This is a segment of the BlockWorks Daily Newsletter. To read the complete edition, Subscribe.

“You don’t have to be a rocket scientist. Investment isn’t a game where a man with 160 IQ beats a man with 130 IQ.”

– Warren Buffett

Warren Buffett is the most cited person in the history of this newsletter. The best achievements of his seven-year career must fulfill him with pride.

Of course, he frequently quoted him because he has a lot to say about investments and markets.

But he’s not making fun of it for us.

It really thinks about how he thinks about investment, so I can know. And there’s a lesson: the greatest investors of all time invest primarily through common sense.

Investment is so common sense for him that anyone can do it:

“You don’t have to do extraordinary things to achieve extraordinary results.”

“If you can separate yourself… From the crowd, you’ll become very rich. You don’t need to be very bright.”

“You don’t have a brain. You need a temperament.”

All of this, like many of his investment adages, is cumming as excellent life advice.

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes.”

“The pond you dive into is more important than how well you swim.”

“Unless you’re doing too many things wrong, you need to do very few things in your life.”

Buffett attributes his incredible return on investment to just about 12 “really good decisions” he made – on average about every five years.

And he lived his life the same way. The sixth most abundant man in the world still lives in the house he bought in 1958 for $31,500.

Conversely, his investment process was as simple as the life he led. For example, he does not build a financial model. For example, he reads a lot.

“I probably read five to six hours a day. I read five newspapers a day. I read quite a few magazines. I read 10kk. I read the annual report.”

He explained that the compound interest knowledge gained from all the readings he explained allowed him to attack when an unusual opportunity came.

“If someone calls me about investment… I usually know in a few minutes if I’m interested.”

For example, in 2003, he bought home builder Clayton Holmes (company as a whole, not just the entire company) for $1.7 billion after reading SEC filings and talking to management over the phone.

In 2008, he declined a request to rescue the Lehman brothers simply because their financial statements were too complicated (a huge red flag for him).

At the height of the subsequent financial crisis, he poured $5 billion into Goldman Sachs after a call with the CEO and hours of negotiation terms.

Of course, the results speak for themselves. Berkshire Hathaway’s shares rose by more than 5,500,000% from 1965 to 2024. 59 year.

By comparison, the total revenue from the S&P 500 Index over that period was “just” 39,000%.

“Buffett’s returns seem neither luck nor magical,” academic research found “but rather, “rewards for using leverage focused on cheap and safe high quality stocks.”

However, recently, Buffett hasn’t found many stocks of cheap, safe and quality enough to take advantage of for the first time in 20 years. Berkshire Hathaway holds more cash than listed shares.

That’s not because Buffett is worried about what politics and tariffs mean for the stock market. “I’m not trying to make a profit from the stock market,” he said.

But failing to find a good business at an affordable price will probably tell us something about his views on the market as a whole.

Buffett Acolyte Chris Bloomstran estimates that S&P 500 investors should expect revenues of “less than 1.1% per year over the next decade” as valuations and profit margins are currently rising.

If so, the “really good decisions” Warren Buffett made, and, in any way beneficial, retired with a record amount of cash, could be a history-decreasing.

“Investment is the greatest business in the world because you don’t have to swing,” explains Buffett in typical Buffett fashion. “All day long, you’re waiting for the pitch you like. Then when the fielder is asleep, you step up and hit it.”

With the market recovering over the past month, despite seemingly bad news about tariffs, he probably doesn’t see any more fat pitch before he retires at the end of the year.

However, he told young investors, “In the long term, stock market news would be good.”

Let’s check the chart.

