Investment advisors are the largest non-retail trackable cohort of purchasing exchange sales funds for Bitcoin and ether, according to new data from Bloomberg Intelligence.

Bloomberg ETF analyst James Sefert said on Wednesday’s X-Post that the investment adviser “controls known holders” of ether ETFs, investing $1.3 billion or 539,000 ether (ETH) in the second quarter, up 68% from the previous quarter.

sauce: James Safert

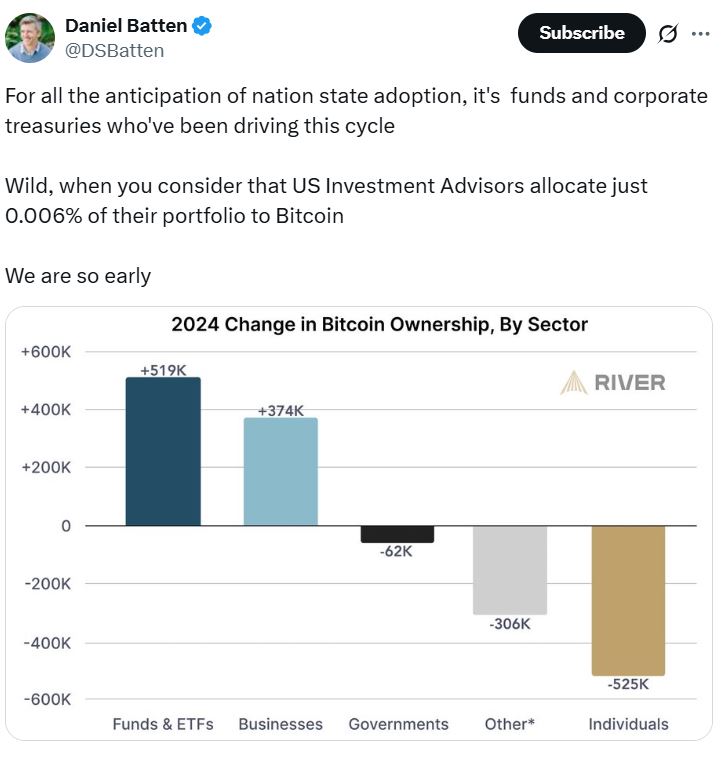

The same was observed in the US Spot Bitcoin ETF. “Advisors are by far the largest holder at the moment,” Seyffart said Monday, with over $17 billion exposure on 161,000 Bitcoin (BTC).

In both cases, exposure from investment advisors was nearly doubled by hedge fund managers.

However, Seyffart said this was based on data submitted to the SEC.

“This data is primarily 13F data. It only accounts for around 25% of Bitcoin ETF stocks. The other 75% is owned by non-filers.

Crypto ETF data tells a story, analysts say

Vincent Liu, Chief Investment Officer at Kronos Research, said the data indicates a shift from a speculative flow to a long-term portfolio-driven allocation.

“As top holders, their strategic positioning provides a deeper liquidity and a lasting foundation for integration of crypto into the global market,” he told Cointelegraph.

Liu said as more advisors adopt Bitcoin and etheric ETFs, crypto is recommended and recognized as a long-term diversification tool within traditional portfolios.

“As more Altcoins join the ETF space and assets that include harvest volumes such as Staked Ether Gain approvals, advisors can use Crypto to not only diversify their portfolios, but also generate returns and encourage broader, longer-term adoption.”

Room for advisors to further lean more towards crypto ETFs

Some people speculate that as regulations come into force, the number of crypto ETF financial advisors could explode. In July, Fox News Business predicted that trillions of dollars could flood the market through financial advisors.

Pav Hundal, lead market analyst at Australia’s Crypto Broker Swyftx, told CointeLegraph that Bitcoin ETF’s investment advisor holdings have increased by around 70% since June.

“We could still be only in the early chapters of growth, and we get two types of participants, just like investments that start building momentum.

“That dynamic will be rolled out both institutional and retail investors. Ethereum is pushed to an all-time high, with US policymakers hinting at a softer financial stance as the labor market shows a crack.

Regulations to play a role in the growth of cryptographic ETFs

Meanwhile, Kadan Stadelmann, chief technology officer for blockchain-based Komodo Platform, told Cointelegraph that the data has made clear that “Main Street is seeking access to the crypto market through Wall Street through financial advisors.”

“Etheric ETFs have experienced the success of Bitcoin ETFs, but they represent a smaller, early transition to institutional adoption. And we are not talking about small Wall Street companies, but about the biggest names like BlackRock and Fidelity,” he added.

Ether ETF top holder according to 13F data at Q2. sauce: James Safert

But in the long run, Stadelmann believes that “regulatory reality” will play a role in the growth of financial advisors in the crypto market.

The Securities and Exchange Commission launched the project Crypto in July to promote blockchain innovation, and the US House passed the Genius Act the same month.

“In lower Manhattan, crypto is undoubtedly seen as fairness rather than revolution, and following the moves by these big players, now followed by financial advisors who are confident in regulatory clarity,” Stadelman said.

But Stadelmann believes that a crypto-friendly government can throw a spanner at work if it is voted in the next election.

“The approach to cryptography can scare the minds of financial advisors that they could freeze into the crypto market at facilities and that offering products could lead to loss of licenses,” he said.

“It hasn’t been seen yet, and Democrats have been able to leave the new status quo because of market demands.”