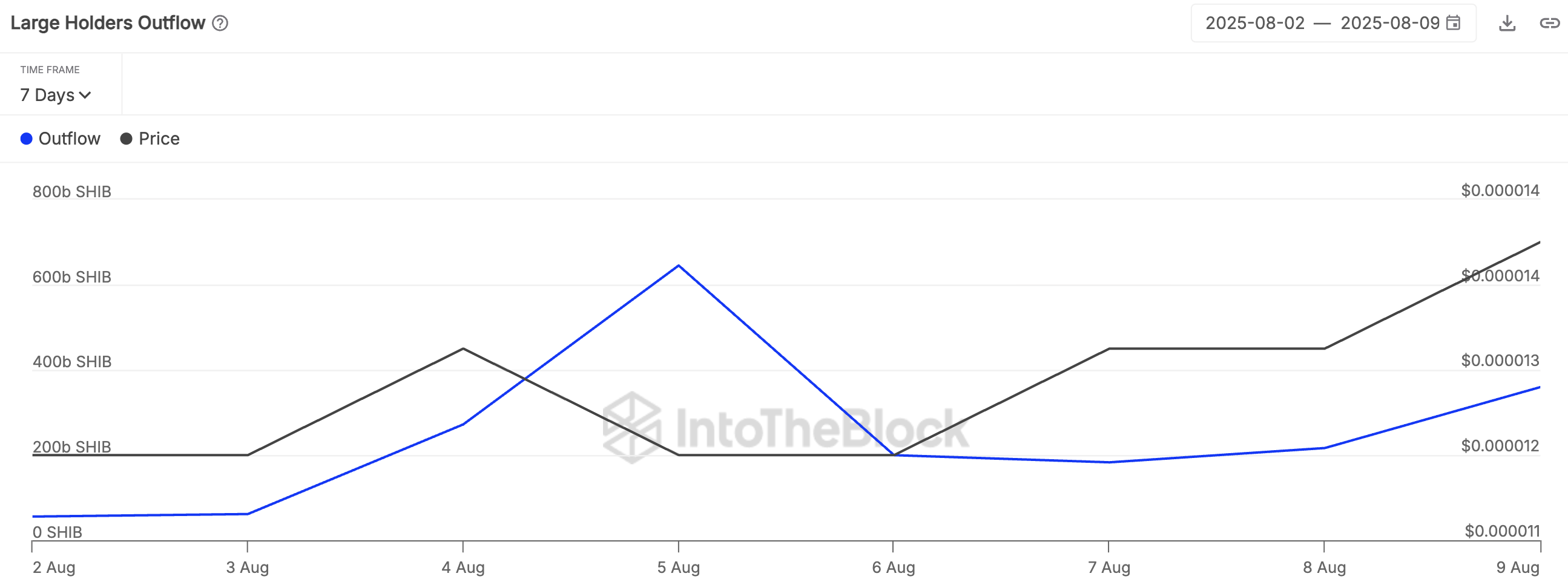

The largest Shiba Inu (Shib) wallet has just made its most substantial move in a few days due to leaks from more than doubled intensive exchanges between Thursday and Saturday. Intotheblock data shows that S1830.3 billion left a massive holder address on August 7th, but by August 9th, that figure had skyrocketed to 359.6 billion. This is a shift that occurred as the token price rose from $0.000013 to $0.000014.

On paper, “large holders” refers to addresses that hold more than 0.1% of the circulation supply. In the case of Shiv, this includes individual “whales” and some of the largest exchanges in the industry.

Coinbase, Binance, and Upbit all sit near the top of the leaderboard, holding a multi-billion dollar worth of shiv in bulk.

When coins leave these exchange-related wallets, it often indicates that the buyer is moving them into private custody. This is usually a movement that follows accumulation rather than a sale.

Shib Price Backs Outflow

From August 2nd to August 6th, both prices and outflows will move very little, and activity levels will remain within a narrow range. This mildness has broken mid-week, suggesting a change in strategy by large owners through adjusted withdrawals or opportunistic purchases following a recent price drop.

As exchanges act as liquidity hubs and retain some of the largest siv wallets, movements of this scale could immediately affect the supply available in the open market.

While large-scale holder spill spiking can indicate panic sales during volatile conditions, the combination of rising spills and price increases suggests a different narrative.

If this trend continues to shrink, replacing floats, new demand could lead to faster price increases than expected.