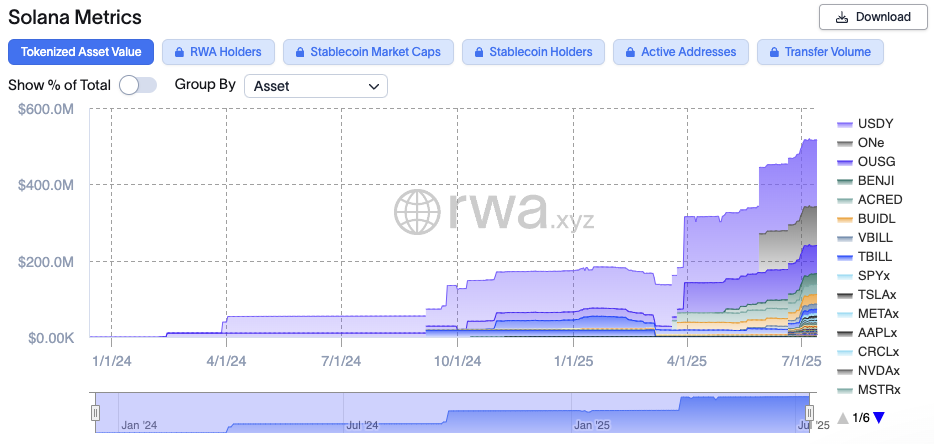

The growth of Solana tokenized real-world assets (RWA) exceeds Ethereum growth this year, with Solana RWA values increasing by more than 200% since the start of the year for each Rwaxyz data.

RWAS is one of the breakout sectors in this market cycle, with the total on-chain RWAs currently skyrocketing from $8.6 billion to $25.5 billion since January 2024.

When it comes to network-by-network distribution, Ethereum has ordered the market share of lions, with over $7.7 billion tokenized RWAs present in the public network.

At $553.8 million, the Solana RWAS is much less value than Ethereum’s RWA total, but the gap is closed. Solana RWA value has increased 218% this year, up 22% over the past month, up from $173.8 million in January.

Meanwhile, Ethereum’s RWA value has increased 81% to $7.7 billion, from $4.3 billion at the beginning of the year.

Solana RWA value. Source: rw.xyz

Messari’s Solana State

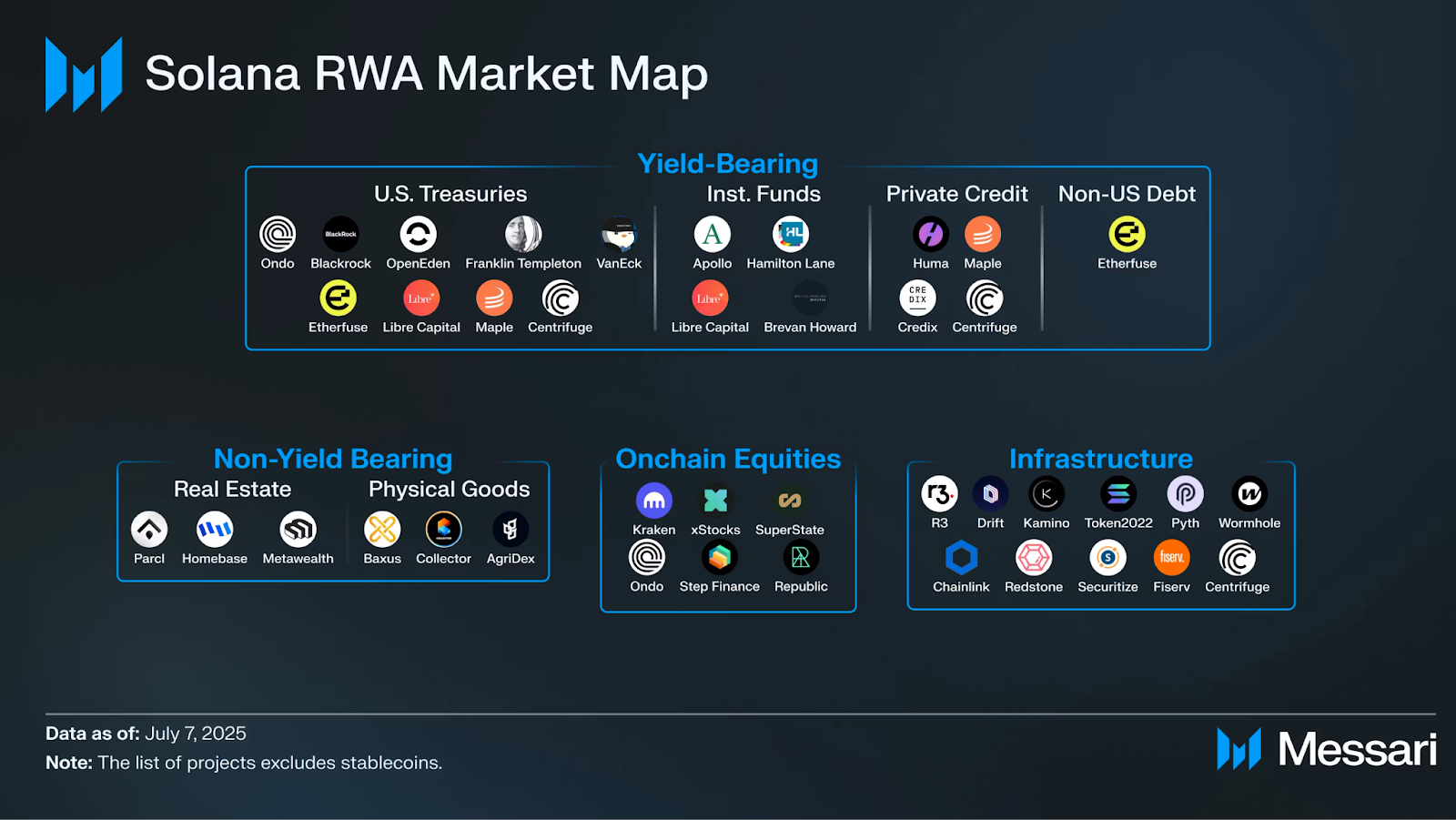

Crypto research firm Messari released a report this week in a similar survey, with 140.6% increase in Solana’s RWA value to $418.1 million in 2025.

The difference between data reports from Rwaxyz and Messari can be attributed to the inclusion of Rwaxyz’s Onyc, a reinsurance underwriting pool backed by Ethena’s Susde, which causes a difference of approximately $100 million in reported RWA values.

“RWA with yields is the most important and fast-growing segment of Solana’s RWA landscape,” led by the tokenized Treasury ministry such as Ondo Finance’s Ousg and USDY, Messari’s report states.

Ondo’s dual token system utilizes the Buidl of BlackRock, a tokenized Treasury money market fund, as the backbone of Ousg, and USDY is a Stablecoin that pays the yield of the Treasury of the Ecosystem. The two assets boast an aggregate valuation of $248 million, and if Onyc is excluded, they account for around 60% of the total Solana RWA market.

Buidl’s Tokenized US Treasuries Fund is the largest tokenized RWA overall, with a market capitalization of $2.8 billion, most of which are Ethereum. However, most of the RWA values for both Ethereum and Solana are derived from Stablecoins per Rwaxyz data, above 90%.