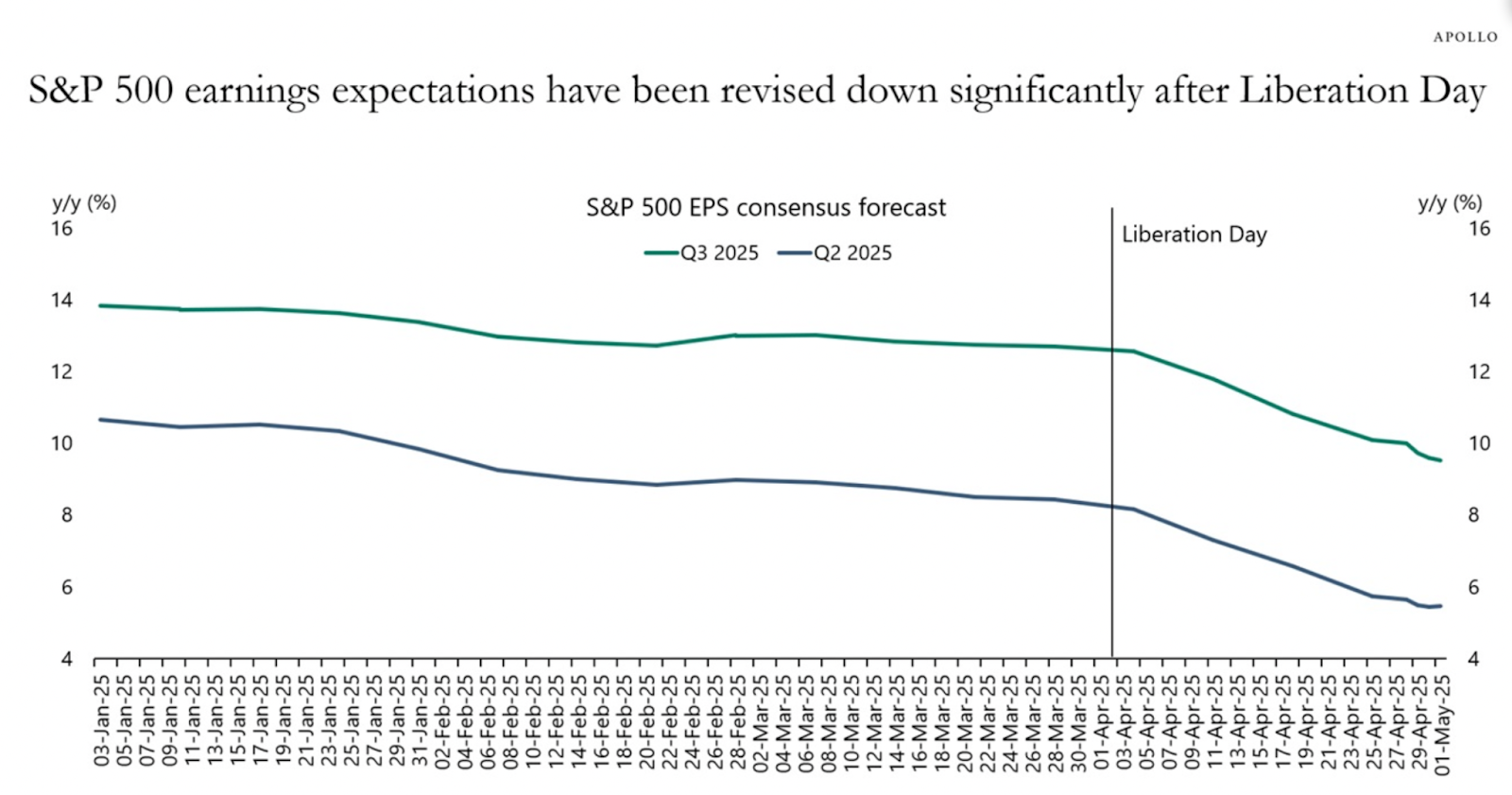

Inventory is increasing, but estimates are declining.

It’s reassuring that the stock has returned before “liberation day,” but that doesn’t mean that nothing happened. According to Torsten Slok, revenue estimates are significantly lower and inventory is significantly more expensive.

