Binance’s list trend for 2025 draws a tough picture for investors chasing the newly launched tokens. Of the 27 tokens added to the platform this year, only three have shown positive returns by April 1st. This shows a failure rate of 89%.

Many of these tokens have fallen between 70% and 90% from the listing price. However, the three coinforms, red and layers defied the trend, resulting in meaningful benefits.

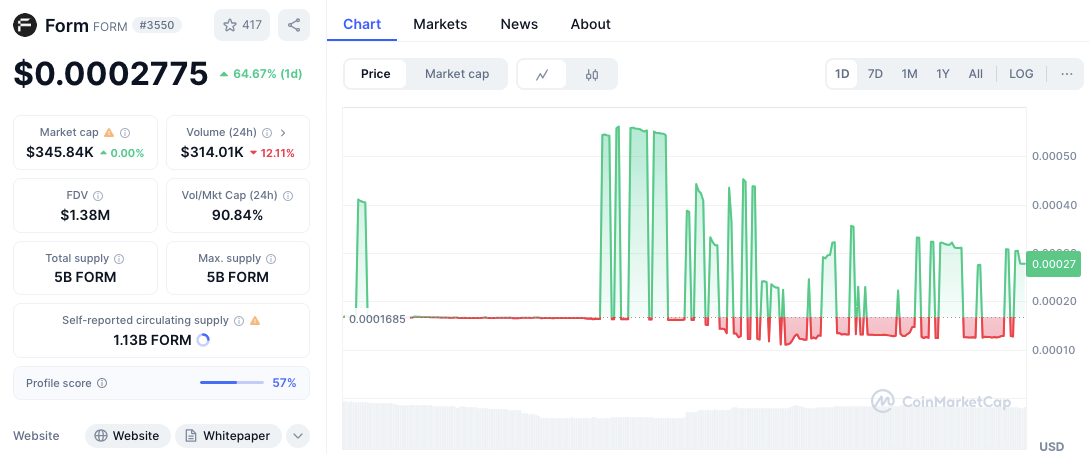

Forms (forms) see volatile benefits, but face liquidity

Form has returned more than 29% since its listing on March 19, rising from $1.74 to $2.25. Despite this growth, recent price action talks about something else. On April 1st, the form traded for just $0.0002777. It rose almost 65% in 24 hours, but daily volumes fell 12.5% to $313,000. This indicates the possibility of cutting off the strength of volume and price.

Source: CoinMarketCap

What’s more, it has a fully diluted valuation of $1.38 million and a market capitalization of just $345,000. This suggests low liquidity trades, which is prone to unstable price movements. Support is near $0.000165, but $0.00050 acts as a resistance.

Prices are integrated between $0.00020 and $0.00030. Breakouts above $0.00032 could cause new momentum, while drops below $0.000165 could cause losses.

Related: Red Crypto Market: ICP, Chain Link, Optimistic Prices Slow – Analyst Weight at Major Price Levels

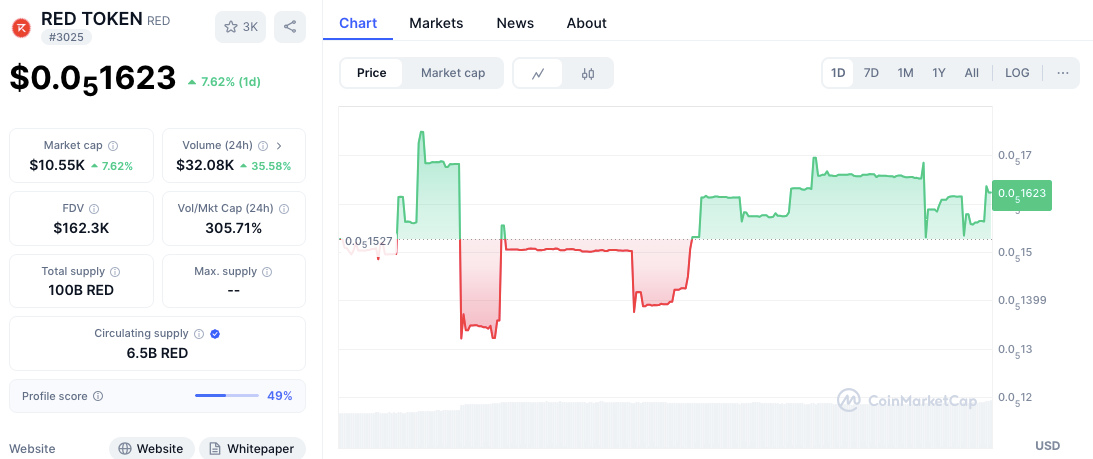

Red tokens gain momentum

Red has risen 23.43% since its list on February 28th. It currently trades at $0.0516, with daily volume exceeding 32% to 31.6K. The token’s market cap remains very low at $10.58K, but the market-to-market cap ratio is over 300%. This suggests high speculation and thin fluidity.

Source: CoinMarketCap

Importantly, price support was formed at $0.0512 and $0.0500. Resistance is close to $0.0540 and $0.0570. Prices have recently been destroyed beyond the combined range and are now even higher. Maintenance over $0.0520 allows you to open a room for a $0.057 test. However, a breakdown of less than $0.0512 could result in pullbacks appearing towards a psychological level of $0.0500.

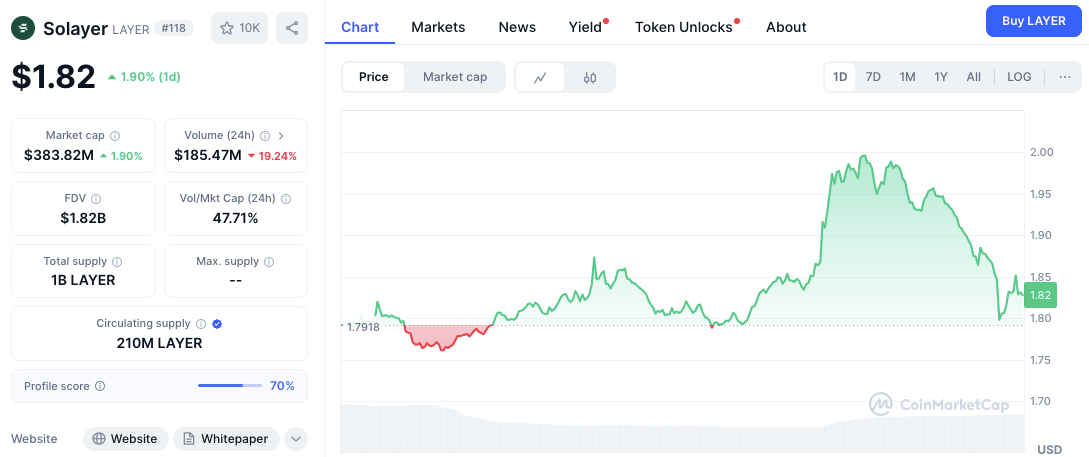

Solayer (Layer) holds firmly beyond key support

Layer has provided the best return on the new list with a profit of 42.41% since February 11th. It trades at $1.84 with a market capitalization of $386.7 million, earning a healthy volume of $100 million a day. Volume has dropped by 19%, but this trend remains bullish.

Source: CoinMarketCap

Related: Mana, Matic and GMT can quickly rise as chart patterns look promising

Support levels are $1.79 and $1.75, with resistance close to $1.95 and $2.00. If the price is above $1.80, the layer can attempt a breakout. However, if it falls below $1.79, sales pressure could be spurred.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.