The crypto forecast market multinationals are set to make their long-awaited return to the US following a $112 million acquisition of small but regulated derivative exchanges, QCX and Clearinghouse QC Clearing.

Polymarket CEO Shayne Coplan won the X to share today’s feat on July 21st. The move “opens the way for American traders to welcome once again.”

This transaction is currently owning an approved derivative clearing organization (DCO) and a designated contract market (DCM) in the form of owning company QCEX, and is therefore considered to be considered compliant under US regulations.

Access to Polymarket, which was restricted for US-based users following the 2022 settlement with CFTC, remains headquartered in New York, and founder Coplan is a US citizen. Since then, the platform has been “read-only” for US users. This means that US residents can see the market and its possibilities, but they cannot participate in the bet. The website says, “We’re working so hard to prepare to launch our US platform.”

The news came shortly after both the CFTC and the Department of Justice announced they would stop investigating Polymarket and Coplan. The news also follows the announcement that “we will deploy a new reward and Oracle resolution system later this year” following the Zelenskyy suit market blunder earlier this month, following the announcement on the Polymarket website.

The platform recently announced its latest fundraiser at the end of June. It was reported that Peter Thiel’s founder fund was to fill a $200 million salary increase.

Poly local growth

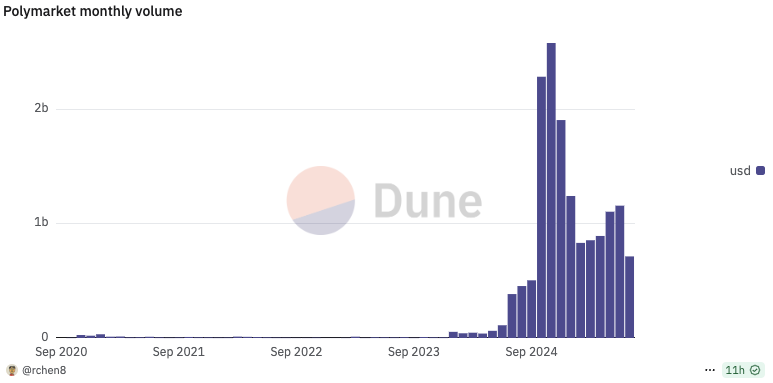

Polymet, which exploded in 2024, leading up to the US presidential election, was one of the breakout crypto products of this market cycle. The forecast market originally launched in 2020, but until last year, most crypto participants, other than the stubborn ones, were barely noticed.

The 2025 platform accounted for an average of about $1 billion per month after an average of $50 million per month in the first half of 2024 and less than $10 million per month in 2023.

Monthly volume of polymake. Source: Dune Analytics

Last month, X (formerly Twitter) announced that it would integrate Polymarket as the social media giant’s priority forecast market platform.

The unfolding of the announcement comes shortly after the US House of Representatives approved clearing out several important crypto bills, with President Trump signing the law on Friday sending out the “made in America” category of altcoin flights.