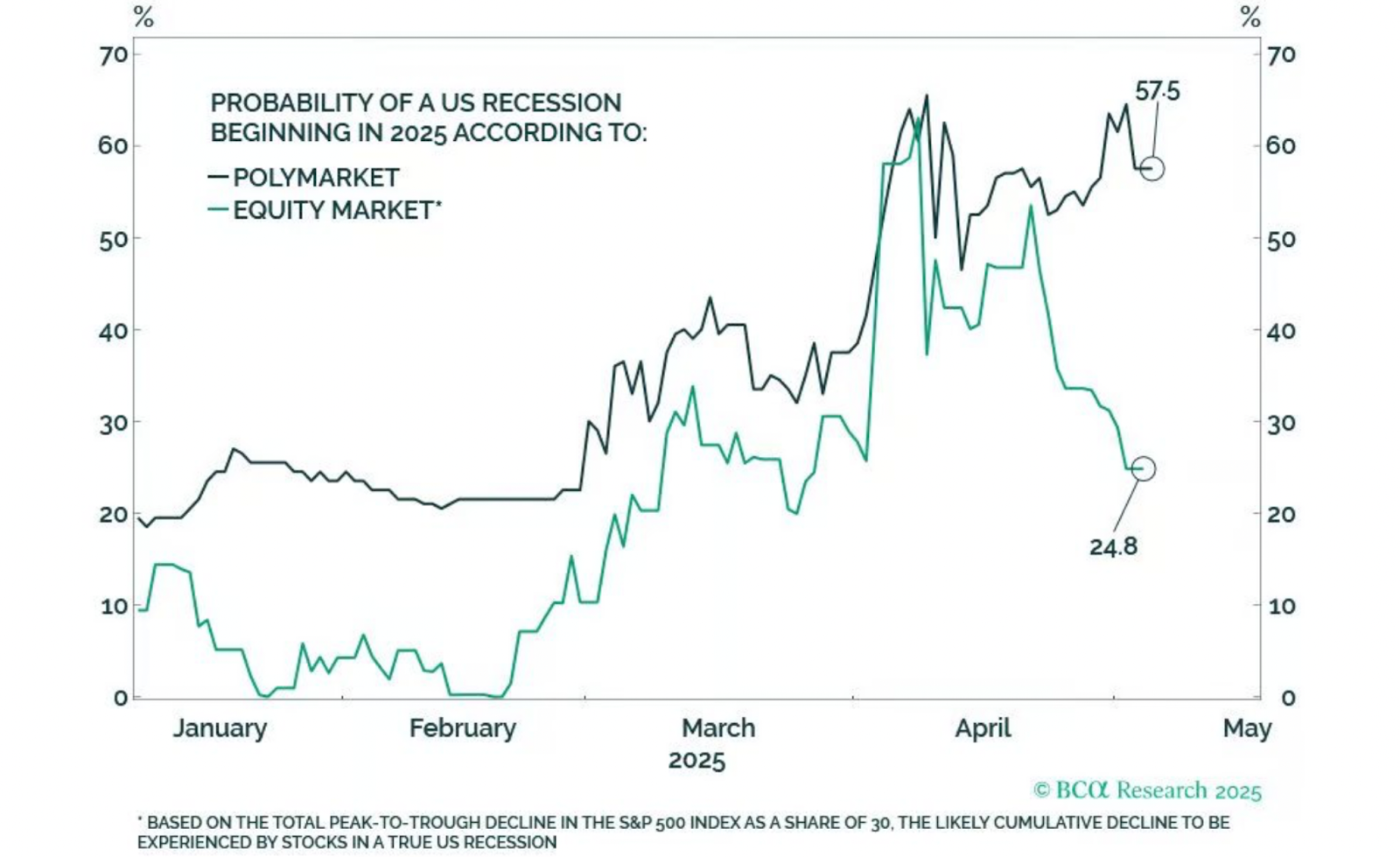

Stock markets and betting markets:

The odds of multi-tier markets suggest that a US recession is still slightly likely, but BCA research estimates that the stock market is currently priced 25%.

