Bitcoin’s price action has been extremely strong over the past week, showing good signs of recovery from last weekend’s low. The premier cryptocurrency has now reached $108,000 in the last few days, but is now at the $107,000 mark. Latest on-chain data suggests that investors have moved away from the market despite Bitcoin’s price resilience in recent months.

BTC retail demand will decline by 10% in June: Analysts

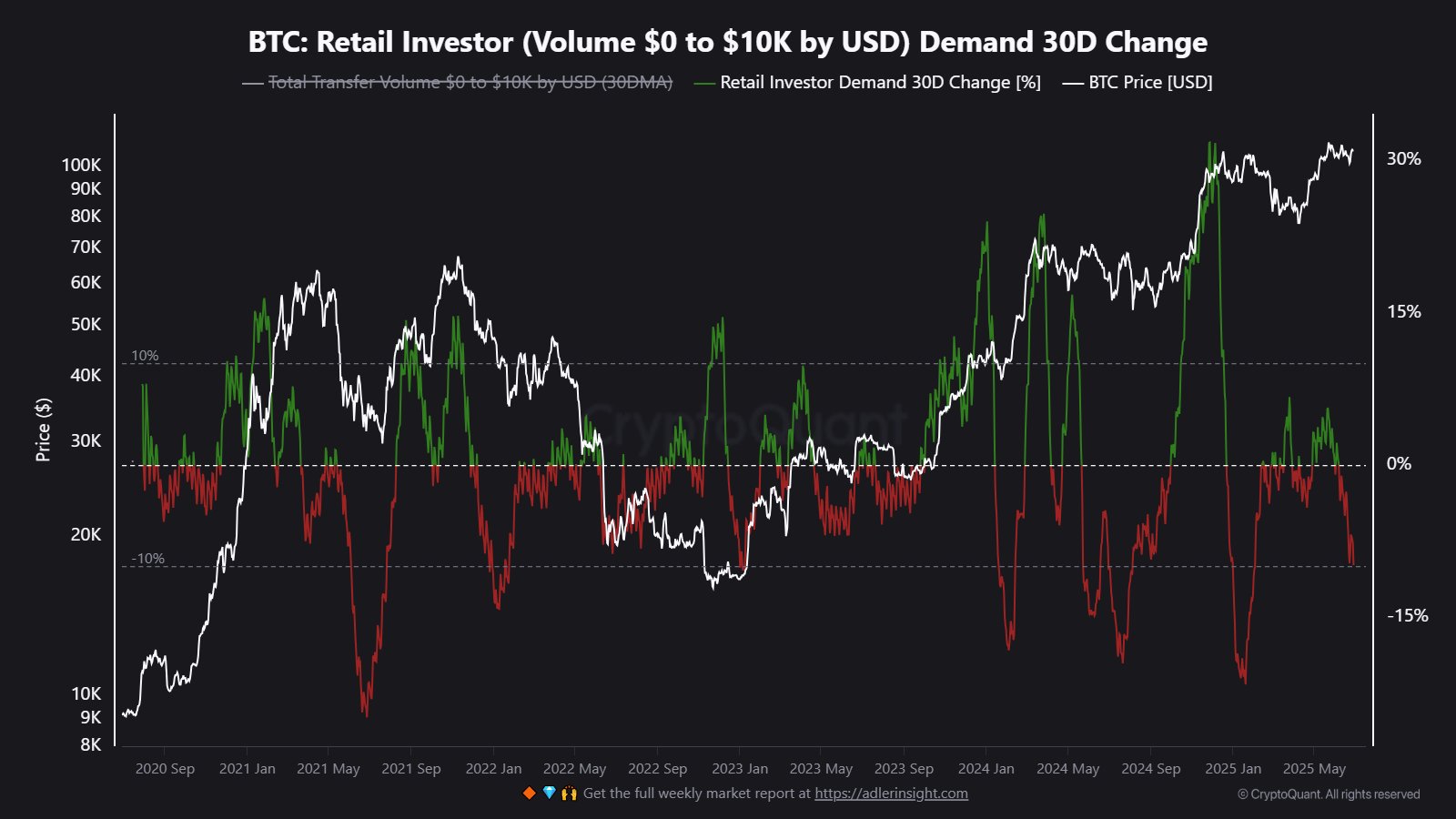

In a June 28 post on social media platform Z, on-chain analyst Maartunn revealed that a cohort of market participants known as retail investors have been relatively inactive for the past few months. This on-chain revelation is based on retail investors’ demand metrics and estimates BTC demand among small investors.

Essentially, this on-chain metric tracks small wallet activities that are usually involved in small size movements. Specifically, this retail investor demand indicator measures the rate of change in the cumulative amount (below $10,000) of small transactions over 30 days.

Source: @JA_Maartunn on X

On the chart highlighted by Maartunn, a 30-day change in Bitcoin retail investor demand plummeted into negative territory, staying in red since early June. Recently, the metric has dropped to 10% levels, representing the lowest levels in more than six months.

Given the fairly stable price action of Bitcoin during this period, it is very surprising that small investors refrained from entering the market. The market appears to be significantly dominated by institutional investors, primarily through the exchange and sale funds of Bitcoin.

Institutions and Bitcoin ETF investors will handle it

The trend in downward retail demand has been spotlighted by on-chain analyst Burak Kesmeci on the X platform, saying institutional and Spot ETF investors now appear to have a strong appetite to accumulate Bitcoin. Over the past week, US-based BTC Exchange Trade Funds recorded a weekly total net inflow of $2.2 billion.

Additionally, Kesmeci said that continuing declines in retail demand could mean that Bitcoin prices are approaching the bottom. Therefore, flagship cryptocurrencies can enjoy bullish momentum and rising price movements over the coming weeks.

At the time of writing, BTC priced around $107,244, reflecting just 0.1% increase over the last 24 hours. According to Coingecko data, market leaders are up over 4% in their weekly time frame.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.