The automated trading system took over Ethereum’s distributed exchange (DEXS), with the bots accounting for more than 73% of DEX trading volume in August – the highest share of 2025 – Spot ET ETH trading volume reached an all-time high, according to data compiled by Crypto Exchange Cex.io.

The volume of the top centralized exchange ETH increased by $519 billion in August, a 55% increase from July, while Ethereum-based DEXS handled a volume of $74 billion, up 45%.

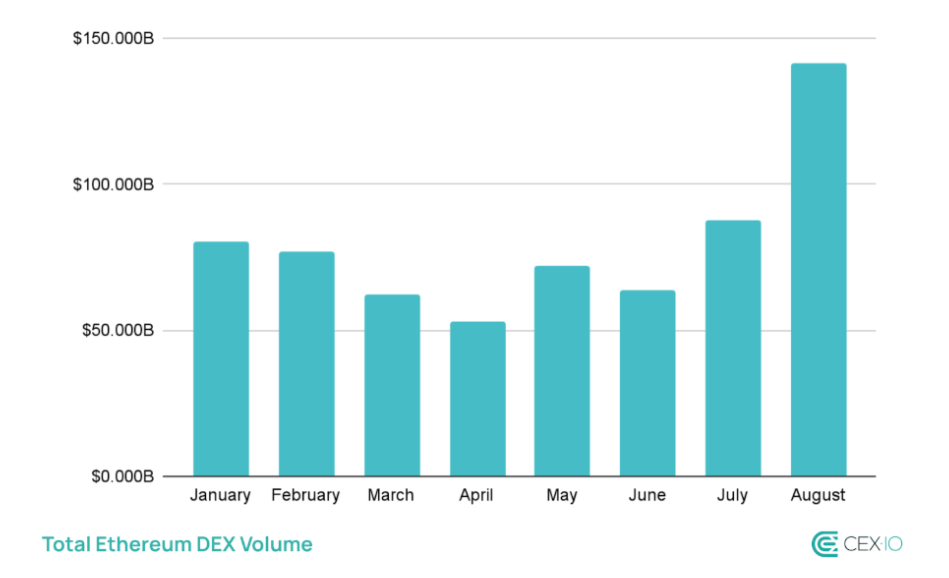

Monthly Ethereum Dex Volume

Analysts at CEX.IO explain that the surge was driven by traders.

Ethereum’s network activity has also skyrocketed. Monthly active addresses surged to 9.6 million, but transactions reached 51.8 million, setting a record level even as average prices fell nearly 40%, at just $0.20.

Bots playing “constructive roles”

However, this also proved that the drop in fees is a double-edged sword, as the bots could trade faster while pumping up the volume of Dex. Bots are often associated with frontrunning and sandwich attacks, but analysts say their growing presence in the stubcoin market “emphasizes a more constructive role.”

“By supplying constant liquidity and carrying out large transactions, automated systems will be more and more useful by improving market efficiency, accelerating stable adoption and enhancing DEX performance.

Bots may help to increase liquidity, but Chain Orisis was discovered in early 2025, and many people have actually used it to manipulate the market. According to a report by Analytics Company, in 2024, roughly 23,400 addresses were linked to potential washing transactions across Ethereum, the BNB chain and bases, with several half-half addresses, nearly $2.57 billion in flagged deals.

Approximately 3.6% (approximately 74,000) of all tokens launched last year showed patterns that could be linked to pump and dump schemes, with most suspicious Dex pools being abandoned within just a week.