors, banks and businesses has created tensions between these traditional financial institutions and Cypherpunks, which launched a crypto movement advocating for the full decentralization of the financial system.

Related: Bitcoin Investment Bank Coming to El Salvador – Government Regulatory Authority

The government is also promoting the institutionalization of cryptocurrency.

The government also has economic incentives to regulate crypto and bring it within the traditional financial system.

“The story is not just because it’s mainstream, but also regulating cryptography to attract technology companies, young talent and fintech startups. Azizov told Cointelgraf.

This increase in regulations means focusing on Money Laundering Anti-Money Laundering (AML) regulations and Knowledge Customer (KYC) requirements, he added.

AML and KYC are already needed for many retail crypto consumer applications in the Asia-Pacific region (APAC) region and Europe, and Azizov said he expects this trend to take shape in the US as well.

The emphasis on consumer surveillance and officially registered accounts is carried out against the value proposition of Decentralized Financial (DEFI) that promises unauthorized access to the censor-resistant financial system.

magazine: Crypto wanted to overthrow the bank, but now they’re becoming them on Stablecoin Fight