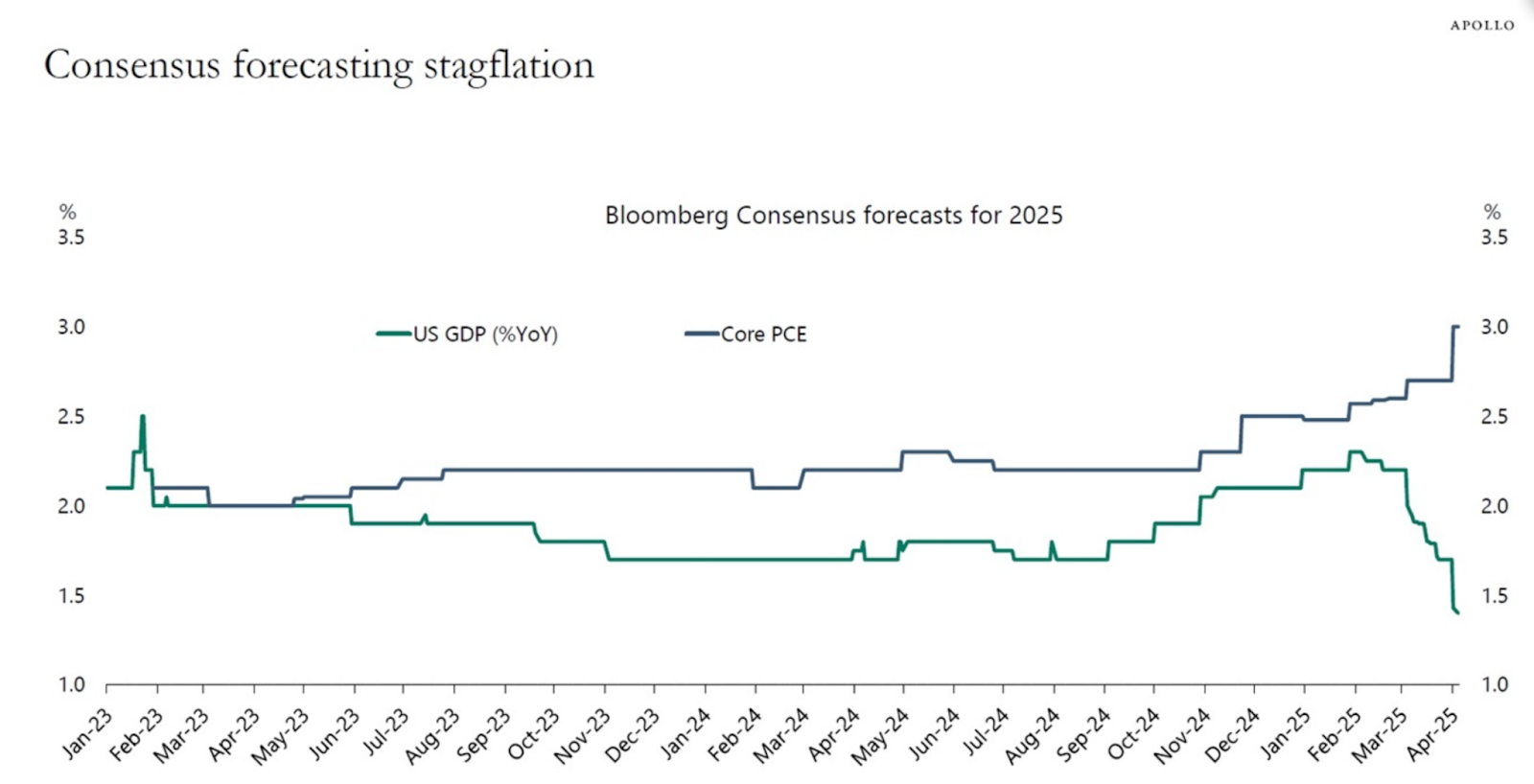

Economists price stagflation:

Torsten Slok points out that rising inflation and increasing GDP estimates indicate that STAGFLATION is coming. At FOMC Press this week, Federal Reserve Chairman Jerome Powell appears to have agreed that “if the massive increase in tariffs announced is maintained, it is likely to generate increased inflation, slower economic growth and increased unemployment.” ”

It may get worse than that:

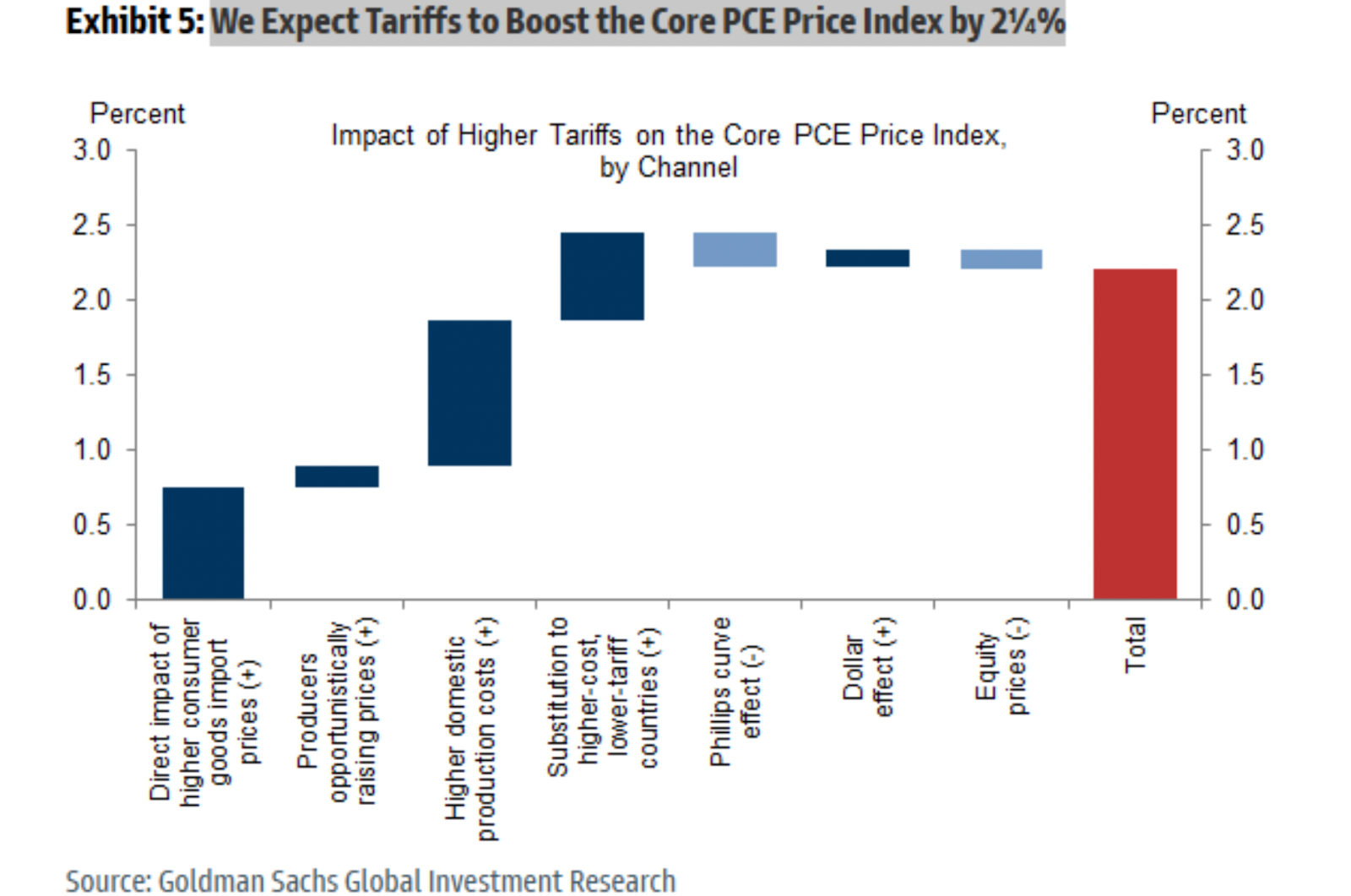

Analysts at Goldman Sachs estimate tariffs will increase by a whopping 2.25%.

