Round Hill has submitted an amendment to the XRP Covered Call ETF, signaling growing acceptance of XRP-based products by financial institutions.

This proposed amendment would only delay the ETF’s launch date, indicating that approval exists but the timing is uncertain.

A filing with the SEC confirms the approval of XRP as an underlying asset for regulated ETF strategies.

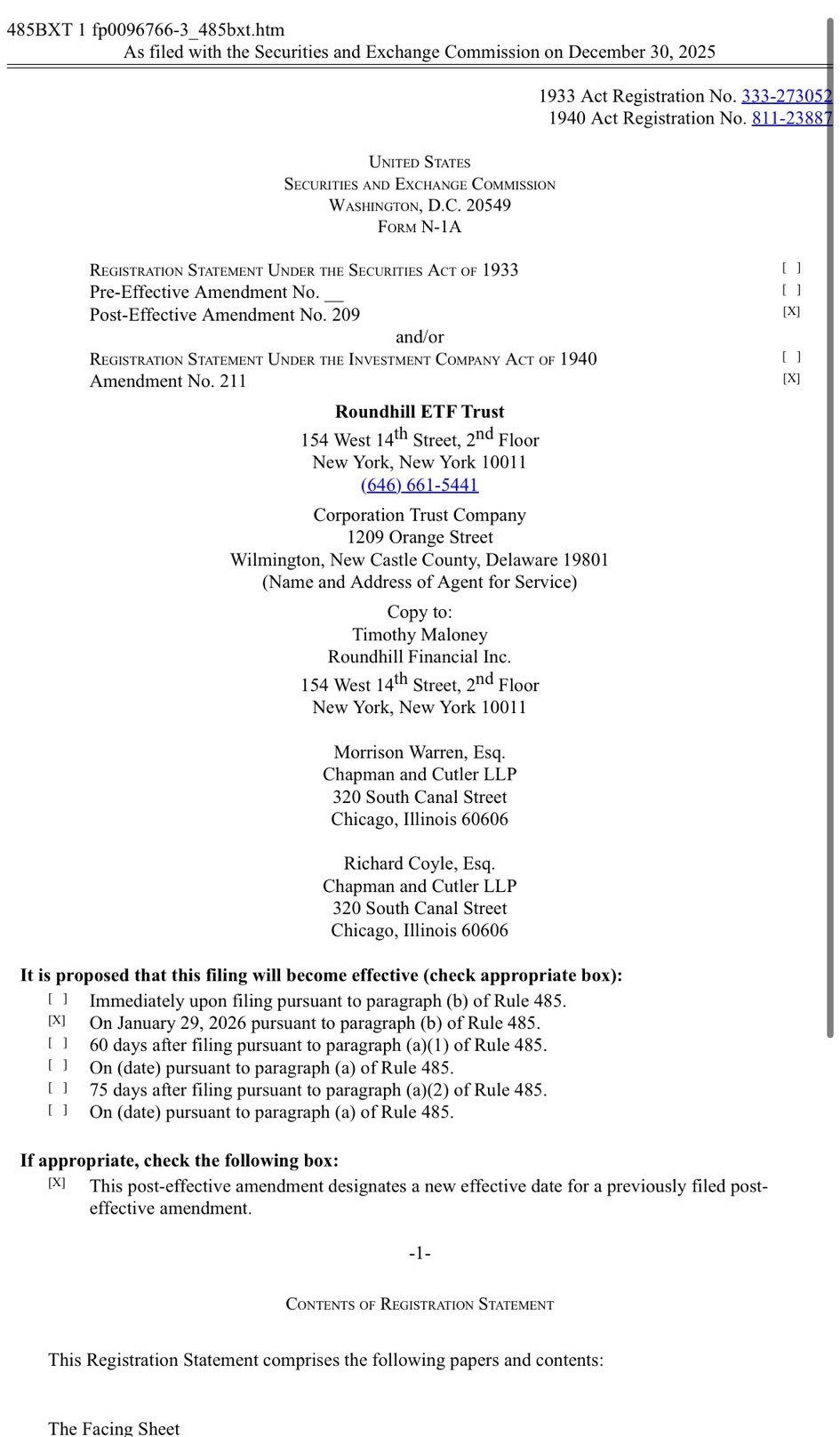

Roundhill Investments, a US-based company known for launching new ETF products, has filed its latest XRP-related ETF documents with the US SEC.

While some see this as an important step forward for Ripple’s XRP, the filing also comes with limitations that investors should be aware of.

Here’s what Round Hill’s updated application actually means.

Round Hill Field Post-Effective Amendments for XRP Covered ETFs

Round Hill ETF Trust has filed a proposed Rule 485 amendment to the XRP Covered Call Strategy ETF, according to a filing with the U.S. Securities and Exchange Commission on December 30, 2025.

This filing indicates that XRP is now accepted as a fundamental asset in regulated ETF strategies, marking a significant step for XRP in traditional finance.

However, this application does not create a spot XRP ETF, nor does it imply that the Fund will hold any XRP tokens directly.

Instead, Round Hill’s ETF is designed to generate income using option premiums linked to other XRP-based ETFs. Simply put, it focuses on generating stable income from XRP price fluctuations, rather than owning XRP itself.

Why is there a statement like the following in the update file?

The filing clearly states that this update was not made to change the ETF’s operational structure, but merely to delay the ETF’s launch date. This means that the structure of the ETF is already ready and approval is not an issue, the only missing part is the timing of when it will launch.

Although this is not a spot ETF, this filing still sends a strong message. This confirms that XRP will be accepted as the underlying asset for regulated ETF products.

This is a significant step forward for XRP, as such moves are typically made after the asset passes key regulatory and structural tests.

Will Roundhill aim for an actual XRP ETF in the future?

For now, Roundhill’s strategy is focused on generating steady income from XRP’s volatility, rather than betting on rising prices. Still, this move lends credibility to XRP’s role in regulated financial products.

Many in the XRP community were hoping that this correction would lead to a spot XRP ETF, but that is not the case at this time.

Following this news, the price of the XRP token rose slightly and is currently trading around $1.87.