Sharplink, the largest public holder of Ethereum, has expanded its ETH position, according to a July 1 statement.

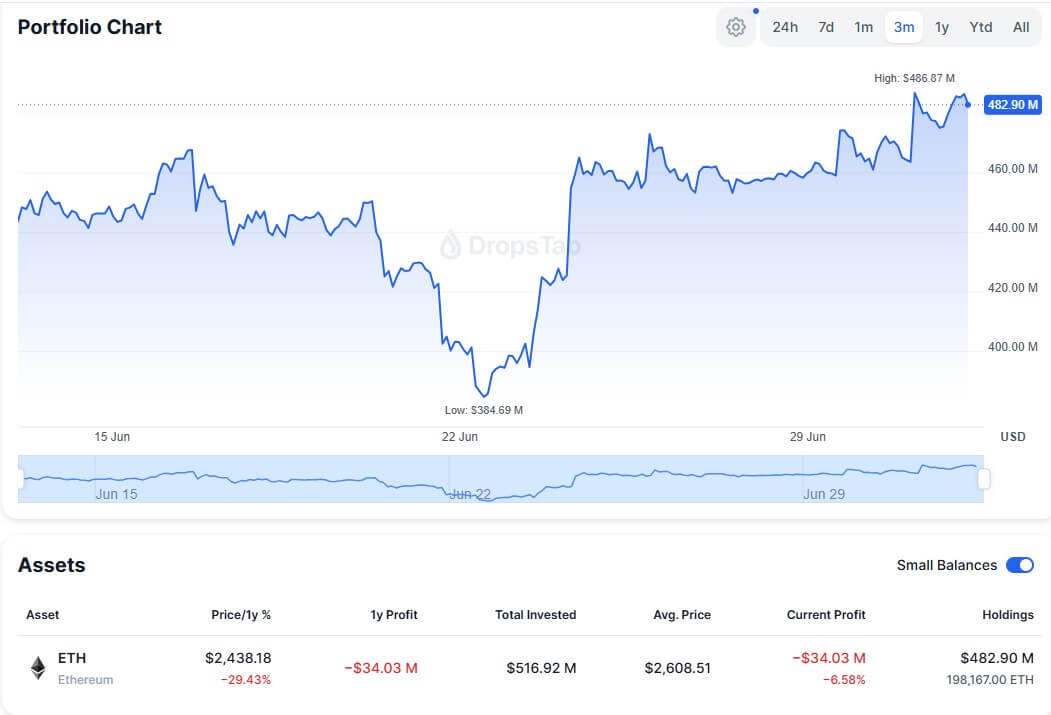

Between June 23 and June 27, the company acquired an additional 9,468 ETH for around $22.8 million, bringing total Ethereum holdings to 198,167 ETH, valuing $.485 million.

According to Dropstab data, the company’s unrealized losses are over $34 million based on the current price of its digital assets.

However, the company is mitigating the pain of losses with the revenue generated from staking assets.

As of June 30th, Sharplink has deployed all ETH reserves to staking protocols. In the week that spans only June 21st to June 27th, the company won 102 ETH to secure compensation.

Since launching its staking strategy, Sharplink has generated 222 ETH, which is valued at around $540,000.

Sharplink Chairman and co-founder of Ethereum Joseph Lubin highlighted the broader importance of the move, saying:

“We are entering a new era where digital assets like Ethereum are no longer speculative commodities. They are rapidly becoming the strategic currency of the modern digital economy.”

New “ETH concentration” metric

Sharplink has introduced a new reporting metric, “ETH Concentration,” to improve transparency and track the company’s Ethereum-related performance.

In particular, this metric is borrowed from the “BTC Yield” key performance indicator (KPI) adopted by Bitcoin-centric companies such as Metaplanet and Strategy (formerly Micro Strategy).

ETH concentration metrics are calculated by splitting the total ETH held in 1,000 diluted stocks into outstanding diluted stocks. The calculation includes actual stock, stock options from warrants, stock options, and restricted stock units, but excludes stock buybacks and vesting restrictions.

Since June 13, when Sharplink first disclosed Ethereum’s accumulation strategy, ETH concentration metrics have risen from 2.00 to 2.35 ETH per 1,000 diluted stock as of June 27.

Meanwhile, Sharplink has appointed Elevate IR to a record-breaking investment institution in its related developments. The company supports Sharplink in shaping financial communications and investor engagement efforts.

Sharplink Gaming CEO Rob Phythian highlighted the partnership as a key step towards maintaining transparency, saying:

“Ethereum is more than a Treasury asset. It is the financial foundation of what we believe will become the next generation of capital management and online gaming infrastructure.”