Bitcoin has regained the $120,000 level, showing new bullish momentum that brings the crypto king closer to all-time highs.

The jump in prices reflects improving investor sentiment as new money flows into the market. Intermediate holders and ETF inflows appear to be playing a key role.

Bitcoin has a strong backing

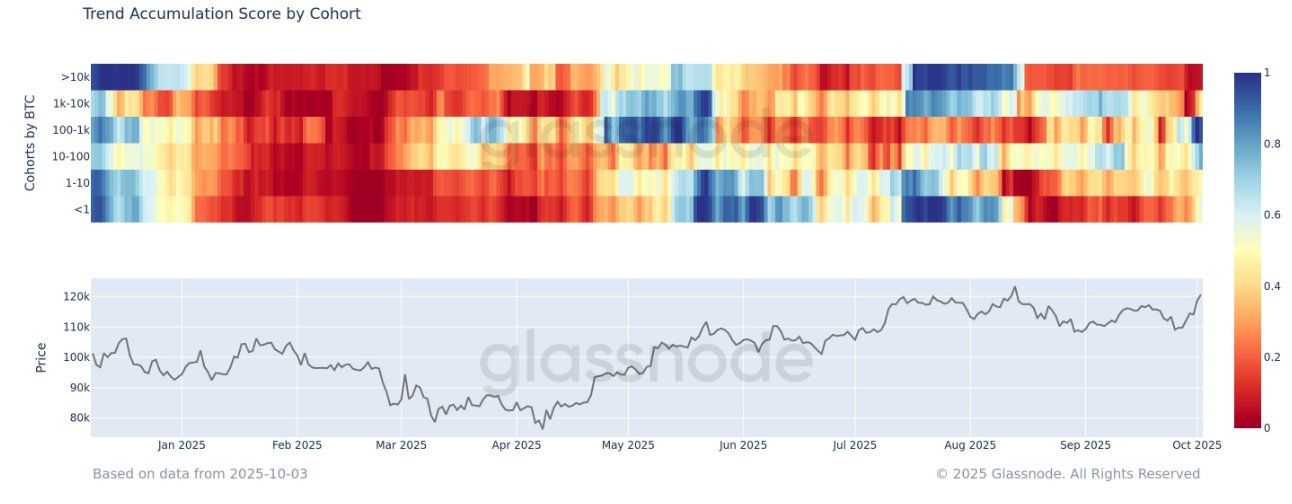

Trend cumulative scores highlight notable changes in market conditions. Medium-sized Bitcoin holders have been accumulating strongly, offsetting continued selling by large corporations. This new wave of demand represents structural support for BTC’s current uptrend and creates a more stable foundation for future gains.

While whale distributions have slowed, small investors have remained mostly neutral. This balance reduces the risk of aggressive selling and strengthens market resilience. Changes in investor behavior suggest a healthier environment for Bitcoin growth.

