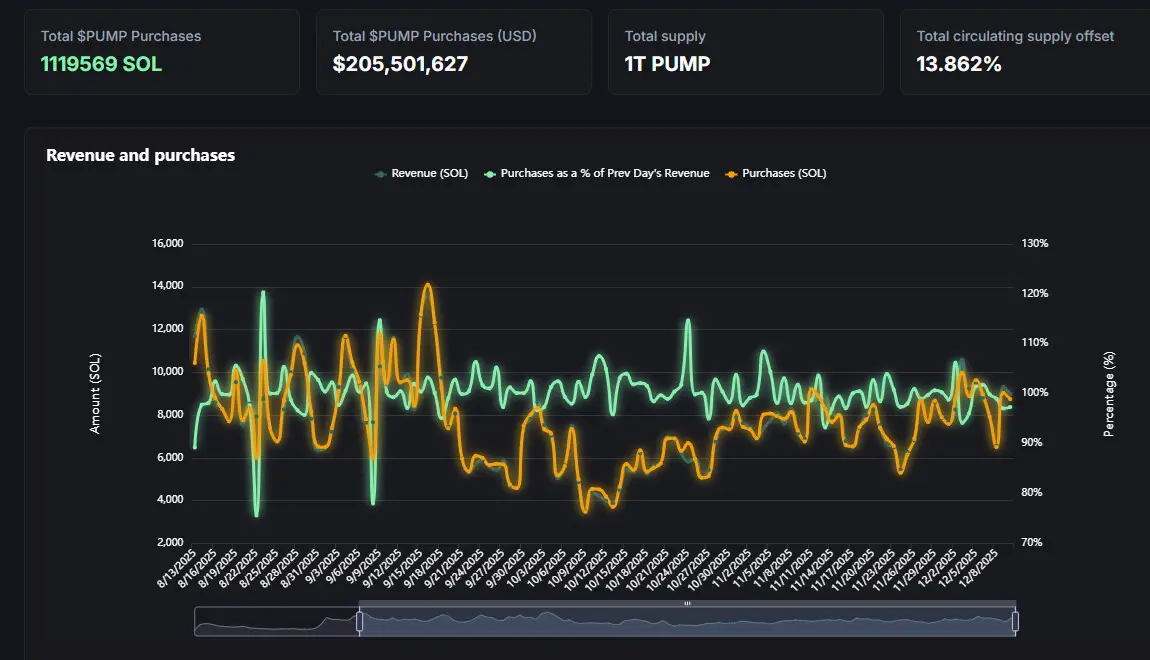

Pump.fun is the Solana project’s leader in native token buybacks. The team has poured over $205 million into PUMP over the past five months.

Pump.fun continues to buy back PUMP and still funnels most of its fees into reducing the supply of the native token.

To date, the team has poured $205 million into buybacks, more than 99% of its daily fees. In total, the team bought back 13.86% of the supply, helping PUMP recover from its lows.

Pump.fun spent over $205 million on regular buybacks, converting nearly all of its daily fees back into the native PUMP token. |Source: Pump.fun pricing.

Pump.fun’s approach outpaces all other Solana projects, which mostly maintain fees. Pump.fun announced a share buyback after months of being targeted for extracting fees outside of the Solana ecosystem. As a rough estimate, Pump.fun has generated around $1 billion in fees since its inception, most of which came from last year’s altcoin peak season.

Are PUMP’s share buybacks adding value?

Despite regular buybacks, PUMP tokens are still hovering near the lower limit. The buyback effectively consumes all of the fees associated with meme token generation and trading, but some are skeptical whether that value will be returned to the community.

PUMP is still trading at $0.0027, down 54.7% in the past three months. Additionally, Pump.fun’s fees are slightly lower and you won’t be able to buy market-shaking PUMPs. The community criticized Pump.fun for failing to properly use the SOL Reserve and selling it for PUMP instead of staking. Even with share buybacks, many PUMP holders remain underwater and will not receive any additional profits or profit distributions.

PUMP’s open interest is also close to an all-time low at $183 million, with approximately 60% of the stock held in long positions. About 51% of traders are long on HyperLiquid, with an increasing number of attempts to bet on further price declines in PUMP.

Also, the token has largely crashed due to liquidation of long positions and no short squeeze has taken place. Only 10 Hyperliquid whales took positions with tokens.

PUMP Reflects Slowdown in Memetic Groove Activity

Pump.fun switched to decentralized trading after daily fees from new token generation decreased. DEXs have been closing the gap, but have yet to catch up to peak meme season revenues.

Pump.fun and its PumpSwap DEX still generate $2.7 million in fees every day, making it among the top five commission-generating apps. Pump.fun is slowing down token production and graduation, but daily fees maintain a high baseline.

Meme token trading is also changing at Solana, accounting for only 5% of trading volume. DEXs have switched to trading wrapped assets, stablecoins, and legacy memes. Newly launched memes and old tokens account for about 5% of Solana DEX volume, down from more than 80% at its peak.