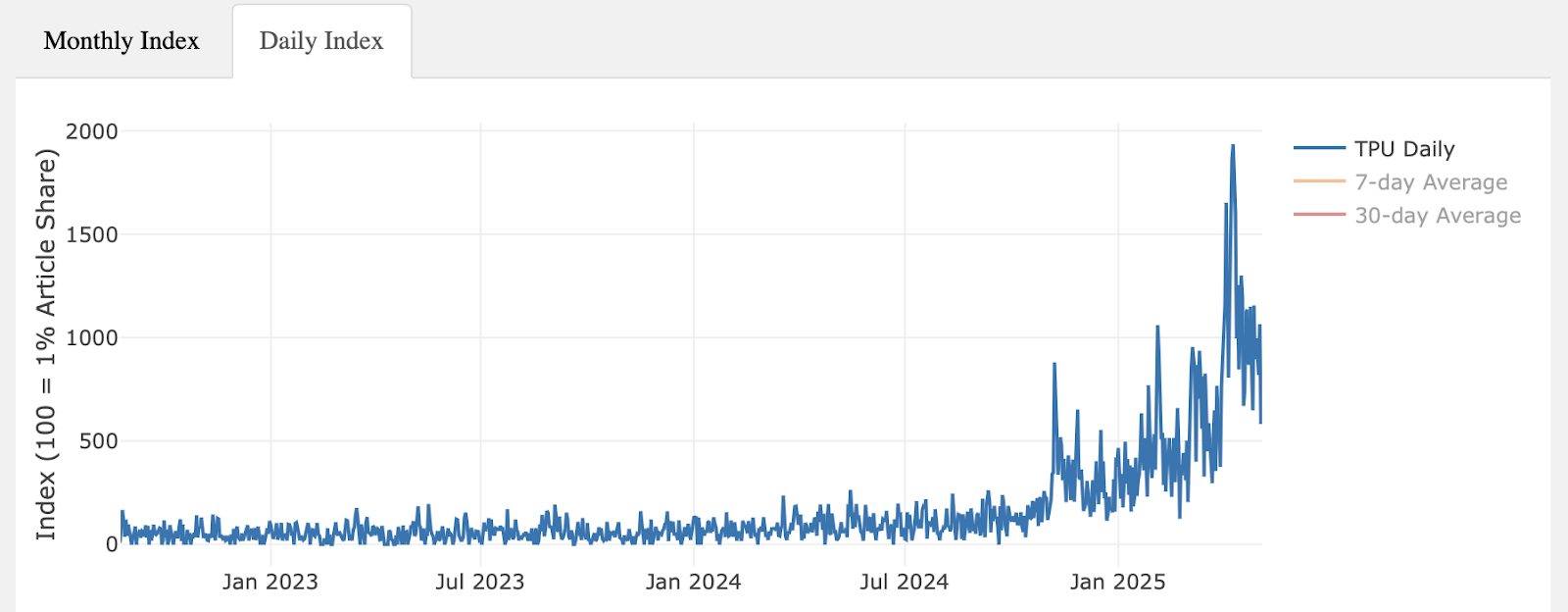

I don’t think trade policy is that uncertain:

Markets are said to avers to uncertainty, and despite all contradictory headlines, the trade policy uncertainty index has declined.

Actual transactions are also declining:

Container reservations from China to the US fell 49% year-on-year. President Trump said it’s a good thing because it doesn’t mean “we have little money.” But he seems to want it Some The level of trade with China – he posted this morning that the current 145% tariff rate could fall to 80%, suggesting that it be left to Treasury Secretary Bescent.

