Today’s Ethereum Price: $1,770

- Ethereum’s open interest increased by 4% with a sharp decline in the Taker Buy and Seller ratio, indicating dominant bearish sentiment.

- However, Spot Investors maintained a bullish bias ahead of the Pectra upgrade, causing 63,690 ETH with exchange net spills.

- ETH could decrease to $1,688 if it fails to recover the main symmetric triangle and 14-day EMA and 50-day SMA.

Ethereum (ETH) fell 2% as it will be live within the next 24 hours after its short position increased before the Pectra upgrade set on Tuesday. While Spot Investors maintained a bullish bias, Futures Traders is potentially leaning towards a shortcoming in anticipation of sales news events.

Ethereum Short Traders puts pressure ahead of Pectra upgrades

With each Coinglass data, Ethereum’s open interest has risen nearly 3% over the past 24 hours, despite a 2% drop in prices.

Open Interest (OI) is the total number of volatile contracts in the derivatives market. An increase in OI with a fall in prices means new money entering the market has flowed into short positions.

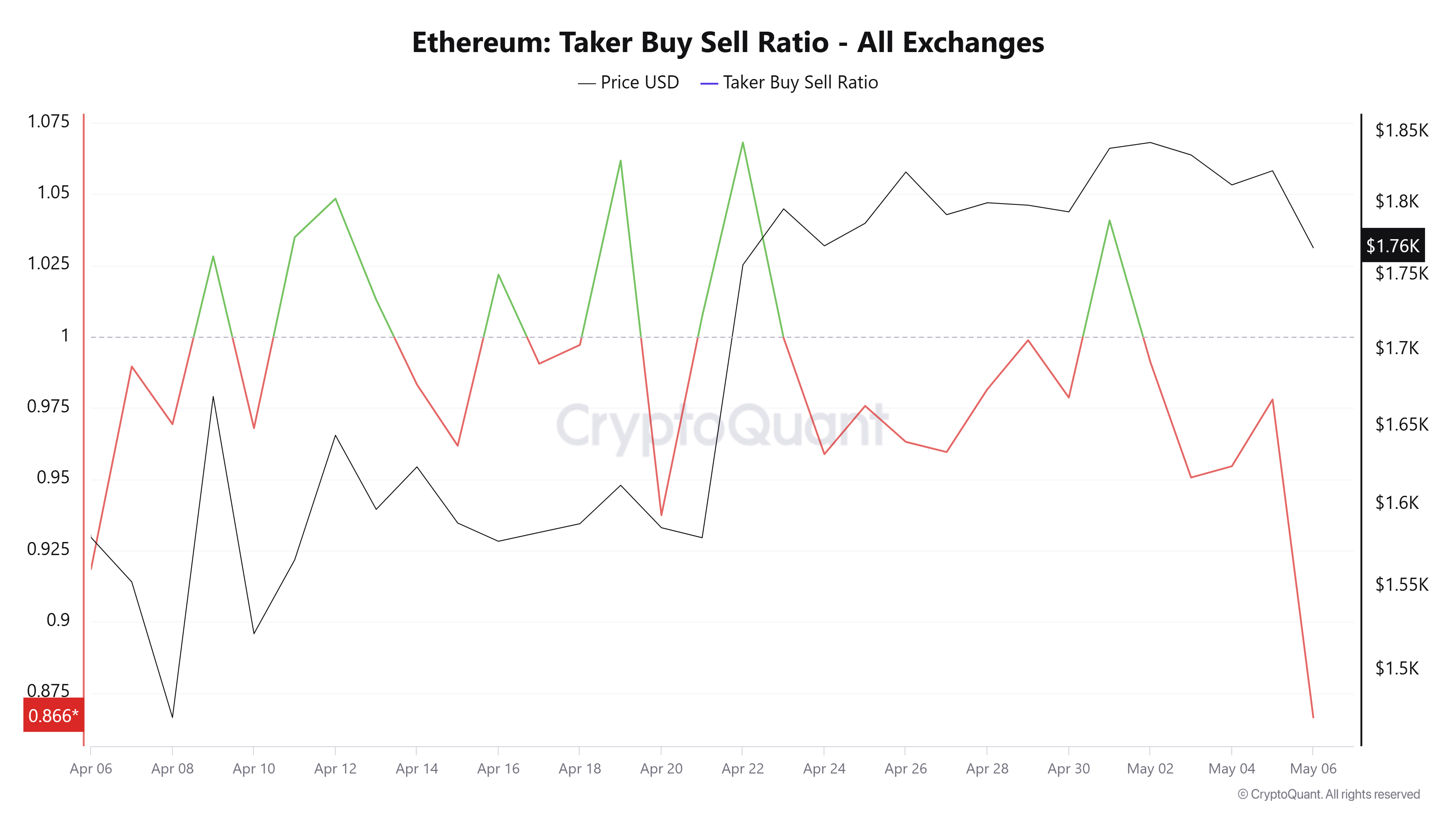

This is evident in ETH’s Taker Buy and Selling Ratio. This plunged to 0.866. This is the lowest level since February 2nd. Values below 1 indicate dominant bearish emotion, and the inverse inverse of values above 1.

