The record-level short position for Ethereum on the Chicago Mercantile Exchange (CME) has sparked a widespread debate of bearish sentiment, but leading market analysts push back, claiming this is a misunderstanding of how sophisticated institutions are with ETH.

Despite a 3.67% decline in the last 24 hours, Ethereum has maintained a solid profit of 3.48%, currently trading at $2,488.16.

CME shorts are structural and not speculative

CME data shows that Ethereum short positions have been steadily climbing since mid-2023, peaking at the -11,154 range in mid-2025. At first glance, such numbers may suggest widespread bearish feelings.

However, this assumption overlooks a fundamental strategy. According to Van de Poppe, the agency uses these shorts as hedges to balance ETH exposure via ETF. These transactions, often referred to as “basic transactions,” allow institutions to lock in arbitrage yields of 12% to 18% per year.

Importantly, the short interest appears to be moving in a near perfect correlation with the ETF influx. This harsh correlation supports the idea that these positions are not speculative. Rather, they are strategic theatres designed to earn risk-free returns. Therefore, record-breaking shorts in this context are not signs of fear, but confidence in the long-term viability of Ethereum.

Papers surrounding the largest short position of $eth are not really valid.

These are just shorts to cover spot long through ETFs of institutions trading basis trades to generate 12-18% APY in a year.

It is almost 1-1, which correlates with ETF inflow. pic.twitter.com/gguqsydvgx

– Mycal Van de Poppe (@cryptomichnl) July 3, 2025

On the charts, Ethereum’s bullish structure is unharmed

Technically, Ethereum recovered support at $2,403, a key level of ongoing bull structures. The price is currently at $2,630 and is integrated just below the resistance.

This zone has been tested multiple times, indicating a strong breakout potential. Van de Poppe believes Ethereum is on track for a push to $3,000 if the $2,630 resistance is supported.

Previous liquidity has strengthened $2,233 intensified purchase strength, further supporting bullish papers. If momentum continues, the next price target will be between $2,800 and $3,000, potentially marking a new local high.

$ETH began running upwards towards $3,000. pic.twitter.com/vfwbj8upfl

– Mycal Van de Poppe (@cryptomichnl) July 4, 2025

Derivative activities demonstrate healthy market dynamics

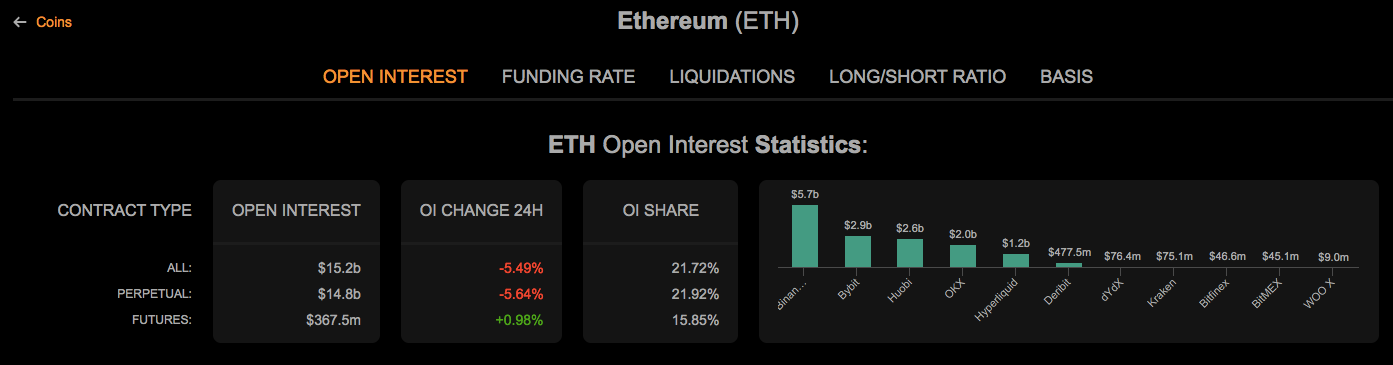

Source: Coinanalyze

Ethereum’s open interest remains strong, totaling $15.2 billion. Most of this comes from permanent contracts, accounting for $14.8 billion. Futures activity remains stable despite a decline in profits that has been fully open for 5.49% in the last year.

Major exchanges such as Binance, Bybit and Huobi continue to dominate ETH derivative trading, indicating sustained market depth and institutional participation.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.