Trade with China was a good thing for us:

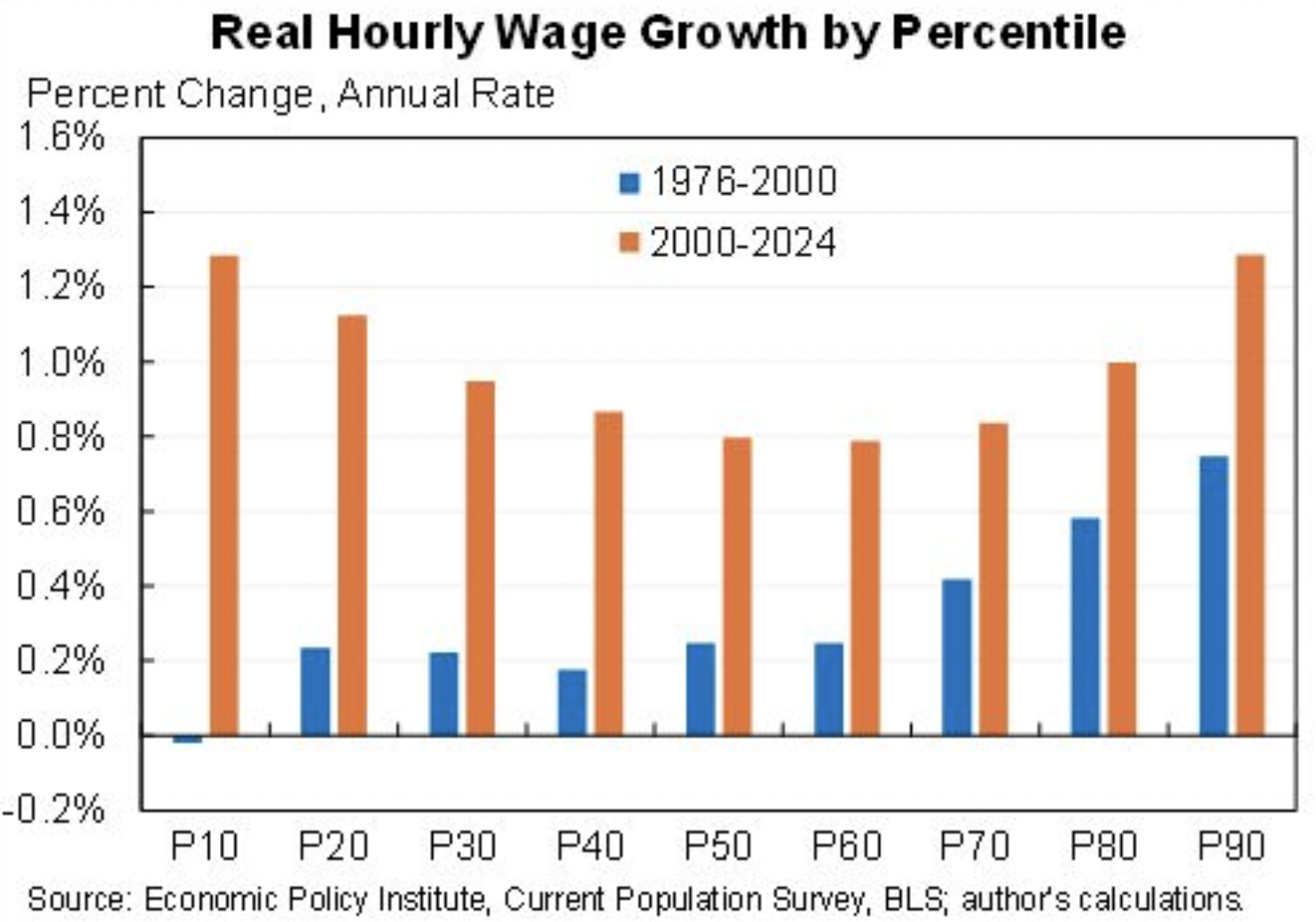

Jason Ferman says US wages have grown faster over 24 years rear China has joined the WTO (orange bar) more than 24 years ago (blue line). Most surprising, wage growth has been far more fair than before in these 20 years of globalization.

A deal with China was a good thing for us (2):