Eth Taker buying and selling ratio. Source: Cryptoquant

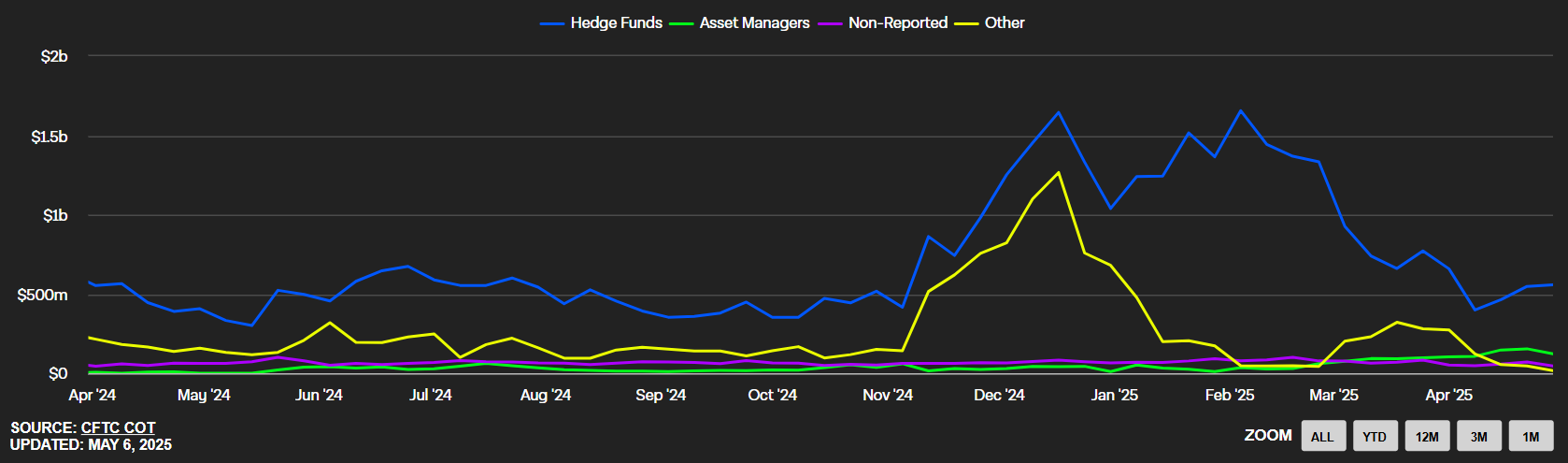

ETH’s OI on most top exchanges rose, but CME’s OI fell by more than 5%, with most traders on the exchange closing positions. This is seen in a decline in strengths from asset managers and retailers.

However, the short position in CME hedge funds has been rising again since mid-April. The rise follows a sustained influx of US spot Ethereum ETFs over the past two weeks. ETH Basic Transactions Between hedge funds.

ETH CME futures (short pants). Source: Block

Despite the price decline, spot investors have maintained bullish bias, causing net exchange rates of 63,690 ETH per encrypted data over the past 24 hours.

The bullishness from spot traders could potentially stem from an upgrade to Ethereum Pectra, with live performances coming within the next 24 hours. Pectra will introduce several features to Ethereum Layer 1, including increasing the blobspace per block from 3 to 6 blocks from 2,048 ETH to 2,048 ETH and increasing the smart wallet functionality to improve data availability.

Ethereum price forecast: ETH below major technology levels, with eye support of 1,688 $1,688

Ethereum saw $553 million in futures liquidation over the last 24 hours for each Coinglass data. The total amounts of liquidated long and short positions are $39.78 million and $11.5 million, respectively.

ETH has fallen below the $1,800 key level, the 14-day exponential moving average (EMA), the 50-day simple moving average (SMA), and symmetrical triangle support, but the Bulls are trying to push back prices above these levels. If ETH maintains daily candlesticks under triangles symmetrical with these key indicators, you can find support of nearly $1,688.

ETH/USDT Daily Chart

The relative strength index (RSI) tests its neutral level, while the stoch oscillator (Stoch) quickly retreats from the over-acquired area to below the neutral level, indicating an increase in bearish pressure.

Daily candlesticks near above a symmetrical triangle invalidate the paper.

Share: Crypto Feed