Disclaimer: The analyst who wrote this article owns shares in Strategy.

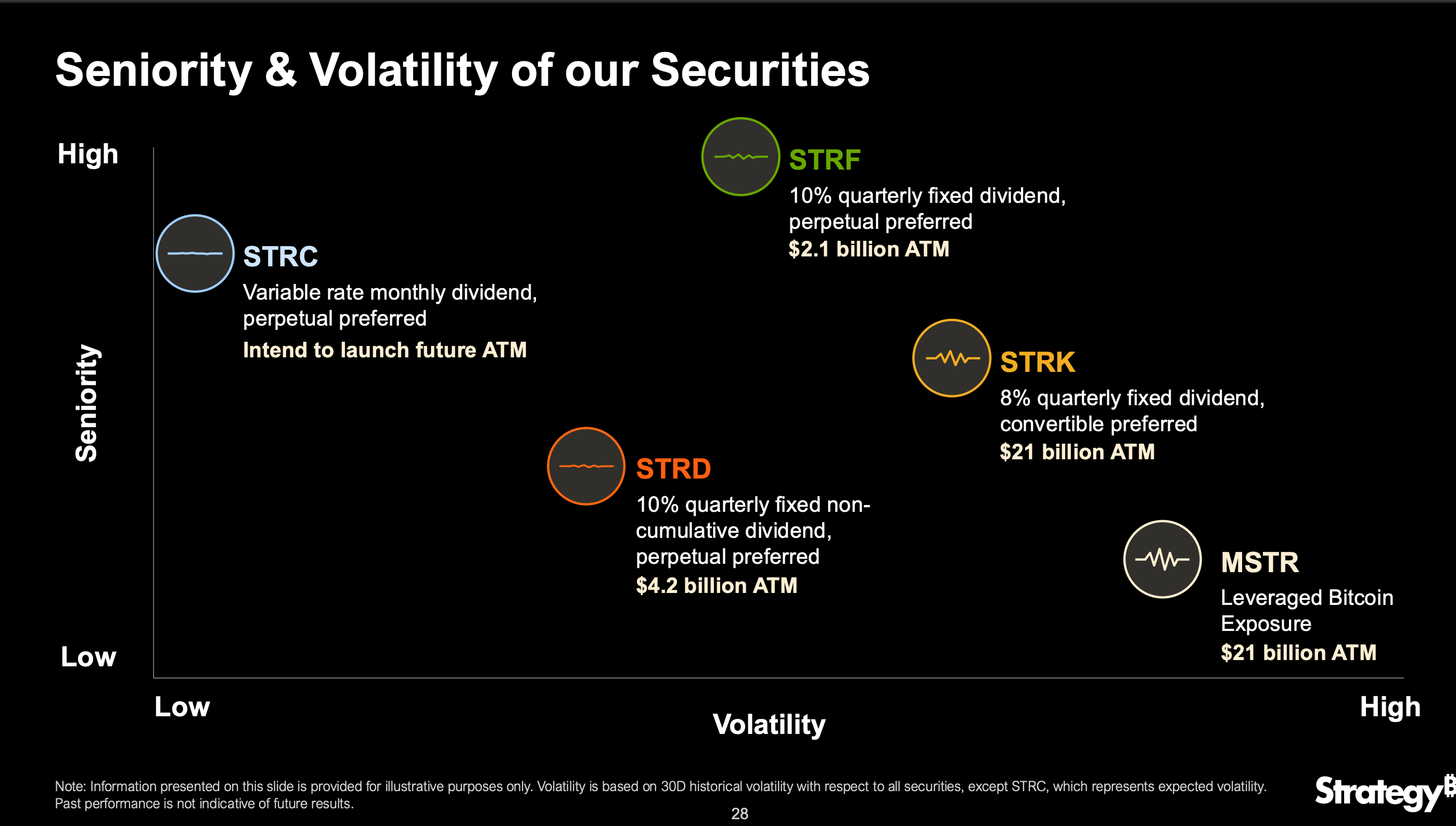

Under the leadership of Chairman Michael Saylor, the Strategy that has just confirmed the largest preferred stock issuance to date (MSTR) with the provision of STRC (Stretch), which offers STRD, STRF and STRK preferred stock, has prioritized stocks to build the company’s credit yield curve.