Bitcoin trend cumulative score. Source: Glassnode

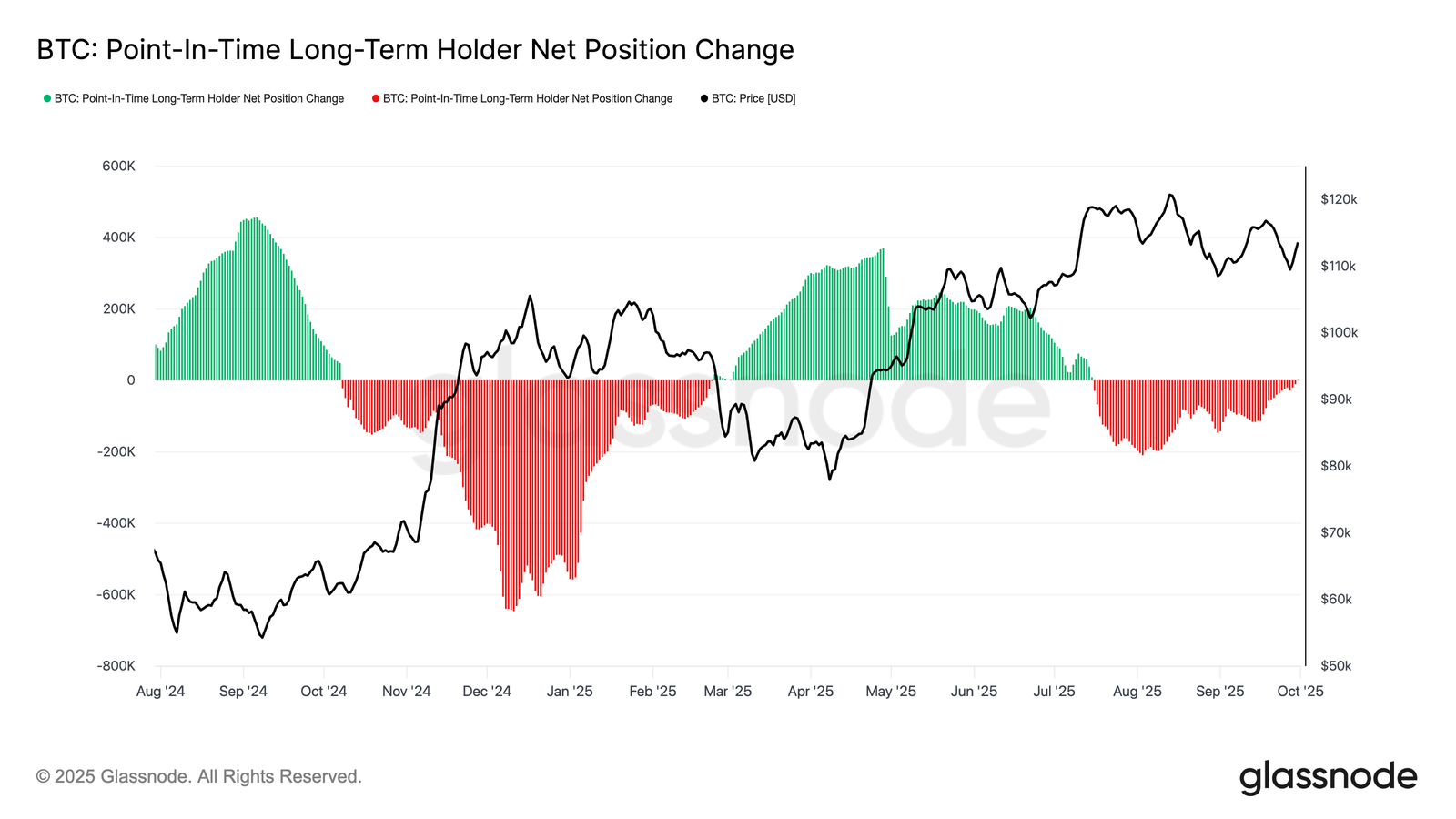

Net position change (3D) for long-term holders has moved in a neutral direction after months of heavy distributions. This suggests that profit-taking by long-term holders has calmed down and the market is less vulnerable to sudden selling pressure. The decline in circulation is a positive sign that price strength will continue.

Once supply pressure eases, external factors such as ETF inflows and institutional demand could drive momentum. If these inflows are consistent, they will provide the support Bitcoin needs to continue rising and challenge all-time highs.

Bitcoin HODLer Net Position Changes. Source: Glassnode

BTC price is aiming for a high price

As of this writing, Bitcoin is trading at $120,290 and is trying to secure $120,000 as a support floor. Maintaining this level is important to maintain momentum and prevent a short-term reversal.

BTC’s immediate challenge lies at $122,000, which is the last resistance before the all-time high of $124,474. Success in breaking through this barrier would pave the way for Bitcoin to chart a new ATH and strengthen the market’s overall bullish confidence.

Bitcoin price analysis. Source: TradingView

However, if market conditions worsen and selling pressure increases, Bitcoin risks losing support at $120,000. In such a scenario, the price could drop to $117,261. This would invalidate the bullish theory and signal a pause in the bull market.

New Bitcoin demand emerges as the price claims $120,000. Next – The post New ATH appeared first on BeInCrypto.