Bitcoin faced significant selling pressure early today, with price trading at as low as $74,604. At the time of writing, however, the assets are seeing quiet rebounds, with prices returning above $79,000.

Despite this slight increase, assets have fallen 3.1% in the past day, nearly 30% from their peak at over $109,000 registered in January. Cryptoquant Contributor IT Tech, a There could be a significant shift in progress.

Old coins start moving: sell first?

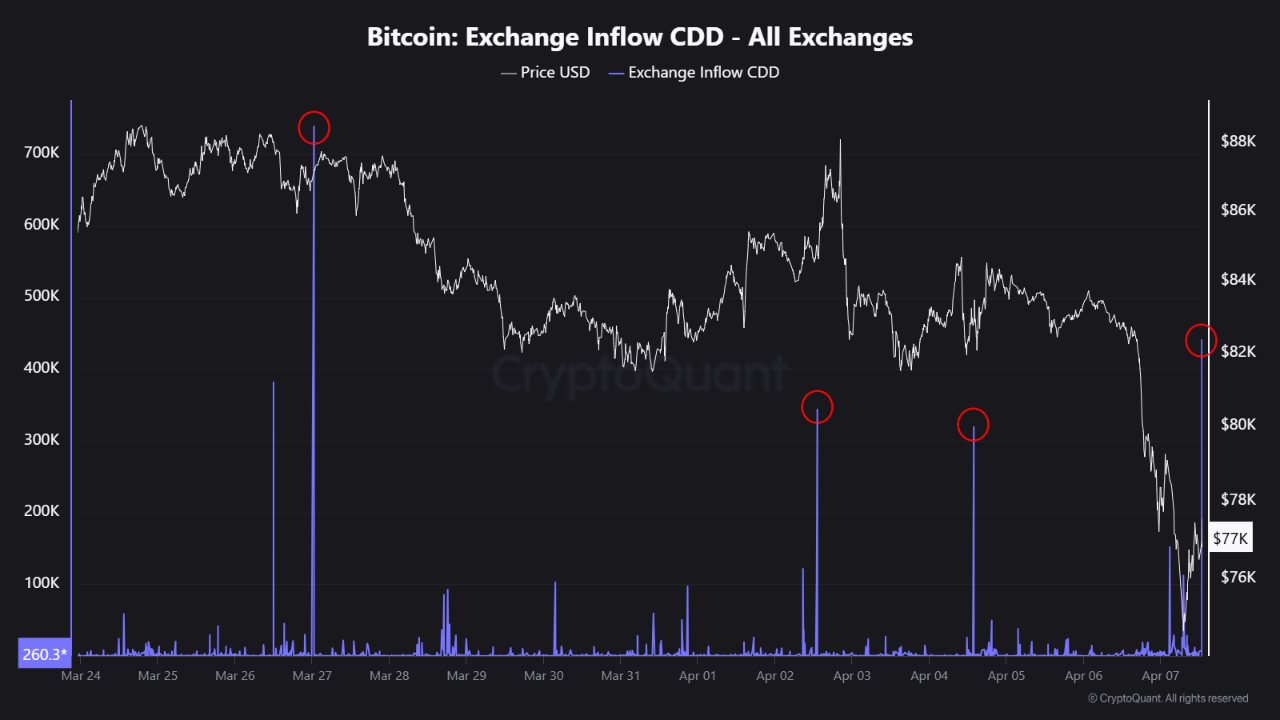

In a recent analysis titled “Old coins in large-scale spike CDD signals of exchange are awakening,” IT technology noted a significant surge in exchange inflow coin days (CDD) metrics. CDD measures the movement of old coins that have not changed hands for a long time.

When coins with higher coin days move, it often indicates that long-term holders are potentially transferring assets to exchange with the intention of selling.

Historically, exchange influent CDD spikes have preceded large-scale price adjustments. IT Tech emphasized that the latest surge in this metric coincides with a $82,000-$76,000 drop in Bitcoin, highlighting that some veteran holders may be preparing. Settle their position.

Such behaviors tend to put additional selling pressure on the market, especially during already unstable conditions. These moves may indicate inflection points, and older investors may be potentially trying to secure profits wider market uncertainty. If this trend continues, it can act as a bear signal, as a coin that reenters the circulation for months or years.

Bitcoin’s short-term indicators show possible cooling trends

On the other hand, another Another crypto analyst, Bilalhuseynov, provided insight into short-term holder behavior through a lens of realized pricing data.

In a post entitled “Bitcoin: Realised Price – UTXO AgeBand,” analysts looked at the realised prices of coins held by short-term investors, particularly coins held for a week to a month and a month, revealing health in ongoing market trends.

These UTXO age bands help you determine whether modern buyers are holding profits or losses. At bullish stages, these bands are turned upwards; Signaling accumulation. However, at the market top, the lines tend to flatten or decline, indicating distribution by short-term participants.

According to Huseynov, this is reflected in current data. The realised price for one to three months repeats the echo patterns seen at previous peaks in April and November 2021, and more recently in March 2025.

If this trend persists, it means new holders are facing losses and could soon surrender, possibly leading to further downsides. Conversely, during past bear cycles, these bands are often present Marked bottom zone If you find the price reversed with support.

Special images created with Dall-E, TradingView chart