Of these, STRC is high in seniority and the expected volatility is low. Add new, short-term layers to the strategy’s fundraising mix and diversify the way companies raise capital for BTC acquisitions.

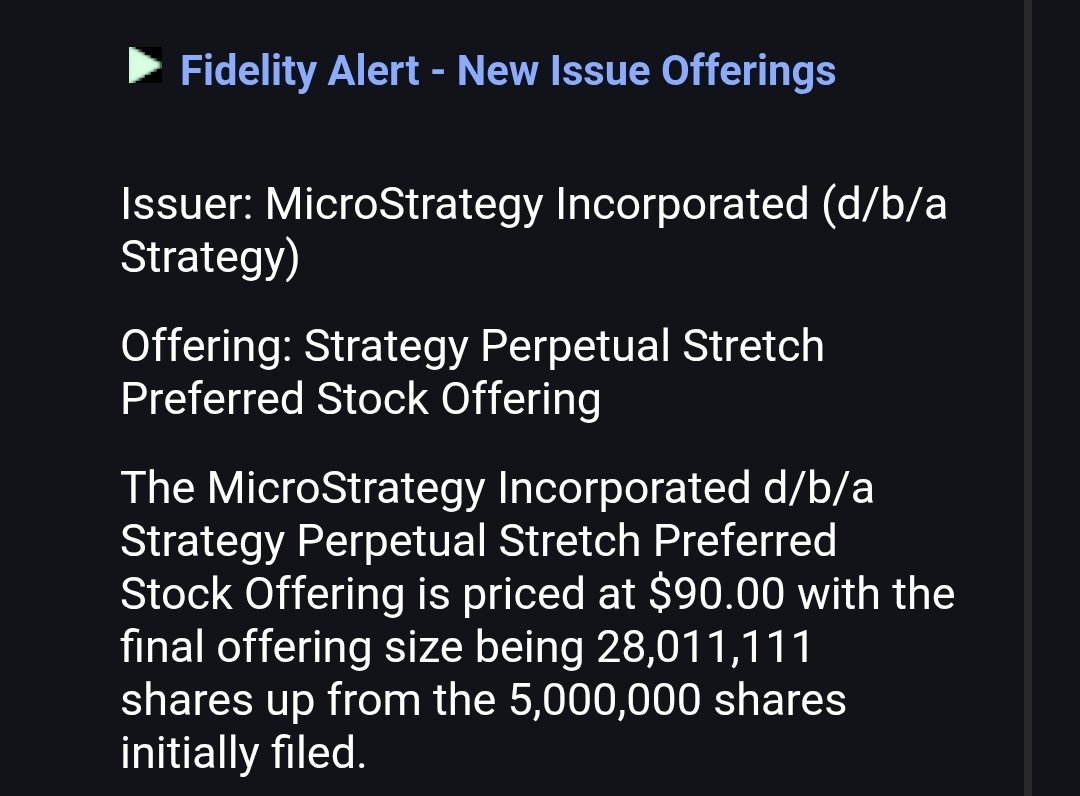

Fidelity Alert MSTR STRC (Fidelity)

According to faithful alerts on X, the deal is 28 million shares at a price of $90 each, totaling over $2.52 billion. This represents a dramatic increase from the original $500 million target announced just a few days ago, highlighting the company’s continued ambitions to actively expand Bitcoin

Holdings.

