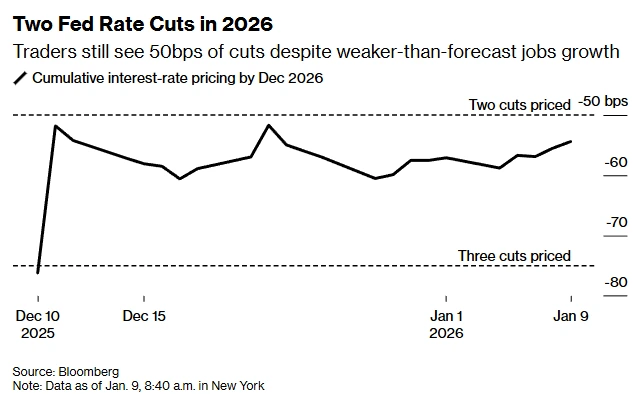

The odds of the Fed cutting rates in January are extremely slim, but traders are expecting at least two rate cuts in 2026.

Morgan Stanley and Citigroup have revised their expectations for a 2026 Fed rate cut ahead of the appointment of the new Fed chairman.

Bitcoin and crypto markets will benefit from risk-on mode due to increased global money supply.

The Fed is expected to continue lowering interest rates in 2026 amid strong pressure from the administration. Wall Street analysts now expect a rate cut of at least 50 bps in 2026, as President Donald Trump prepares to name a nominee to replace Jerome Powell as Fed chair.

Morgan Stanley and Citigroup expect further Fed rate cuts in 2026

The Federal Reserve plans to begin cutting interest rates by at least two 25 basis points in 2026, according to client notes from Morgan Stanley (NYSE: MS) and Citigroup (NYSE: C). Morgan Stanley revised its forecast for 25 basis point rate cuts in January and April 2026 to June and September 2026.

Citigroup changed its forecast for 2026 Fed rate cuts from January, March, and September to March, July, and September. As a result, Citigroup expects the Fed to begin cutting interest rates by as much as 75 bps in 2026, bringing the rate cuts below 3%.

Why is Wall Street expecting more interest rate cuts?

Wall Street expects the Fed to continue lowering rates in 2026 after cutting rates three times in 2025. With President Trump expected to name a new Fed chair soon, Wall Street is confident of at least two interest rate cuts in the coming months.

Source:X

Despite weaker-than-expected job growth, Treasury Secretary Scott Bessent stressed the need for lower interest rates to spur economic growth.

What impact do you expect on Bitcoin and cryptocurrencies?

The Fed’s expected rate cuts coincided with an ongoing liquidity injection under President Trump. The Fed will begin quantitative easing (QE) in early December 2025, and President Trump plans to inject $200 billion through the housing industry.

These events are extremely dovish for the crypto market. Moreover, Wall Street investors are gradually switching to risk-on mode. As the stock market bull market continues, Bitcoin and the broader altcoin industry will ultimately post a strong bull run in 2026, with capital expected to flow from the precious metals industry.