Ethereum (ETH) has had a bumpy year, falling 24% since January 1st, 48% below peak price. But don’t count ETH yet. The forecast market is bustling with optimism. At Polymarket, 25% of traders bet that ETH will reach $3,000 by the end of the month, but Kalshi’s bets show a lot of love for Crypto World’s No. 2 player.

Ethereum’s Future splits forecast markets – $1k crash or $6K rally?

Ether’s $306 billion market capitalization accounts for 9.3% of Crypto World’s total $3.27 trillion, but not all sunlight and rainbows. Compared to last month, it has soaked 0.5% and falls 24% since the start of the year, below 36%, which was standing six months ago. It is also traded at around 0.02402 BTC at a price of $2,532 per ETH. Still, the Polymet bet with $4.58 million action shows that there is a 25% chance that $3,000 per ETH will appear on the table by June 30th.

Around 12% of traders bet on hitting Ethereum $3,200, while a large 56% say $2,300 is a plausible result. Polymarket’s individual forecasts are $6.45 million in volume, which estimates the price of ETH at the end of the year, with a odds of $4,000 tag at 38%. Also, Ethereum, which is likely to be 24%, will rise to $5,000, with a 16% chance of flying up to $6,000. That said, the similarly weighted 16% bet predicts that ETH could fall to $1,000 by December 31st.

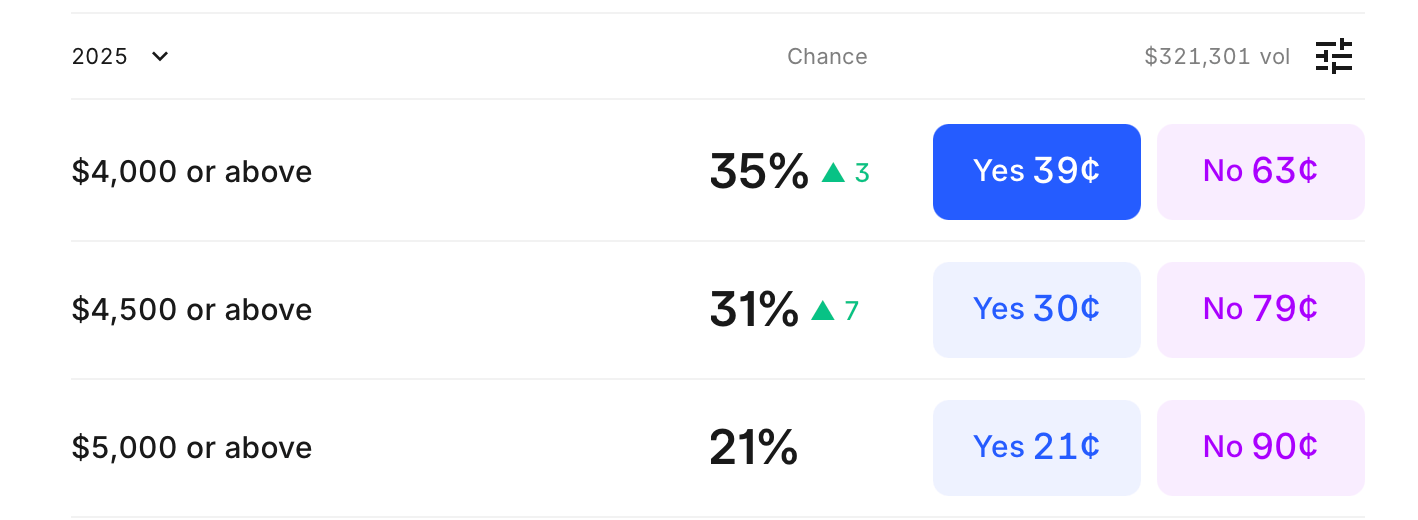

Kalshi will bet on the price of ETH by December 31, 2025.

On Kalshi’s forecast platform, Ethereum is currently increasing its odds by 3 points, reaching 35% in 2025 to over $4,000. The forecast for the move to $4,500 has grown to 31%, reflecting a 7-point increase. Meanwhile, the $5,000 goal appears to be unconvincing, with only 21% of people believing that this year. So far, $321,301 has been wagered across these results.

Ethereum’s advancement will not be resolved as they ride on millions of potential results. The tension between bearish short-term performance and bullish long-term speculation reveals markets captured by uncertainty, but it is potential. Whether ETH is rebounding or retreating, one thing is clear. Traders have not retreated from betting that big moves are still ahead.