The latest figures reveal that the Stablecoin economy grew by 5.33% in July, adding an additional $13.537 billion increase during January.

USDE, USDF steals spotlight with 62.55% and 103% jumps in one month

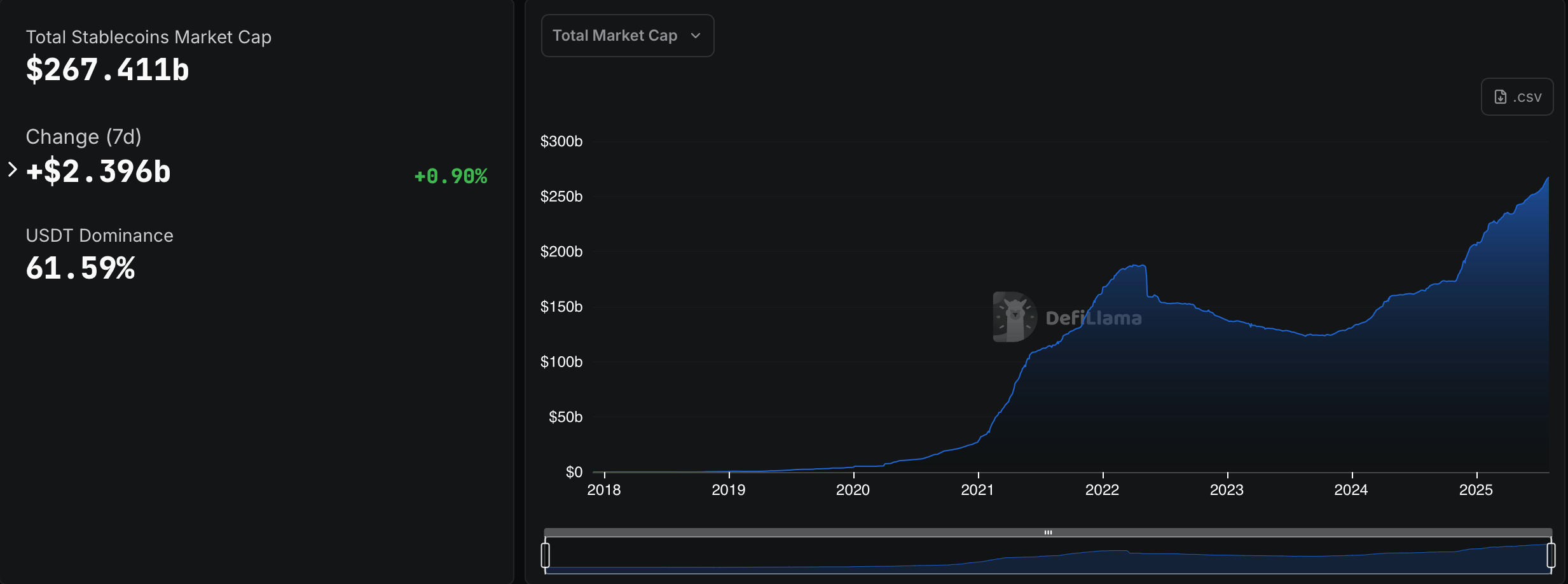

The Stablecoin market continues to expand, with an additional $2.589 billion flow next week that will exceed the $270 billion threshold. As of Saturday, August 2, 2025, the Fiat Peg tokens were $26.741.1 billion since the beginning of July, $13.537 billion. Tether (USDT) is still leading the pack, leading 61.59% of the overall market.

USDT’s distribution supply increased by $5.555 billion, boosting its market capitalization to $164.7 billion, according to data from Defilama.com. USDC added an additional $2.53 billion in supply, increasing its total valuation to approximately $639.9 billion. Ethena’s USDE won 62.55% Bown in July after getting a supply of $3.3118 billion.

The USDE’s market capitalization is currently at $8.633 billion. Sky’s USDS also rose, but it slowed down, adding $296.82 million to a market value of $4.857 billion. Dai’s growth is still small, with only $23.57 million being charged to $400 billion.

BlackRock’s Buidl (Stablecoin, backed by the US Treasury) dropped its valuation to $2.398 billion in July, exceeding $433 million. World Liberty Financial’s USD1 fell by $36.57 million during the same stretch, now at $2.17 billion. Ethena’s USDTB also shrunk, falling $2,382 million to $1.438 billion in land.

Falcon synthetic dollars, USDF, is an over-materialized stub coin from Falcon Finance, filling 103% in July and surged to the ninth slot of the top 10. The coin saw a new value of $549.72 million and brought its market capitalization to $1.085 billion. FDUSD is in 10th place, which is now worth $1.032 million after cutting $17924 million last month.