Famous cryptocurrency analyst Michael Van de Poppe shared his bullish outlook on Ethereum (ETH) in an X post dated May 17, 2025.

He claims that ETH prices below $2,400 are “steals” following the recent surge, suggesting that Ethereum can continue its upward trajectory. His post included a chart showing Ethereum’s sharp rebounds.

The chart shows the high support and key resistance zone of ETH

The TradingView chart shared by Van de Poppe shows Ethereum’s price action (USDT) against Tether in Binance Exchange. It shows ETH that had sharply intensified in early May 2025 after a long decline. The chart marks a clear high time frame support zone for ETH, close to $2,100, and a resistance area identified between about $2,600 and $2,800, with Van de Poppe specifically pointing to $2,750 as a resistance point.

Ethereum $2,400 Purchase Zone has been highlighted. sauce: x

Van de Poppe labels the $2,400 level as a “significant opportunity,” meaning that current prices still offer value before potential continuity. His predictions show the possibility of integration that is close to resistance, followed by a further rise.

Ethereum Eye Rise Breakout

van de Poppe’s analysis is consistent with optimistic growth across the crypto market. The current structure of Ethereum suggests that traders can monitor the $2,100 to $2,400 range for signs of support and accumulation.

Chart means bullish setup. With this setup, a confirmed breakout above the resistance zone can lead to further benefits. The chart directional arrow points to the new high, but no exact time frame is provided.

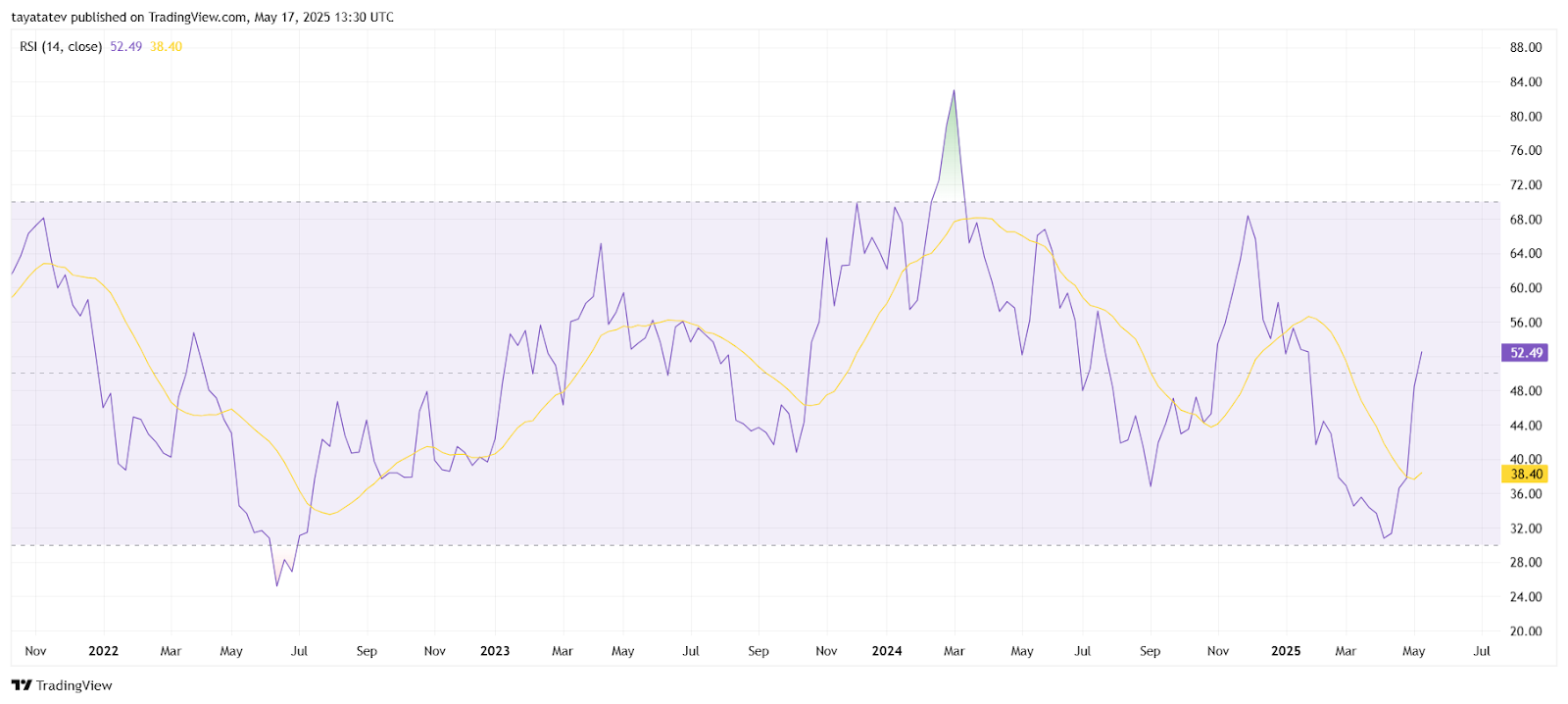

Ethereum RSI breaks key 50 midpoint

Meanwhile, Ethereum’s relative strength index (RSI) rose to 52.49, surpassing the neutral 50 mark for the first time since March 2025. The RSI’s moving average is currently 38.40, reflecting previous weaknesses.

The Ethereum RSI will break above 50 for the first time since March. sauce: TradingView

This upward movement indicates an increase in purchasing momentum. RSI measures the speed and intensity of price changes on a scale of 0 to 100. Levels above 70 are considered over-purchased, while levels below 30 suggest over-selling conditions. Positions above 50 usually indicate bullish pressure.

Ethereum’s RSI has remained below 50 over the past few months, reflecting seller control. The current breakout shifts this dynamic. The last meaningful advantage came when RSI temporarily surged to 85 in early 2024 and then surged backwards.

The current rise indicates a new trend change without extreme conditions. Unlike previous failed attempts, this movement also clears moving average.

Advances above both the average and midpoint levels of RSI indicate a reversal of the potential trend. It emphasizes an increase in emotional changes. This could support further profits if wider market conditions align.

As the RSI direction rises, traders have an early signal to monitor price continuity, especially when volume sees momentum.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.