The UK completed a £8.1 million capital raise shortly after BTC exceeded 2,050. Can accumulation of BTC raise stock prices?

summary

- The UK has seen a surge in Smarter Web Company’s shares surged 208% in the past month following the acquisition of Mass BTC.

- The company recently purchased 225 BTC and raised its total holding to 2,050 BTC. It reflects the broader trend of companies renewing their BTC holdings to raise stock prices.

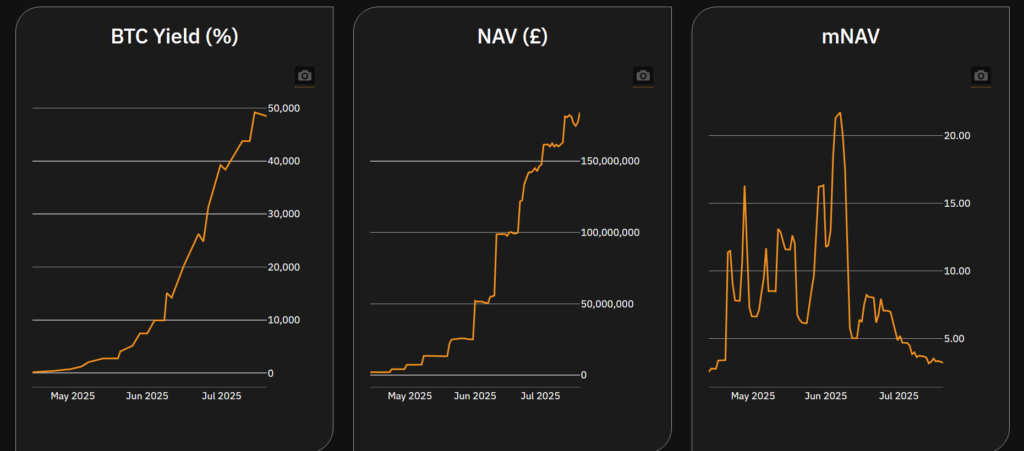

- As of August 4, the company holds a total of 2,050 BTC in reserves, during which the share price is trading at £230.75. According to the company’s official website, Smarter Web Company’s market net asset value was 3.22, down from nearly 20 in June.

According to a recent press release, the total offer generates the company’s capital worth £8.1 million ($10.75 million). Smarter Web Company’s funding round provided £2.05 per share. The newly issued shares are expected to be available for trading on August 7, 2025.

Data from Google Finance shows that the stock has reached 208.094% over the past month as it continues to increase cryptographic protected areas by purchasing more BTC (BTC). In early July its holding was 543.52 BTC, jumping to 2,050 BTC by the end of the month. This 4x BTC holding boost was converted to a 200% stock jump on the stock market.

The same thing happened in June when SWC shares reached peak prices at £500. June was the first month the company reached 500 BTC since it established its BTC Ministry of Finance’s stockpile strategy in April 2025.

Price list of smarter web company stock prices for the past year on August 4, 2025 | Source: Aquis.eu

You might like it too: The UK’s smarter web company has reached 1,000 BTC milestones

The impact of BTC stocks on stock prices

On April 28, 2025, the smarter web company announced its “10-year plan” and its Bitcoin financial strategy. The company previously owned BTC internally. However, this was the first time the company had declared its commitment to stockpiling BTC and announcing its purchases to the public.

Unfortunately, the transition to BTC companies was not immediately recognized as a positive indication among market investors. On April 28, its share was still stuck at a 52-week low of £3.125, but its market capitalization was still at £5.1 million. At the time, the first BTC purchases the company made were still standing at just 2.3 BTC of its reserves.

Until early June, Smarter Web Company’s market capitalization rose from just £5 million to £150 million in just two months. In fact, the stock price has skyrocketed. I hit 500 pounds above my previous low and barely reached £0.05. This has led to a stock price jump of over 1,000% two months after the BTC strategy was announced.

Chart depicting BTC yields, net asset value and market net asset value of smarter web companies | Source: Smarter Web Company

As of August 4, the company holds a total of 2,050 BTC in reserves, during which the share price is trading at £230.75. According to the company’s official website, Smarter Web Company’s market net asset value is 3.22. This means that investors will pay a share price of £3.22 for every pound of Treasury value held in Bitcoin and cash.

Michael Saylor’s strategy is a company that many have cited as inspiration for creating dozens of BTC-focused companies afterwards, with MNAV of 1.65, meaning that its stock is trading at a ratio of 1.65 compared to Bitcoin Reserve.

How does Smarter Web Company compare to other BTC-centric companies?

Smarter web companies are not isolated cases. Many companies in the past few days have announced the formation of their BTC financial strategies. This usually involves announcements issued almost daily about recent BTC purchases and their total holdings.

On June 30, Banadi Coffee, struggling with Spanish coffee chains, saw a surge in stock by 242% after receiving approval for a new strategy to start getting more BTC on its balance sheet. Today, the shares have boosted its value slightly after announcing its recent purchase of 7 BTC, increasing its holding to 85 BTC.

Despite holding a small BTC Trove on BTC Trove compared to something like MicroStrategy, which currently owns 628,791 BTC, news of the 7 BTC purchase was enough to raise the stock price by 0.73% in the market.

Meanwhile, the same thing has not yet happened to bravery. Another publicly available UK company that established the Bitcoin Treasury on August 1st. Similar to the start of the smart web company Bitcoin, its inventory appeared to be down 4.35% on past days compared to the previous day. At the time, the stock was currently trading at 0.033 euros.

Today, the stock remains at 0.03 euros. However, this may change as we have not announced our BTC purchasing activities.

According to data from Bitcoin Treasuries, 287 entities hold Bitcoin. This includes agencies and state governments. Over the past 30 days, this number has increased by 22 entities, reflecting the continued growth of companies that hold BTC on their balance sheets.

read more: Former Prime Minister: Britain risks falling behind in codes