After years of high-risk investments, investors are now shifting some money towards safe investments.

They have poured cash at the fastest pace in gold, ultra-short Treasury ETFs and low-volatile stocks since March 2023. They act amid concern that the World Trade War represents a lasting threat to economic and revenue growth.

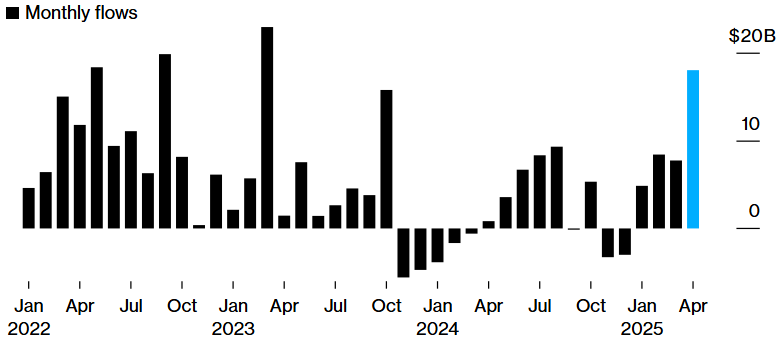

Data edited by Bloomberg Intelligence These three groups have seen a total inflow of about $18 billion so far in April, with about two-thirds of them flowing into cash-like funds.

SPDR Bloomberg 1-3 Month T‑ Bill ETF (BIL) raised $8 billion this month, followed by the iShares Short Treasury Bond ETF (SHV) for $3 billion, and iShares 1-3 Year Treasury Debt (Shy) won $1 billion.

Gold-related funds have earned the third consecutive month of profit, but after nearly two years of outflow, low-power equity ETFs have rebounded.

Investors poured $18 billion into safe funds in April. Source: Bloomberg

Risk-off sentiment escalated Monday when concerns over the Federal Reserve’s independence sparked the sale of US stocks, dollars and long-term Treasury debt. The S&P 500 index fell 3% that day.

Trump’s warning to the Fed has forced investors to go into safe funds

In addition to his mood, President Donald Trump warned that if the Fed doesn’t cut interest rates immediately, the US economy could slow down. As a result, there has been a surge in safe havens like the Swiss franc and the Japanese yen.

“The market is looking for policy clarity from Washington, which remains elusive,” said Ryan Grabinski, senior investment strategist at Strategas Securities. “Consumers, businesses and even the Fed are reluctant to make big decisions because there’s a lot to be unclear.”

Despite the risk-off slope, broad index funds continue to attract above-average inflows. Leading the group is the ISHARES Core S&P 500 ETF (IVV), which has drawn $35 billion over the past month.

“We continue to see signs of caution, but it’s not panic,” said Cayla Seder, macro multi-asset strategist at State Street Global Markets. “At a high level, this appears to have less flow to stocks for both stocks and cash, and there appears to be more demand. Everything means more room to look for shelters if your hard data starts to weaken.”

Elsewhere, investors still chase high risk, with stocks outstanding among the top 50 ETFs leveraged by assets since Trump’s so-called “liberation date” on April 2nd.

“The idea of investors shopping remains,” says Mark Hackett, chief market strategist nationwide. “Despite record levels of pessimism, retail investors continue to buy.”