Tokyo-based Metaplanet reported record Bitcoin (BTC) revenue revenues in its third quarter results for 2025, up 115.7% compared to the previous quarter.

Additionally, the company has revealed that it has already exceeded its annual BTC accumulation target. Given this performance, Metaplanet also raised its full-year revenue and operating profit forecast.

Metaplanet Q3 Bitcoin revenue jumps by 115.7%, doubling annual forecast

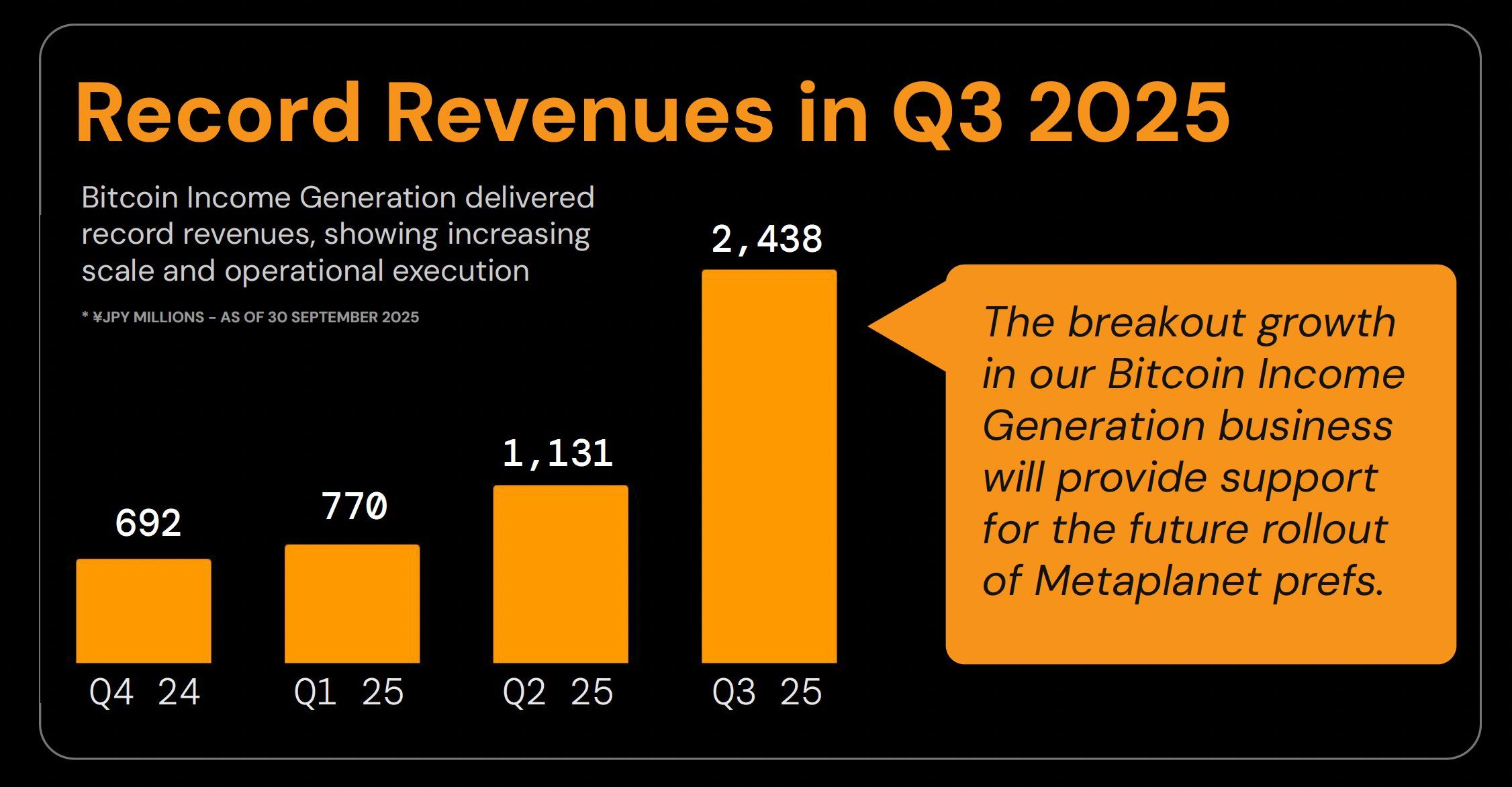

CEO Simon Gerovich revealed in the third quarter that he withdraws 2.438 billion yen ($16.56 million) from Bitcoin’s revenue generation segment. That was more than twice the 1.131 billion yen (7.69 million) recorded in the second quarter. Furthermore, compared to the first quarter, the company’s revenues rose significantly by 216.6%.

Metaplanet Bitcoin revenue. Source: X/Simon Gerovich

Behind the results, the Tokyo-based company doubled its annual revenue forecast to 6.8 billion yen, up from the previously forecast of 3.4 billion yen. We also increased our operating profit guidance from 2.5 billion yen to 4.7 billion yen.

The revision represents a 100% increase in expected revenue, a jump of 88% in predicted profit compared to previous estimates. This shows an increased confidence in the company’s core strategy of placing Bitcoin at the heart of its financial model.

“The Q3 results demonstrate operational scalability and strengthen the financial foundation for planned Metaplanet Preferred Stock Issuance.

