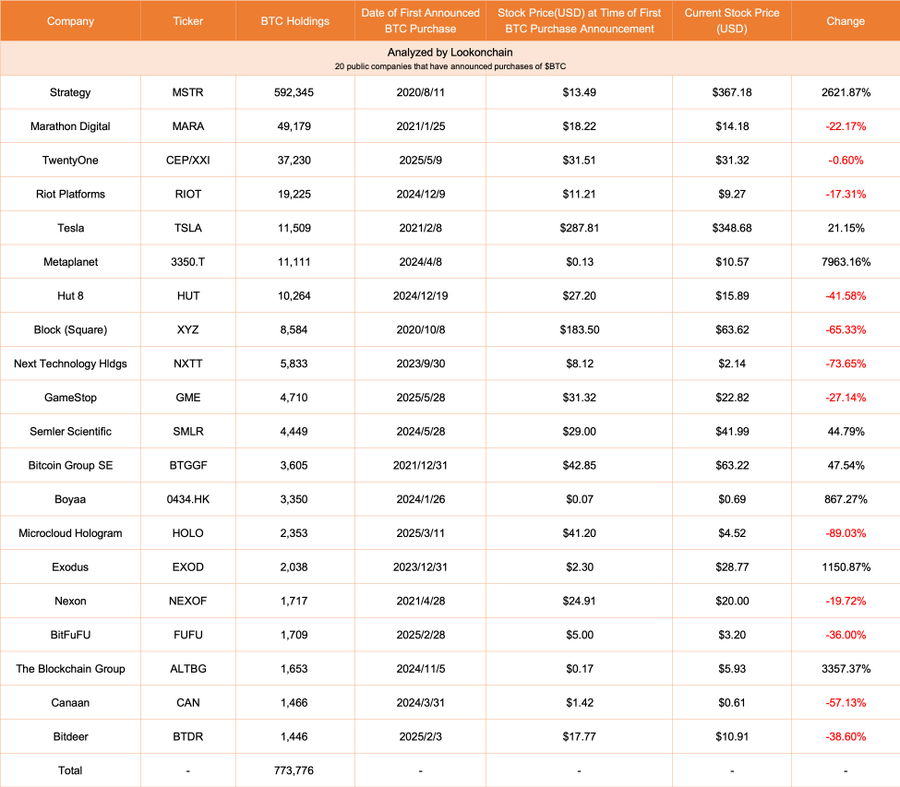

- The publicly traded companies currently hold over 773,000 Bitcoin worth $81.45 billion, with market responses still mixed.

- Metaplanet shares rose more than 7,900% after revealing BTC Holdings in April 2024.

- Twelve of the 20 companies saw stocks decline despite adding Bitcoin to their balance sheets.

Adoption of Bitcoin by public companies has gained momentum, with 20 companies currently collectively calling 773,776 BTC at $81.45 billion. According to LookonChain, these companies’ BTC holders will trade for multiple sectors, but the performance of the stocks has been significantly different following the announcement.

Source: x

Eight companies, including people with amazing returns, have recorded profits, but most have witnessed a decline in stock prices. Metaplanet, registered in Tokyo, has registered the highest growth. Since announcing BTC Play on April 8, 2024, the company’s stock has risen 7,963% to 820.65 yen compared to 10.13 yen.

MicroStrategy (MSTR) is another major competitor that began purchasing Bitcoin in August 2020. The price is $13.49, which means the price is up 2,621%. Founded by Michael Saylor, the company is still at the top of the corporate holder for 592,345 BTC. Boyaa and Exodus also reported significant increases of 867% and 1,150%, respectively, when holding numerically small amounts of Bitcoin.

Despite BTC exposure, tech stocks and gaming stocks are struggling

Not all companies benefit from Bitcoin exposure. Gamestop (GME), which reported BTC investments in May 2025, fell 27%. Gamestop owns 4,710 BTC and is trading at $22.82 today, making the Newsday price below $31.32.

Also among the worst performances are the block (formerly square) which fell 65% from October 2020 and the Hut 8, which fell 41% from December 2024.

Tesla, which owns 11,509 BTC, has experienced a 21% medium return since it announced BTC as the center of its December 2021 declaration. Meanwhile, Bitcoin Groups SE and Semler Scientific have increased by 47.5% and 44.8%, respectively.

This trend indicates that generating Bitcoin is becoming more strategic, but does not mean good performance in the stock market. Other operational factors appear to dominate the market’s response to BTC holdings.

Small businesses show big profits from BTC Pivot

Several small businesses have offered exceptional returns following their BTC plan disclosures. The Blockchain Group (AltBG), which owns only 1,653 BTC, has raised its astounding 3,357,873% to its current price of $5.93. Similarly, Semler Scientific, which holds just 4,449 BTC, rose more than 44% within a month.

Boyaa, a stock listed in Hong Kong, has increased its shares to HK $0.69. These findings show that following the announcement of a crypto-centric financial approach, there is a possibility that revaluation of small and medium-sized businesses with historically low ratings could be greater.

However, the biggest loss was recorded in Microcloud Hologram (Holo). This acquired 2,353 coins in BTC in March 2025, but fell 89%. This difference in price action shows the nature of Bitcoin purchases.