Binance Research has released a report on Trump’s tariffs and how it will affect the crypto market. It noted that while the most risky investments suffer the most, RWA and the exchanges suffer the least.

Additionally, new correlations with the stock market increased the risks associated with Bitcoin. Only 3% of investors voted in mind were considering their preferred asset classes in the event of a trade war.

Binance Research analyzes tariffs

Binance Research, a subsidiary of the world’s largest crypto exchange, has been investigating industry trends in 2025. Recently, we have reported an important gap between the latest crypto air mounting models and distribution models.

Today, Binance Research has produced its latest report. This has to do with US tariffs.

President Trump’s proposed tariffs have been particularly relevant to vinance as they have had a major impact on the crypto market. The report says these will be the strictest tariffs in the United States since the 1930s, promoting male dog horror and the world trade war.

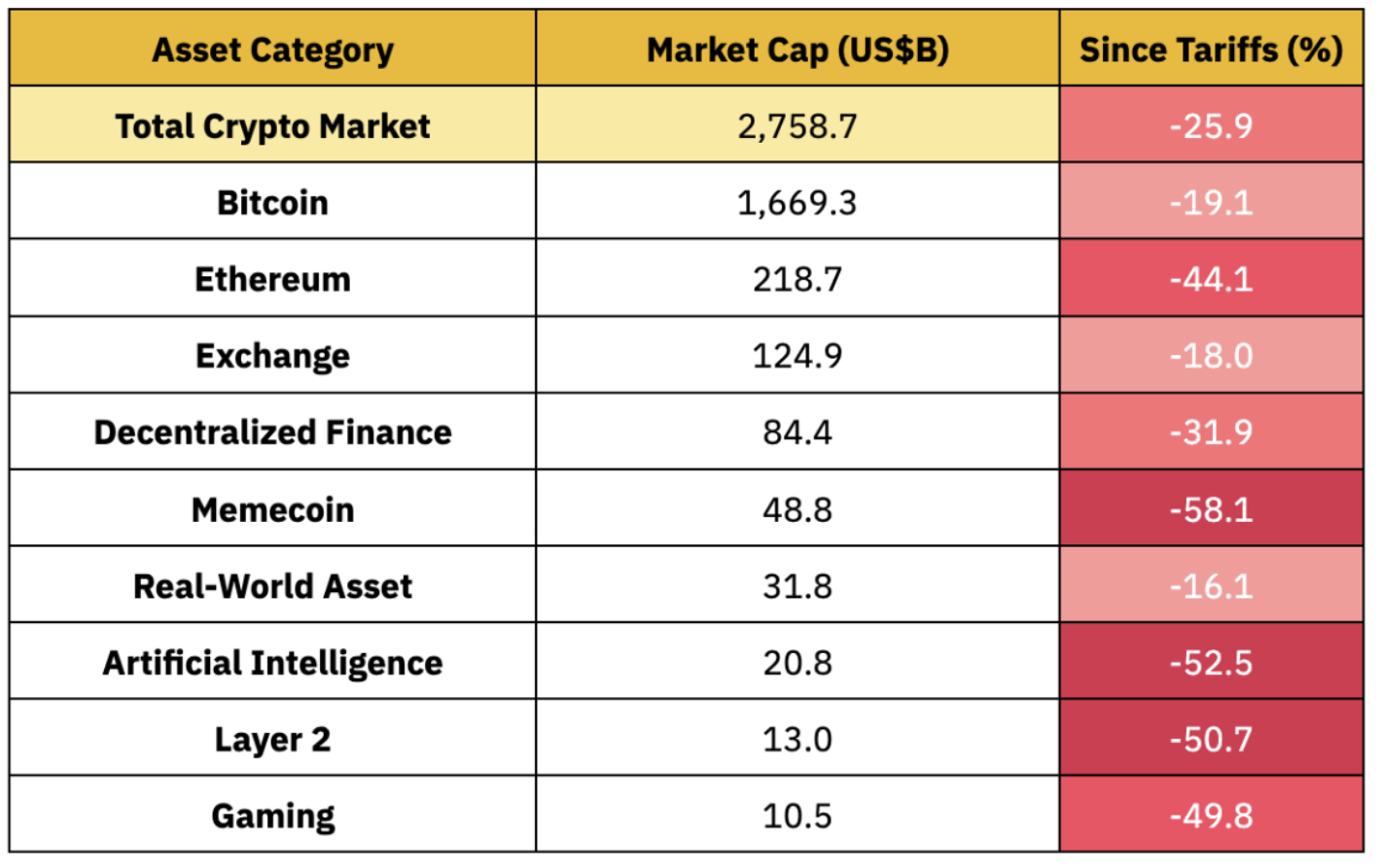

Binance Research analyzed various crypto-related assets to determine risk.

Customs duties affect cryptography. Source: Binance Research

The claim is supported by today’s market movements. For example, Ethereum fell in March 2023, but Mantra’s OM token rose after it announced its major RWA fund.

Apparently, RWA is the crypto market sector facing the lowest risk from tariffs. The report states that the most vulnerable sectors are those recognized as the most at risk, such as memecoin and AI.

Both the AI tokens and meme coin sector have fallen by more than 50% since the tariffs were announced, but RWA tokens have only been lost 16%. Exchange-based tokens were only soaked 18%.

Binance Research further claims that only 3% of FMS investors view Bitcoin as a priority asset class in the case of trade wars. One of the most popular stories about Bitcoin is that it can hedge against inflation, but this new correlation can affect its characteristics.

“Macroeconomic factors, particularly trade policy and rate expectations, are increasingly driving crypto market behavior and temporarily overturning demand dynamics. Whether this correlation structure will last is key to understanding Bitcoin’s long-term positioning and diversifying value,” argues Binance Research.

Ultimately, the report identified many factors that could have a serious impact on the crypto market. Some of the other factors include escalation of trade wars, rising inflation, Federal Reserve policy, and crypto-specific development.

“The risk-off response to mutual tariff announcements has resulted in the S&P 500 losing more than $5 trillion on two-day trading days. In the past 44 trading sessions, the US stock market has lost more than $11 trillion. Gomining Institutional told Beincrypto.

Overall, the key point is that many variables are currently being played, but despite this confusion it is still very possible to choose a safe option. Blockchain projects driven by utilities and long-term development seem to be the safest option in the current volatile ecosystem.