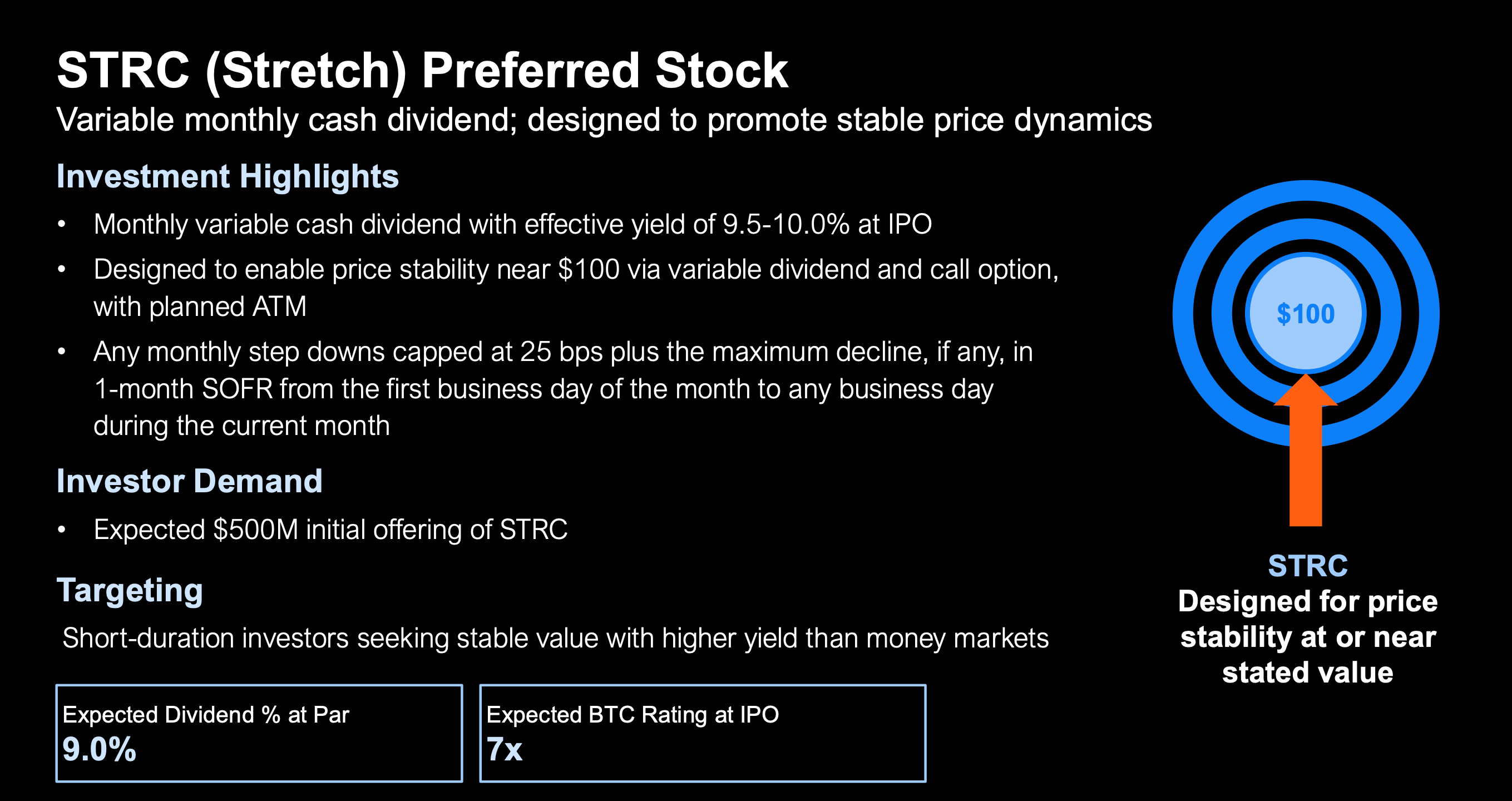

Stretch Preferred Stock (Strategy)

STRC is a permanent preferred stock for seniors that offers fluctuating monthly dividends designed to appeal to investors seeking yields who want stability close to PAR value. At the time of recruitment, STRC carried an effective yield of 9.5% to 10.0% each month. It includes mechanisms that maintain a trading range close to $100, including adjustable dividend rates, secondary issuance windows and substandard call options.

