As Ethereum-based collections rose along with ether prices, the non-useable token (NFT) sector has skyrocketed to a market capitalization of over $9.3 billion.

NFT Data Tracker NFT Price Floor on Wednesday showed the overall market capitalization of the NFT collection reached $9.3 billion, a 40% increase from July. According to data from Dappradar, the NFTS’ market capitalization was $6.6 billion last month.

Ether (ETH) has recently passed the $4,000 milestone and has been a key driver behind the surge in the NFT market. At the time of writing, ETH was traded over $4,600 and had a market capitalization of over $557 billion, according to Coingecko.

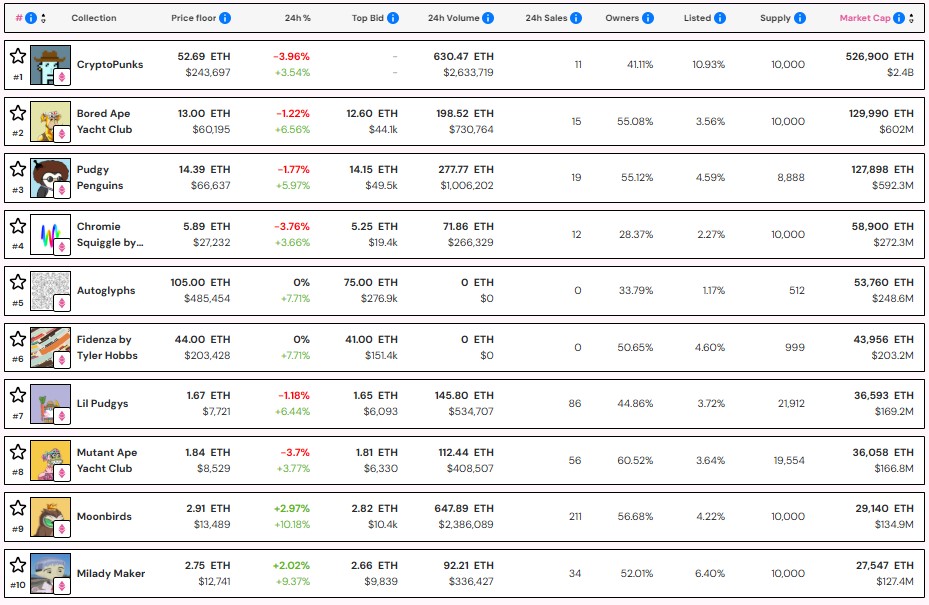

Many NFTs are based on the Ethereum mainnet, so their sales and ratings are sected in ETH. Therefore, the bullish momentum of crypto assets leads to higher market value and increased activity in the NFT space. At the time of writing, the top 10 NFT assets by market capitalization were Ethereum-based.

Top 10 NFTs by market capitalization. Source: NFT Price Floor

NFT’s market capitalization has skyrocketed 40% since July

Cryptopunks holds its place as the top NFT collection by market capitalization. NFT price floor data shows that this collection is worth at least 526,900 ETH (approximately $2.4 billion).

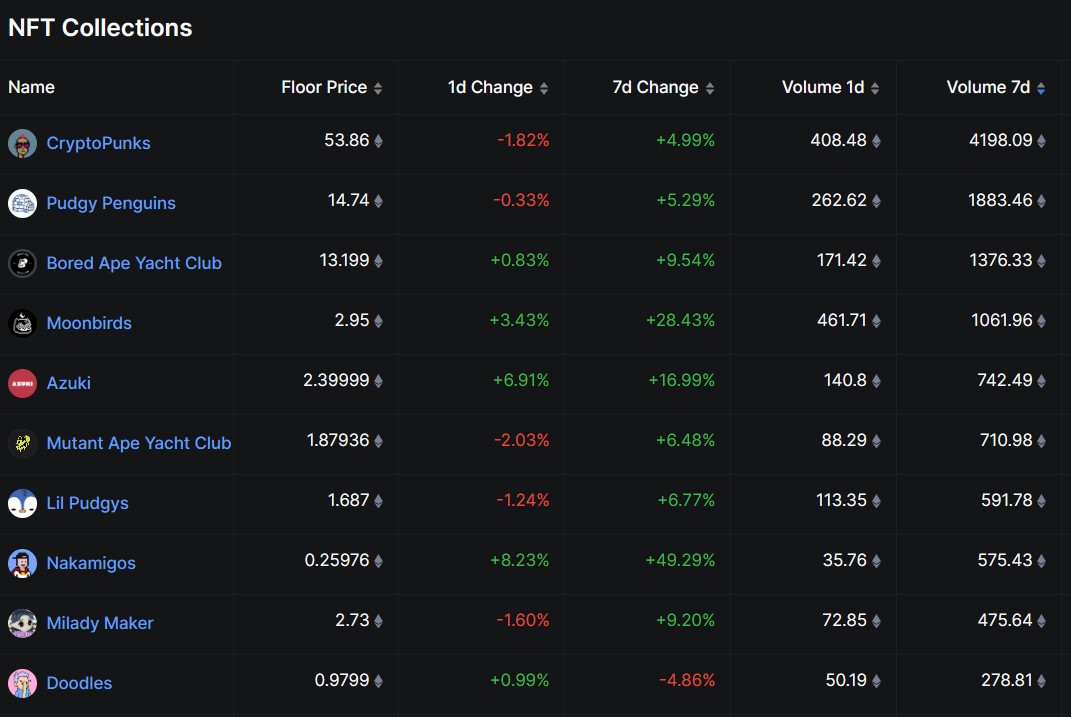

Over the past seven days, Cryptopunks volumes have been worth almost $20 million, with ETH of nearly 4,200 ETH. For the week, the collection had a total sales of 90, an average of $217,331 per NFT.

Top NFT collection with a 7-day volume. Source: Defilama

The bored APE Yacht Club (BAYC) is valued at $622 million following the ranking Cryptopunks, while Pudgy Penguins continues closely at $591 million.

Related: In July, NFT sales of $8.5 million reached $574 million, the second highest in 2025

Porky penguins added to the Ministry of Cryptocurrency

Still, Bayc is leading the ratings, but the Pudgy Penguins Collection outperforms Bayc in terms of seven-day volume. Defillama data suggests that Pudgy Penguins has had a volume of $8.7 million over the past week, while Bayc has $6.3 million.

In an interview with Cointelegraph, Pudgy Penguins CEO and Owner Luca Schnetzler (known as Luca Netz) said that in 2022 the expansion of the collection to a physical toy brand saved the company from bankruptcy.

Since then, the collection is a major NFT brand that rivals other blue chip collections.

This week, Blockchain Company BTCS Inc. said it added three sleazy penguins to its corporate finances.

sauce: A stubborn penguin

Apart from the three collections, the other top 10 NFT collections by market capitalization include Art Block Chromie Squiggle by Snowfro, Autoglyphs, Fidenza by Tyler Hobbs, Lil Pudgys, Mutant Ape Yacht Club (MAYC), Moonbirds and Milady Maker.

magazine: How Ethereum Finance Companies Can Cause “Defi Summer 2.0”