KuCoin Pay is integrated with Pix, an instant payments network operated by Brazil’s central bank, allowing users to convert and spend their cryptocurrencies at any merchant that accepts Pix QR codes.

The launch will tap into one of the world’s largest cryptocurrency user bases, with some 26 million Brazilians, or about 12% of the population, currently using digital assets, the exchange said in an announcement Friday.

This integration supports instant conversion of cryptocurrencies to Brazilian currency (Brazilian currency is real) and allows users to transfer funds from their KuCoin accounts to Brazilian banks or make payments directly to merchants through Pix. It also features a multi-functional wallet tool to manage both crypto and fiat currencies within the KuCoin app.

https://www.youtube.com/watch?v=GbZWNjtyouM

Launched in 2020, Pix is an instant payment system operated by Brazil’s Central Bank, serving more than 175 million users.

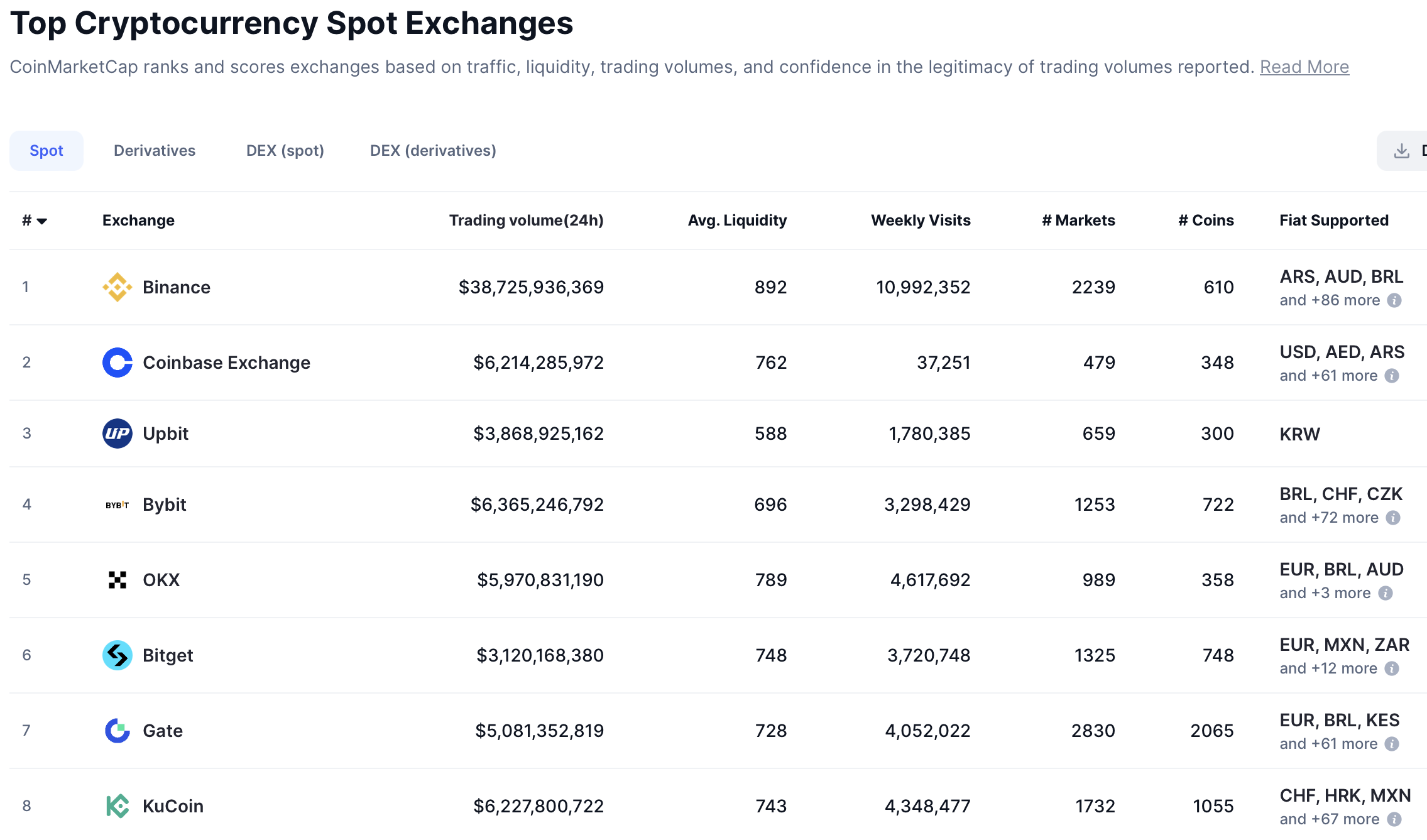

KuCoin Pay, the payments arm of cryptocurrency exchange KuCoin, is a sales tool that allows businesses to accept cryptocurrencies for online and in-person transactions. According to CoinMarketCap, KuCoin ranks as the world’s 8th largest cryptocurrency exchange with spot trading volume of over $6.2 billion.