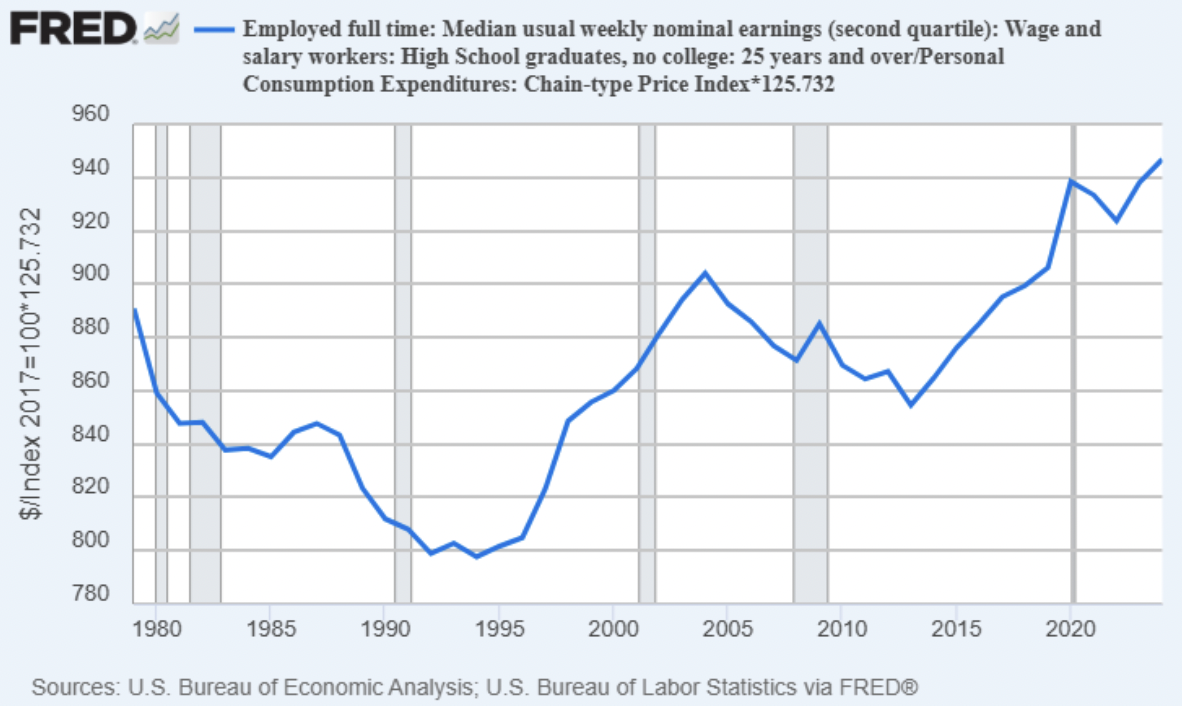

Jeremy Holepodal digs a little deeper and discovers that the actual (i.e., inflation-adjusted) revenues of high school graduates without a college degree are higher than at least 50 years (and, he speculates that it hasn’t been before, but hasn’t gone back any further). That seems to be getting even better too. This week’s Wall Street Journal reported on high school juniors who received a job offer of $70,000 a year as his school offers welding classes.