In addition to revenue milestones, in the third quarter, Metaplanet completed its target of accumulating 30,000 Bitcoin by 2025. As of September 30th, the company had held 30,823 Bitcoins.

The latest purchase of 5,268 BTC pushed the company’s holdings beyond its target with a purchase of approximately $615.67 million. Additionally, Stack positions Metaplanet as the global fourth largest publicly listed Bitcoin holder.

Metaplanet is currently the fourth largest public Bitcoin finance company in the world pic.twitter.com/kg8quw2jyr

– Simon Gerovich (@Gerovich) October 1, 2025

According to industry tracker Bitcointreasuries, now it’s just behind (micro) strategy, Tesla, XXI. Furthermore, Metaplanet’s Bitcoin Treasury Ministry is more than 0.1% of its total cryptocurrency supply.

The company’s Bitcoin yield since the start of the year is currently 497.1%, with an overall average acquisition cost of $107,912 per Bitcoin for the total holdings.

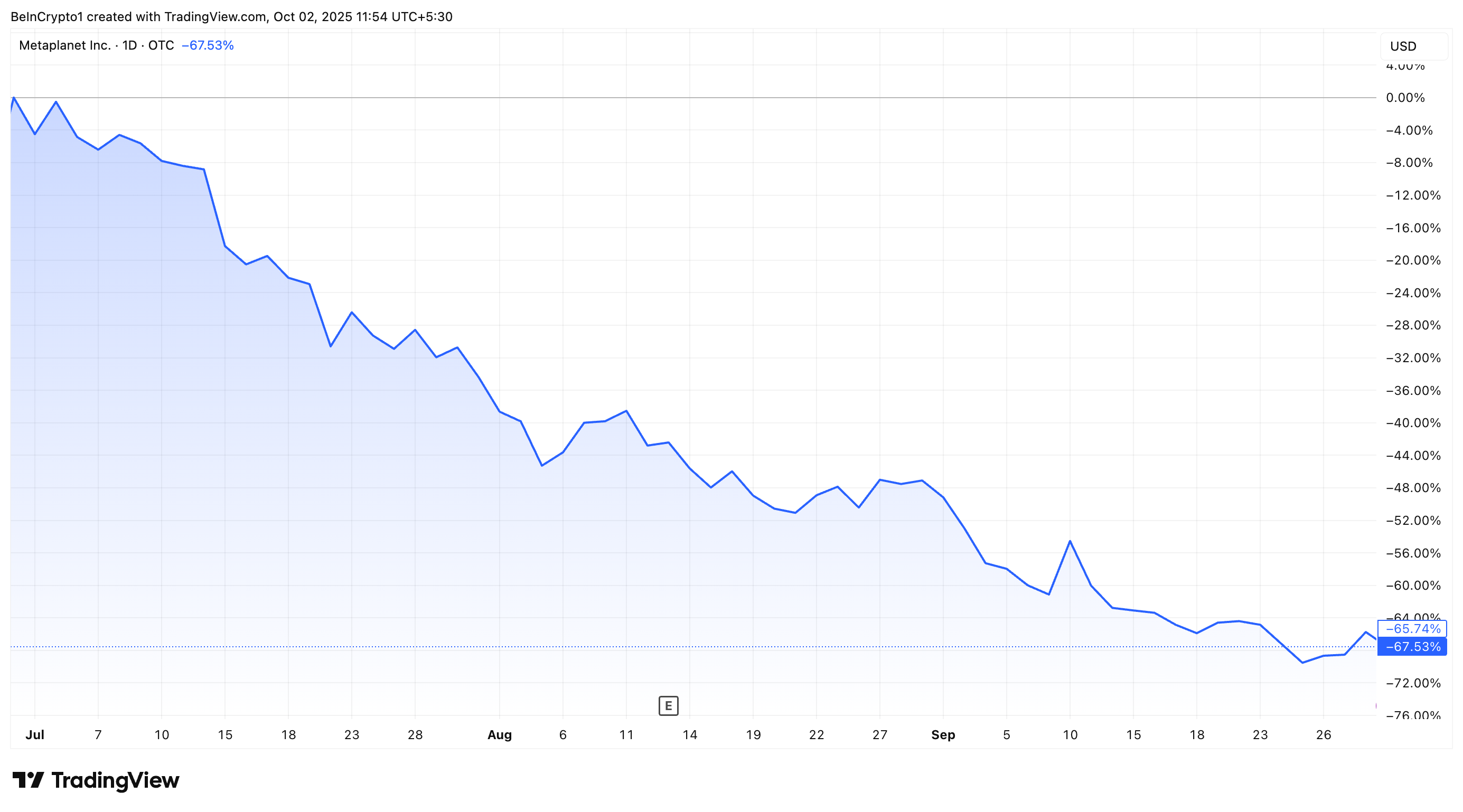

Despite its operational success in the third quarter, the stock’s performance revealed a completely different photo. Market data revealed that the stock price fell 67.5% between July and September.

Metaplanet Stock Performance for the third quarter. Source: TradingView.

In contrast, Coinglass data showed that Bitcoin itself closed Q3 with a gain of 6.31%. The Sharp sale highlights the challenges Metaplanet faces in aligning its operational outcomes with investor trust, while solidifying its role as one of the world’s largest corporate Bitcoin holders.

Post Metaplanet Bitcoin revenue jumps by 115.7% as stocks plummeted in Q3.