The broad crypto market has turned bullish with key cryptocurrencies that showcase key indicator strengths on the last day, but Shib continues to show signs of weakness following recent data provided by blockchain analytics platform Intotheblock.

The white whale pulls back

After achieving a massive spike of 24.3 trillion Siv on a massive transaction volume on June 5th, the whales have been pulled back significantly with just 2.06 trillion Siv flowing into the wallets of shiv adults over the past 24 hours.

This has led to the popular dog-themed meme tokens recording a massive 91.5% drop in Shiv’s large transaction volume in just four days.

Large trading volumes are often measured by Shib transfers above $100,000, but are usually done by institutional investors or retail whales.

Thus, a sudden drop in SHIB’s large transaction volume suggests a significant drawback by key holders or a broader reduction in investor trust and trading profits.

This isn’t surprising as Shiv consistently trades sideways, and it seems like the hype surrounding the token is being cooled, and it’s struggling to regain that bullish momentum.

As Shib’s whale activity rushes from a massive 24.3 trillion to 2.06 trillion on June 9, the massive drop threatens Shib’s potential price performance and raises concern among investors.

The reason behind the sudden pullback on Shiv’s large transaction volume remains unknown, but negative metrics appear despite a proper revival in token prices.

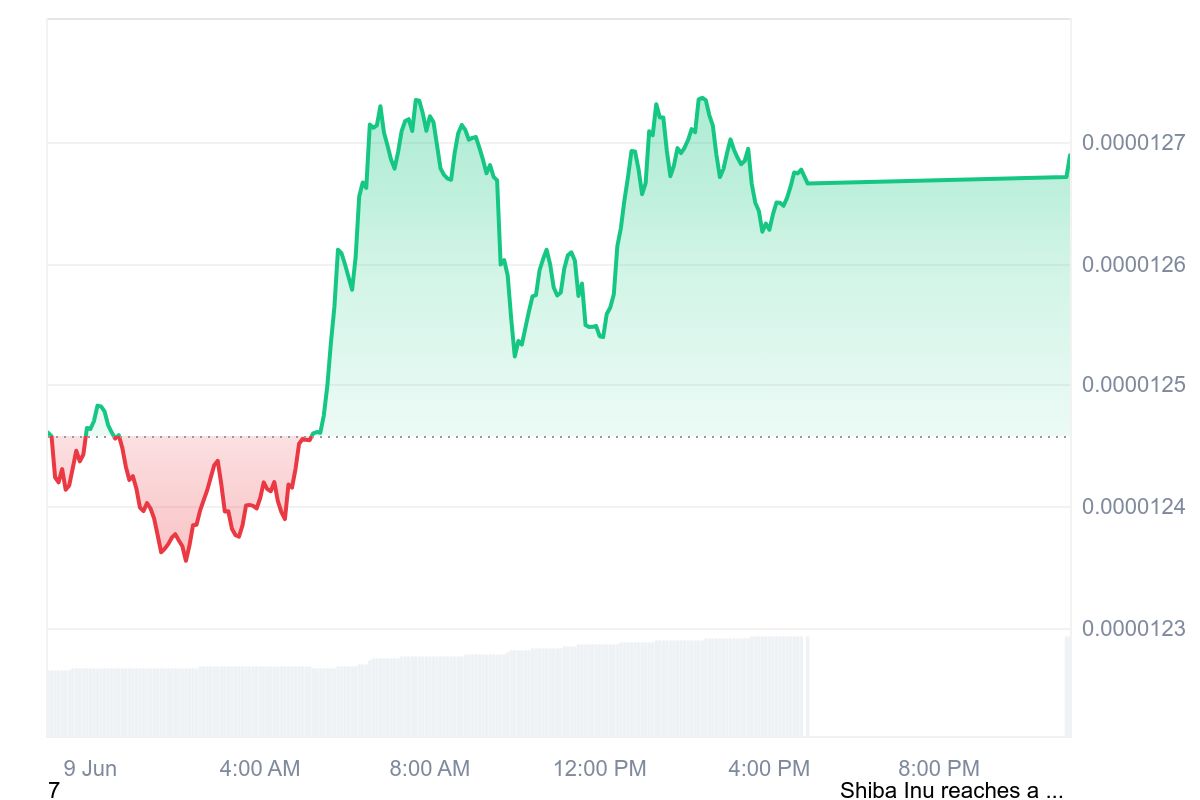

As of June 9th, SHIB reached $0.00001273 from the lowest recorded early in the day, $0.00001235. The token has shown resilience over the past few hours, but is steadily trading at $0.00001,292 at press time. This shows a decent surge of 1.75% over the last 24 hours.

The reasons behind whale activity remain uncertain, but the notable slump in whale movements when markets focus on price revival suggest that large holders may be adopting a waiting approach.

Often, such a rapid decline in large transactions has waned momentum and uncertainty among SHIB owners, leading investors to question the sustainability of ongoing price increases.