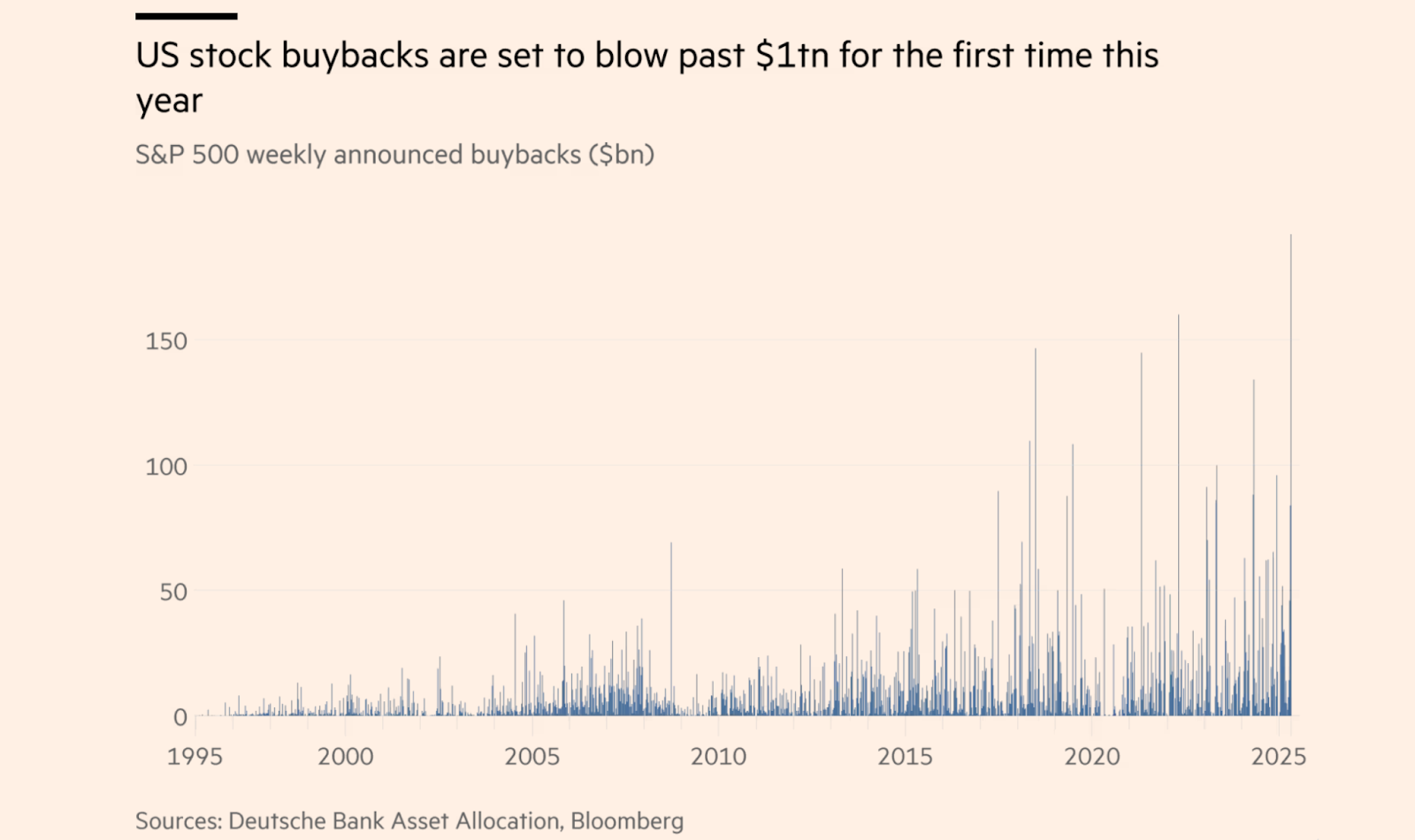

Companies are still buying:

FT reports that US companies are on track to buy more than $1 trillion in stock this year.

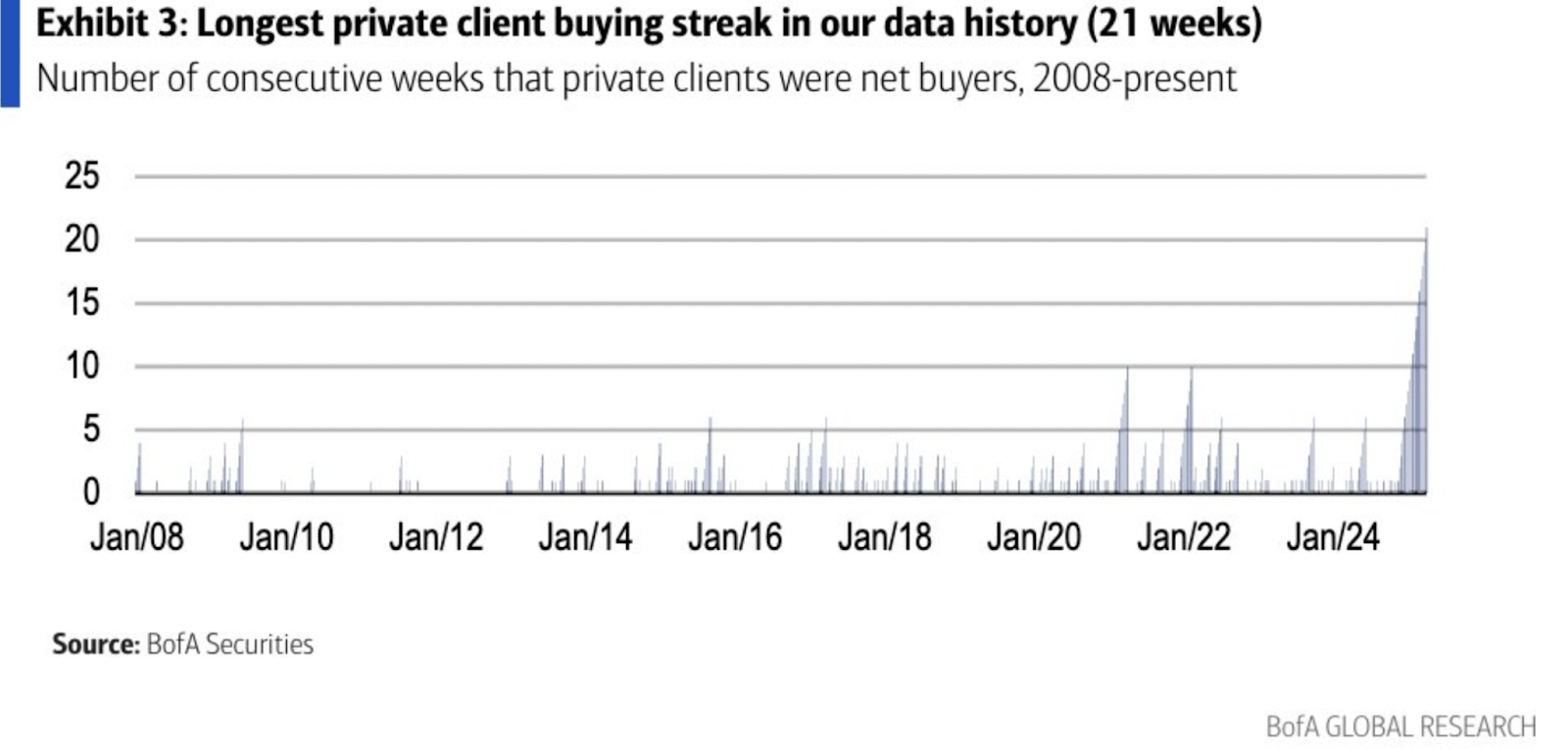

Retail investors are still buying: