Cryptocurrency markets have had a year full of ups and downs, with most of the large digital assets turning out for mixed performance in 2025. After a tough start to the year, Bitcoin prices started to pick up in the second and third quarters, with Bitcoin prices hitting multiple all-time highs in a six-month period.

However, the flagship cryptocurrency has struggled for most of the final months of 2025 and is likely to end the year in the red. Interestingly, the latest on-chain data and historical patterns suggest that Bitcoin price could be set for a much stronger year-end close than expected.

There are no negative days left in 2025, but a serious correction could occur in 2026.

On Saturday, December 6th, AlphaRactal CEO and Founder Joan Wesson took to the X Platform to share what she expects for Bitcoin price at the end of 2025. According to on-chain experts, market leaders are likely to end the year in a flat price range.

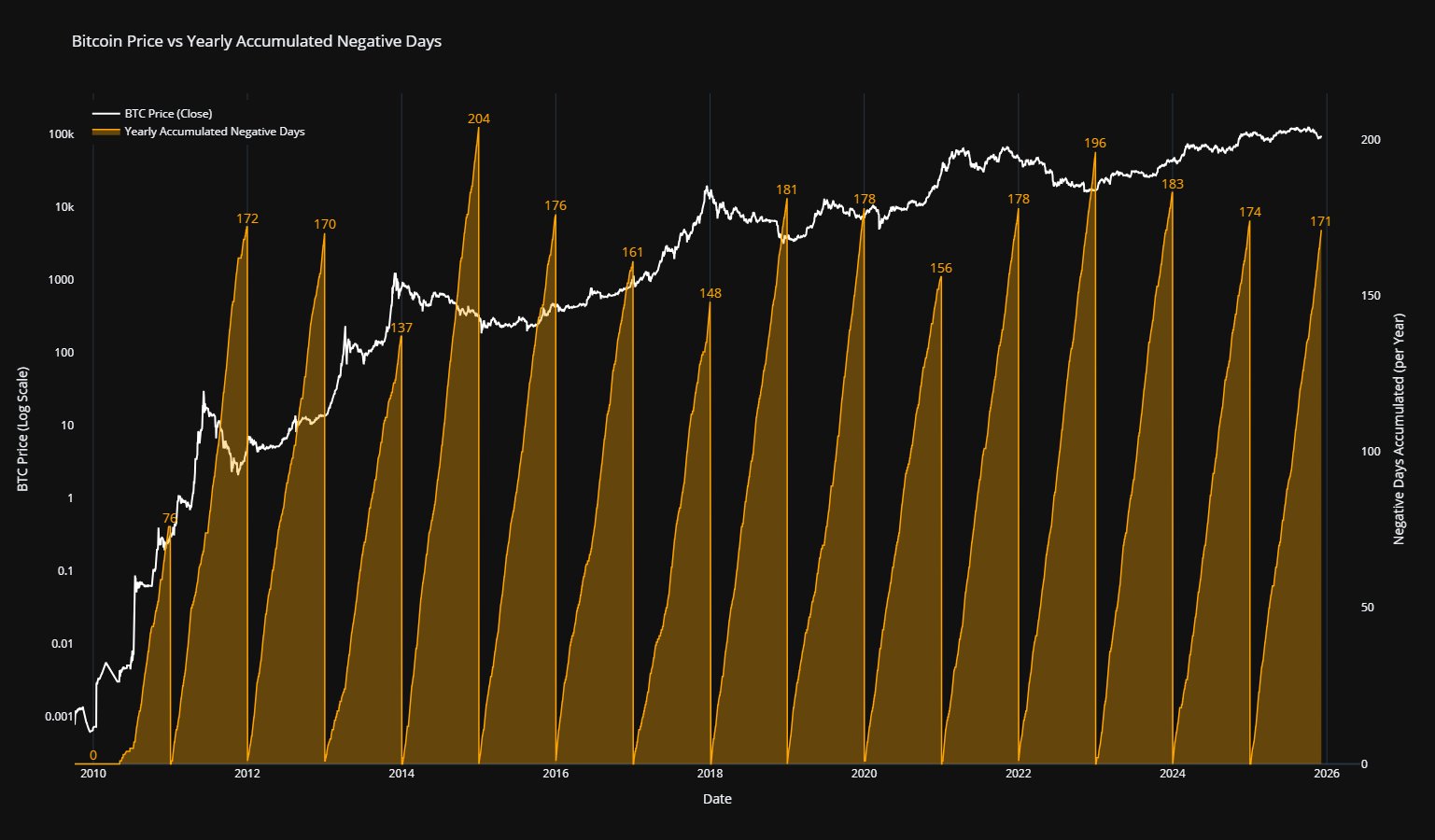

The relevant metric here is the cumulative number of negative days per year. It tracks market resilience by measuring the number of days in a year that an asset’s daily price candlestick ends in the red.

Historical data and patterns show that Bitcoin typically experiences an average of 170 days of negative price fluctuations per year. This average value or level provides insight into the stress threshold of the world’s largest cryptocurrency by market capitalization.

Source: @joao_wedson on X

When the number of negative days approaches or exceeds this threshold of 170 days, as Bitcoin already did in 2025, fatigue sets in among the bears and selling pressure in the market tends to subside. Wesson revealed that the leading cryptocurrency has already accumulated 171 negative days by 2025.

On-chain experts noted that crossing this threshold “strongly suggests” that Bitcoin price will not see any more negative days in the final weeks of 2025. Wesson said if a deeper correction is imminent for market leaders, it will likely happen next year.

However, as the Alpharactal founder emphasized, Bitcoin prices are likely to end the year in a consolidated range. Adding further credence to this assumption is the lack of market demand, as seen in the decline in capital inflows to spot Bitcoin exchange-traded funds.

Bitcoin price overview

As of this writing, the price of BTC is around $89,397, reflecting a decline of just 0.3% over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

editing process for is focused on providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is carefully reviewed by our team of top technology experts and experienced editors. This process ensures the integrity, relevance, and value of your content to your readers.