The crypto market shows an increase in signs of weakening traders’ appetite. On Monday, April 7th, the exchange’s Stablecoin balance fell to a three-month low. According to Crypto Analytics Firm Nansen, this is the lowest number since January. Furthermore, in April, the crypto exchange flow between incoming and outgoing was reduced.

The Stablecoin balance for the exchange has reached a 3 month low. The lowest since January

Forget about emotional investigations. Track what people do with their money. pic.twitter.com/aze0kallvd

-Nansen🧭 (@nansen_ai) April 7, 2025

The change coincides with Bitcoin’s DIP below (b) $75,000, marking the lowest level seen since early November. The continued uncertainty surrounding the impact of Donald Trump’s tariffs is weighing heavily on both the crypto and stock markets.

You might like it too: Tether seeks involvement in US stubcoin regulations

Relatedly, data points to lessen investor desire as risky assets become less attractive. The low balance of exchange stability suggests a decline in liquidity across the crypto market.

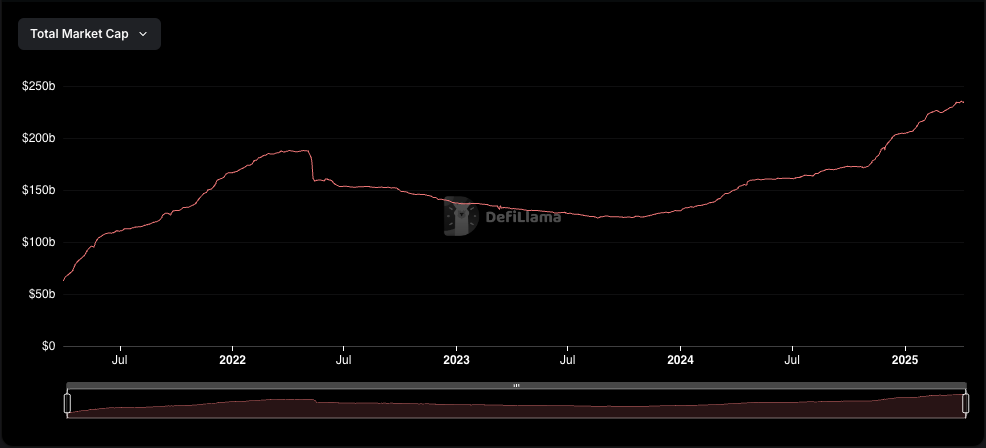

Stablecoin’s market capitalization continues to increase

Despite the low exchange flow, the total market capitalization is StaticILY increased in 2025. This figure has now increased from $203 billion on January 1st to $234 billion. This growth can be caused by traders converting Altcoins into more stable assets. This is a general trend during periods of market stress.

Stablecoins play an important role in crypto ecosystems as payment methods and as tools for managing risks. They tend to be much less volatile than other digital assets, making them attractive during uncertain times. Its role could expand even further once new regulations come into effect.

Last week, on April 2, the House Financial Services Committee approved a stable law. The purpose of this law is to enhance stable transparency and consumer protection, requiring businesses to disclose reserves.

read more: The SEC says it is a “covered stub coin” rather than under its jurisdiction.