The market value of real-world assets (RWA) could more than triple its current value by 2026 as it expands beyond crypto-native use cases and utilities, according to Chris Yin, co-founder and CEO of RWA-focused layer-2 blockchain Plume.

Yin told Cointelegraph that the value of RWA has grown rapidly in the last year, roughly doubling, and that he expects it to increase by 3-5x in 2026 as a base case.

“We are currently tracking more than 10x the number of RWA holders year-to-date and expect it to continue to grow, and we think it is not unreasonable to imagine another monumental year with more than 25x growth in user numbers,” he said.

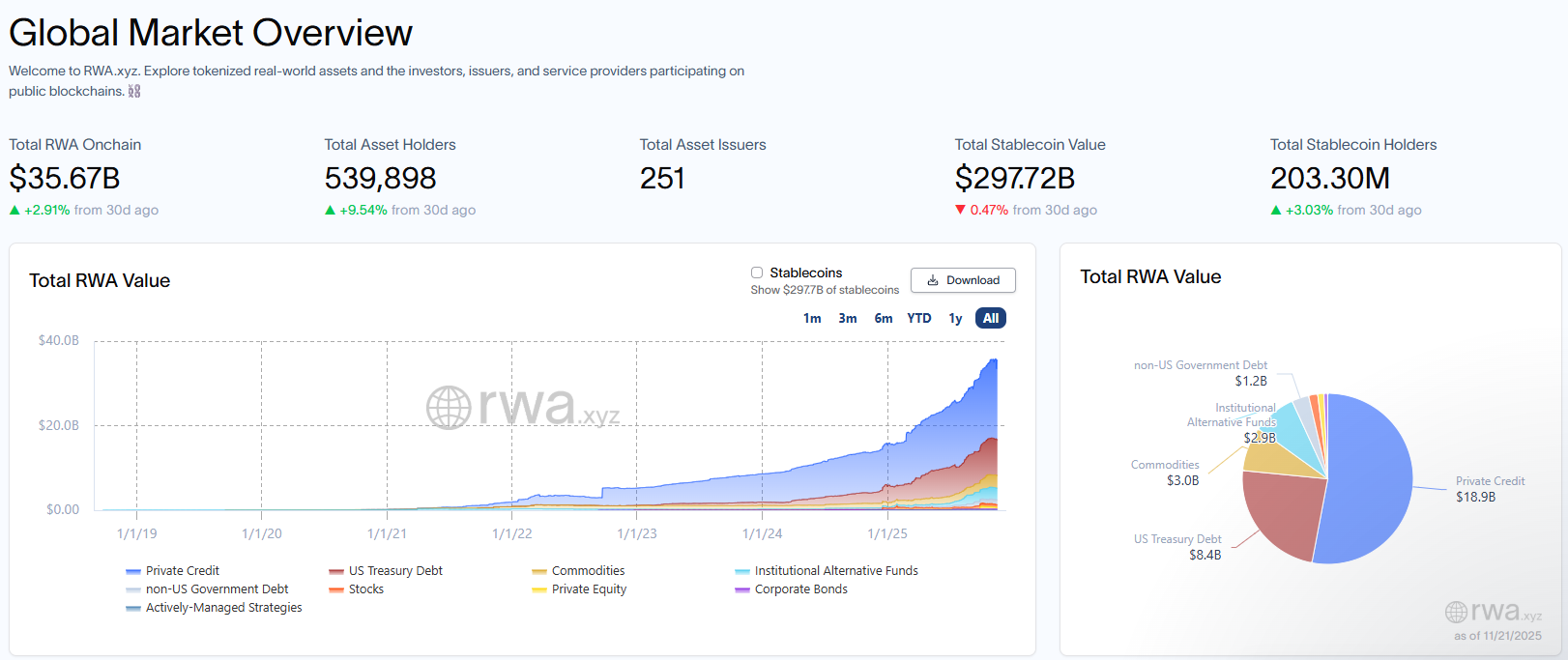

According to RWA.xyz, more than $35 billion in RWA is estimated to be on-chain across more than 539,000 holders.

Chris Yin believes that real-world asset market values could soar beyond the current $35 billion. sauce: RWA.xyz

RWA market will grow exponentially

Yin said that the market for tokenized RWA, fully servicing crypto-natives, is expected to grow exponentially across total value, users, asset classes, and utilities.

“Currently, most of the value of RWA is in U.S. Treasury bills, but a combination of market maturation and interest rate cuts is driving on-chain users to seek higher yields in new locations,” he said.

“We are already seeing an increase in private credit as well as alternative assets such as mineral rights, oil, GPUs and energy.”

Regulation may also be a factor. Many countries are working on legislation governing stablecoins and other tokenized assets. Yin said this will allow it to move quickly from the sandbox to real-world use.

“Besides pure issuance on the supply side, we expect the demand side to eventually start appearing on-chain,” Yin added.

Plume Ink does business with Securitize

Plume announced Wednesday that Securitize, a tokenization platform backed by BlackRock and Morgan Stanley, plans to bring institutional-grade assets to Plume’s Nest staking protocol.

Related: Plume Network receives SEC Transfer Agent status and brings TradFi on-chain

The Nest Staking Protocol allows investors to trade tokenized assets and earn yield. According to Plume, the partnership will connect Securitize’s tokenized funds to Plume’s network of over 280,000 RWA holders.

The Hamilton Lane Fund will be the first, with other issuers and asset classes on the securitization platform to follow in 2026.

sauce: plume

Plume has 279,692 holders, which accounts for approximately 50% of the total number of holders across all RWA networks. However, according to RWA.xyz, Plume is not in the top 10, and RWA’s largest networks are Ethereum and the BNB chain.

However, Yin explains that although Plume has a large share of users, each owner may hold fewer RWA assets than other networks.

“Plume has 280,000 users and $200 million in total RWA, which is a much healthier measure of usage on the network,” he added.

magazine: Crypto Massacre — Is Bitcoin’s 4-Year Cycle Over? Trade Secrets