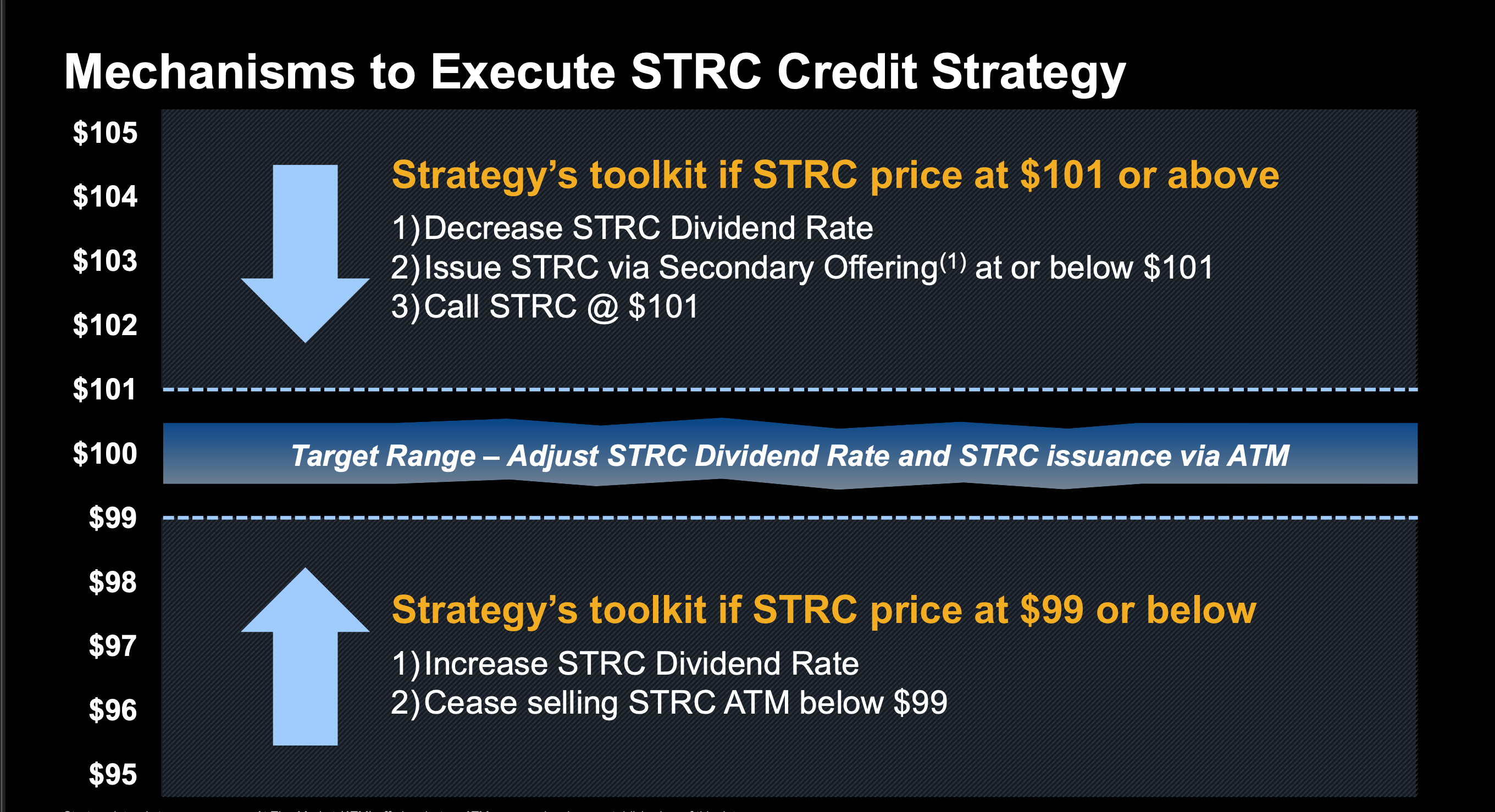

Stretch Preferred Stock (Strategy)

The toolkit includes raising dividends when STRC falls below $99 and suspending sales, or issuing new shares and calling out stock if it exceeds $101. These levers are designed to create self-correcting systems that promote market stability while providing attractive returns in the current interest environment.

Dividend step-downs are capped to a maximum reduction in the protected overnight funding rate (SOFR) for a month over the period, in addition to 25 basis points.

