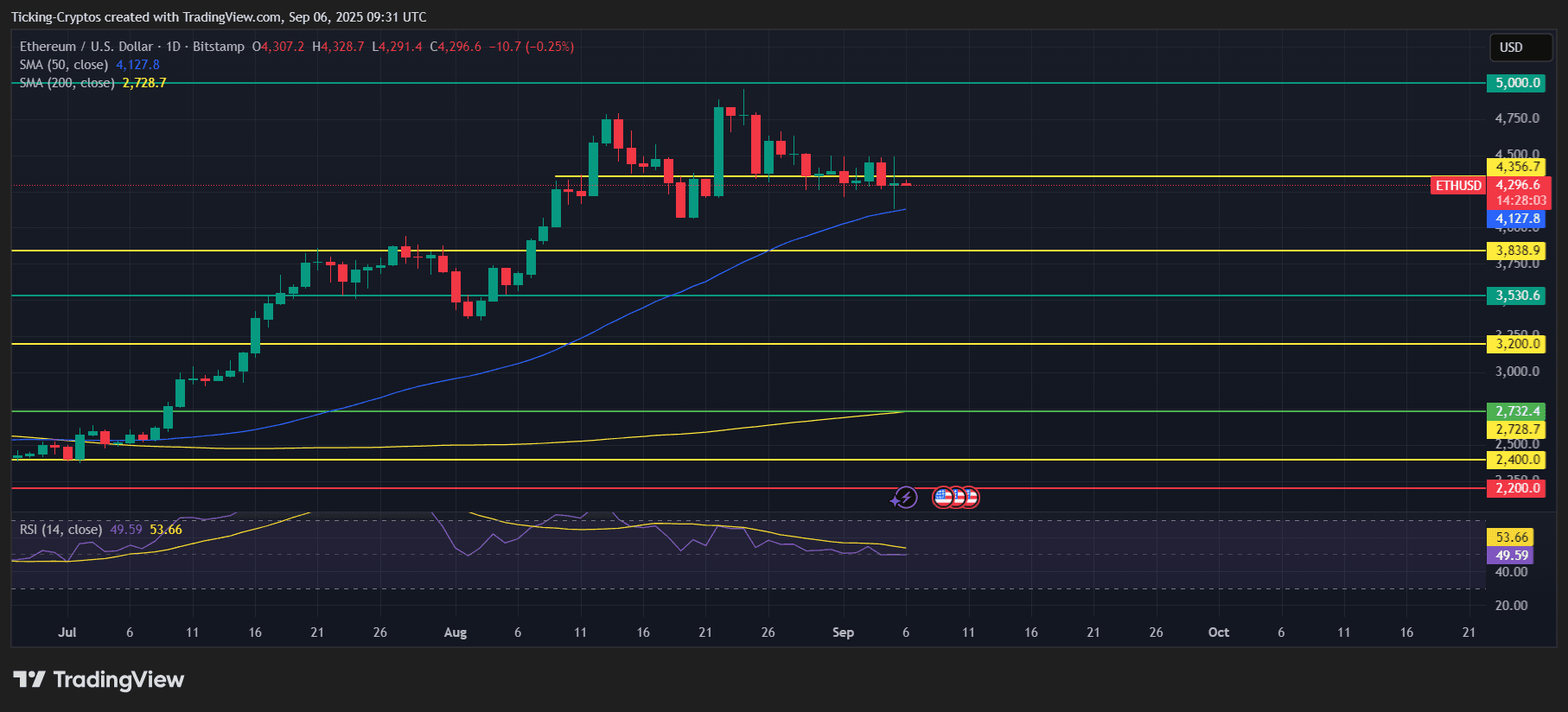

Ethereum ($ eth) It is at the crucial point of the chart. After weeks of volatility, the price will merge around $4,300, balancing strong technical support and harsh resistance. As Crypto Market searches for directions, Ethereum performance allows you to set the tone for the next major Altcoin movement:

Key support and resistance levels

- Immediate support: $4,127 (50-day SMA)

- Resistance zone: $4,356 – $4,500

- Secondary support: $3,838 and $3,530

- Key support: $2,728 (200-day SMA)

- Upside Target: $5,000 psychological barrier

ETH/USD 1-Day Chart – TradingView

The chart shows ETH is repeatedly testing the $4,127 level. Here, the 50-day moving average serves as a cushion. The decisive bounce here could promote a pushback to $4,356 or later, but the breakdown could open the door to $3,838 or $3,530.

Momentum and RSI signals

Ethereum’s RSI is hovering nearby 49–53sitting on neutral ground. This suggests that the market is still undecided and neither the bull nor the bear holds control. Breaks above RSI 55 can cause bullish momentum, but slips below 45 can also confirm downside pressure.

Portfolio Manager Takes Ethereum Prices

From a professional trading and portfolio management perspective:

- A bullish scenario: If the ETH breaks beyond $4,127 and exceeds $4,356 resistance, it’s likely to pass to $4,750, and ultimately $5,000. Portfolio managers can justify an increase in exposure if the institutional inflow reflects the strength of Bitcoin.

- Bearish scenario: The risk of under $4,127 will drive sales pressure and bring ETH back to $3,800 or $3,530. The portfolio manager may consider a position trimming or hedge exposure if this support fails.

Risk management remains important as ETH is integrated near short-term trendline support.

Ethereum price forecast: What’s next for ETH prices?

In the short term, $Ethereum could trade within Range of $4,127 – $4,356 Until the catalyst gives off momentum. If it exceeds $4,356, a retest of $4,750 will be set, and ultimately $5,000. On the downside, losing 50 days of SMA could trigger sharper fixes towards $3,800 and $3,530 before stabilizing.

For long-term investors, the $2,728 200-day SMA remains a line in the sand. As long as the ETH is kept above it, the macro-up trend remains.