Ethereum shows signs of new strength after a volatile week, surpassing the $3,350 level of last Sunday. After facing deeper correction sales pressure and fear, the Bulls retreated, pushing prices higher and regaining control of the short-term market momentum. The increase in volatility has brought new attention to ETH, with analysts looking closely as assets try to regain their major zone of resistance.

The wider picture remains fundamentally strong. Institutional interest in Ethereum continues to grow, with more recent reports of large purchases. On-chain activity is also rising, suggesting increased demand and user involvement across the Defi, NFTS, and Layer-2 ecosystem. Furthermore, Ethereum’s role in real-world asset tokenization and smart contract infrastructure strengthens its long-term value proposition.

Once the ETH passes the resistance level, the next few sessions become important. A successful consolidation of over $3,700 can confirm bullish continuity, but a denial could open the door for another pullback. In any case, Ethereum’s recent performance and fundamental foundations suggest that investors’ trust is returning.

Ethereum whales accumulation demonstrates long-term trust

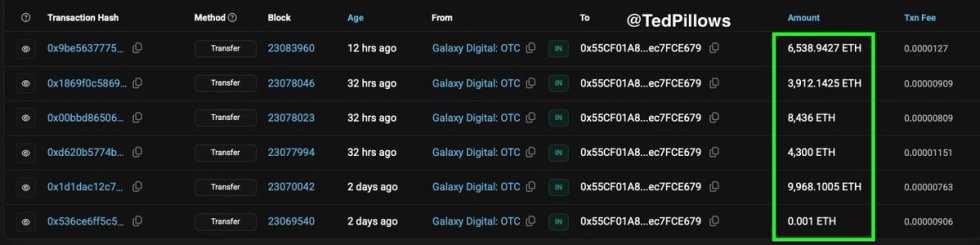

According to top analyst Ted Pillows, the mystical whales and facility players have purchased ETH worth $122,955,634 in the last two days. This massive accumulation comes as an attempt to rebound Ethereum from its recent lows and a critical level of $3,800. This move has been interpreted by many analysts as a strong signal that smart money is quietly using recent DIP to build a long-term position.

This magnitude and timing of buying suggests that it reflects strategic intentions, the confidence in Ethereum’s fundamental foundations, and its broad role in the evolving digital economy. As Tradfi (traditional finance) continues to flow in crypto, Ethereum has emerged as a core asset in its facility portfolio due to its programmerity, its robust developer ecosystem, and widespread use cases in tokenization and debt.

Bitcoin shows signs of overheating, and while many altcoins are still below important levels, Ethereum’s relative strength stands out. Although the broader markets are cautious, this accumulation trend highlights how informed investors view past short-term volatility and multi-year high positioning.

Price Action Details: ETH retests critical resistance

Ethereum (ETH) has skyrocketed over 13% since last Sunday, testing critical resistance levels at $3,860, as shown on the 4-hour chart. After forming a local bottom of nearly $3,350, ETH steadily climbed with increasing volume, signaling buyers’ interest and bullish momentum.

The recent breakout, which exceeded the $3,700 mark, came with a strong green candle supported by a simple moving average (SMA) recovery of 50, 100, and 200. This alignment of SMAs below current prices strengthens the bullish outlook as ETH establishes a support zone between $3,630 and $3,685.

However, the $3,860 resistance level remains a significant obstacle. It marked an earlier rejection zone in late July and is not supported yet. A confirmed breakout above this range, followed by sustained volumes and integration, could open the door for ETH to challenge the $4,000-$4,200 region in the short term.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.