Stretch Preferred Stock (Strategy)

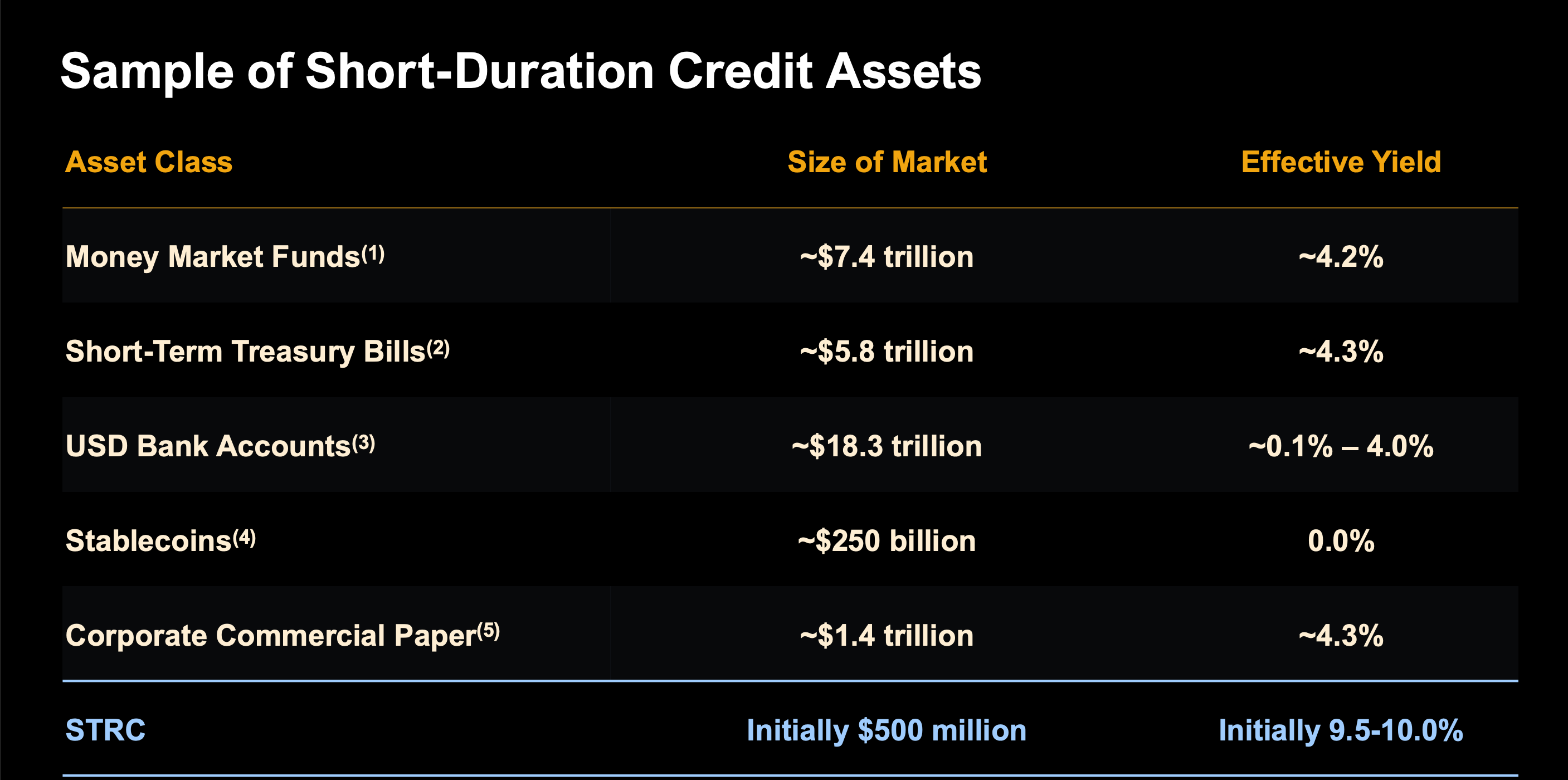

Compared to traditional short-term credit options, STRC stands out, offering more than twice the 4% available from money market funds and Treasury bills. It targets investors looking for a higher yield without significant price volatility, and is positioned in a competitive position against traditional equipment such as commercial paper and bank deposits.

Stretch Preferred Stock (Strategy)