Top virtual currency exchange by market capitalization. sauce: Coinmarketcap.com

Related: Tether supports Perfin to drive institutional adoption of USDT across Latin America

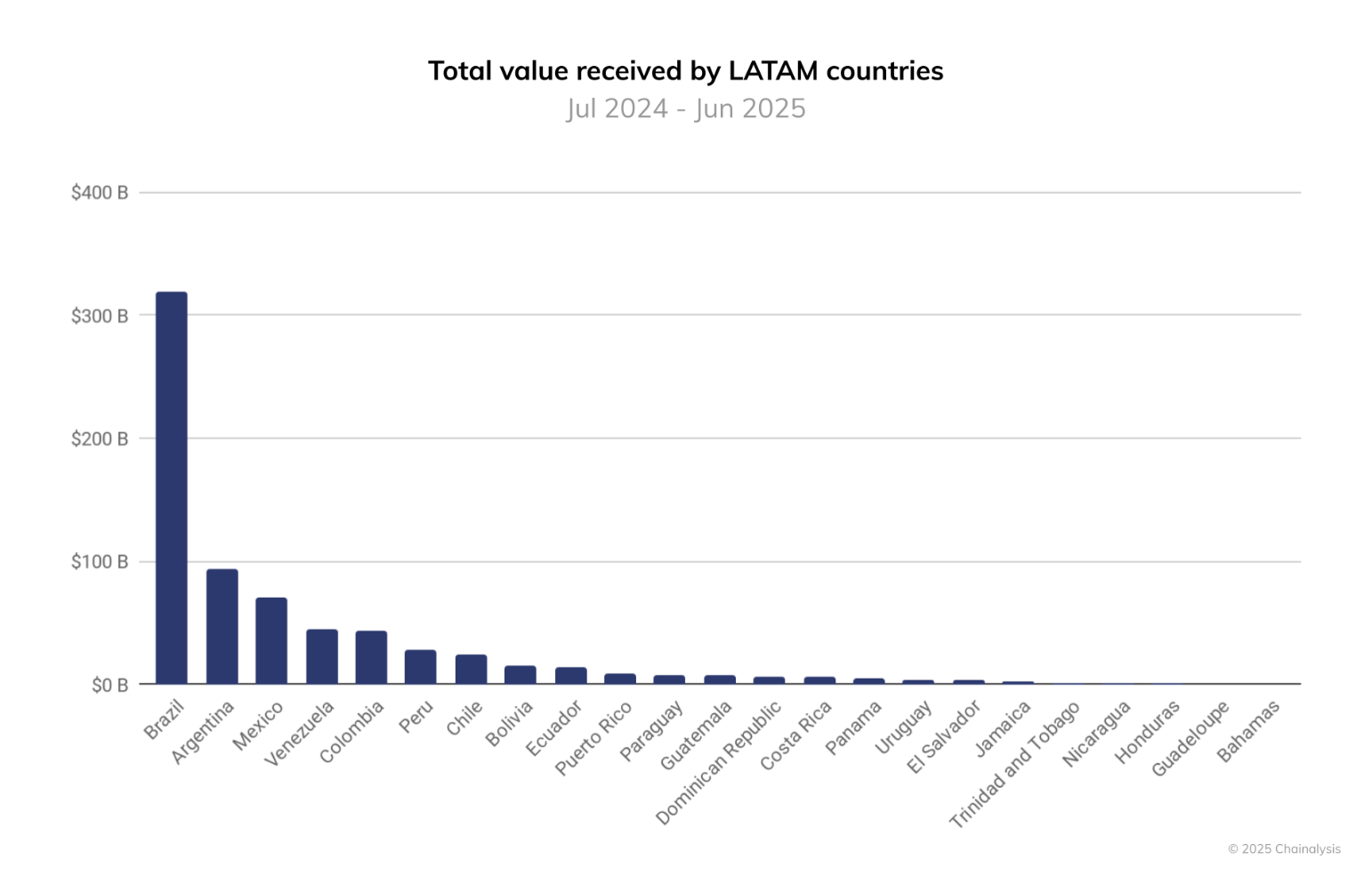

Brazil leads Latin America in adopting virtual currency

Brazil accounts for nearly a third of all crypto activity in Latin America, with approximately $318.8 billion in trading volume from July 2024 to June 2025, according to an October report from Chainalysis. The country’s high adoption rate is attracting a wave of new initiatives from domestic and international companies.

Deployment of encryption in Latin America. sauce: Chain analysis report

In September, Itaú Asset Management, Brazil’s largest private asset management company, established a cryptocurrency division and appointed former Hashdex executive João Marco Braga da Cunha to head the division. The company manages more than 1 trillion reais ($186 billion) in client assets.

In October, São Paulo fintech company Crown raised $8.1 million to launch BRLV, a Brazilian real-denominated stablecoin aimed at giving financial institutions easier access to Brazil’s high-yield bond market.

On November 3, Brazilian digital bank Banco Inter completed a blockchain-based trade finance pilot with Chainlink, the Central Bank of Brazil, and the Hong Kong Monetary Authority. This pilot demonstrated how blockchain can streamline cross-border transactions.

On Wednesday, Coinbase announced that it is bringing its “DeFi Mullet” decentralized trading feature to the country, allowing local users to access tens of thousands of tokens without leaving the Coinbase app.

Still, regulatory uncertainty remains. Brazil overhauled its tax system in June, abolishing the progressive system and imposing a flat 17.5% tax on all crypto capital gains.

magazine: Ethereum’s Fusaka fork explained to beginners: What exactly is PeerDAS?