Bitcoin (BTC) prices have been providing higher electricity in recent weeks, temporarily exceeding $95,000 per coin. The surge is steep, with an increase of around 9% over the past seven days, setting a bullish stage for Bitcoin price prediction.

In a report in late April 2025, Geoff Kendrick’s Crypto Research team at Standard Chartered expects Bitcoin to reach around $120,000 in the second quarter of 2025 and $200,000 by the end of the year.

These goals are repeated even if Bitcoin was trading around $93,700 at the time, reflecting the bank’s belief that recent gatherings could last through the summer.

Source: Standard Chartered

Spring was often the strongest season for Bitcoin. Data shows that Bitcoin’s average return in the second quarter (April-June) was historically about +26.9%), making it the highest performing quarter on average.

In particular, April tended to be bullish. One analysis shows that the average gain in April is about 34.7%. For example, between 2016 and 2020, Bitcoin prices rise on average by around 30% in April each year.

However, seasonality is not guaranteed. There were notable exceptions, such as Bitcoin falling by around 15-17% in April 2022 and April 2024.

In short, Bitcoin has frequently closed its second quarter in positive territory, but traders are noting that past patterns may not repeat each year.

Standard Chartered Bitcoin Price Prediction and Performance

The new target for Standard Chartered marks the latest in a series of ambitious Bitcoin forecasts from banks. In September 2021, Jeffrey Kendrick’s team predicted that Bitcoin could “slash $100,000 by the start of next year” (2022), reaching a long-term $175,000.

By April 2023, the bank had raised its view to $100,000 by the end of 2024 as the “winter” of code had been unzipped. A few months later (July 2023), Standard Chartered once again raised its price target to $120,000 by the end of 2024.

Each revision follows a strong Bitcoin rally. Currently, in April 2025, Kendrick’s Note forecasts $120,000 in the second quarter of 2025 and $200,000 by 2025, roughly double the current level.

These evolving goals suggest that banks’ outlook became more bullish as Bitcoin prices and demand on the chain recovered.

- September 2021: Bitcoin projected to reach ~$100,000 by the second half of 2021/early 2022.

- April 2023: Forecast $100,000 by the end of 2024 as interest was returned.

- July 2023: In light of new profits, we raised our 2024 target to $120,000.

- April 2025: ~$120,000 for the second quarter of 2025, $200,000 by the end of 2025

Each forecast cites a combination of market drivers and emotional changes. Bitcoin is already scathingly gathering this spring, so Standard Charter believes its momentum will work out in 2025.

Kendrick highlights some key factors that can drive Bitcoin towards these lofty targets. A convenient way to view these is as a list of catalysts.

Geoffrey Kendrick’s standard charter report outlines key drivers poised to push Bitcoin to new heights.

The analysis identifies four catalysts that drive this optimistic prediction. First, investors are shifting capital from US stocks and bonds towards alternative assets like Bitcoin.

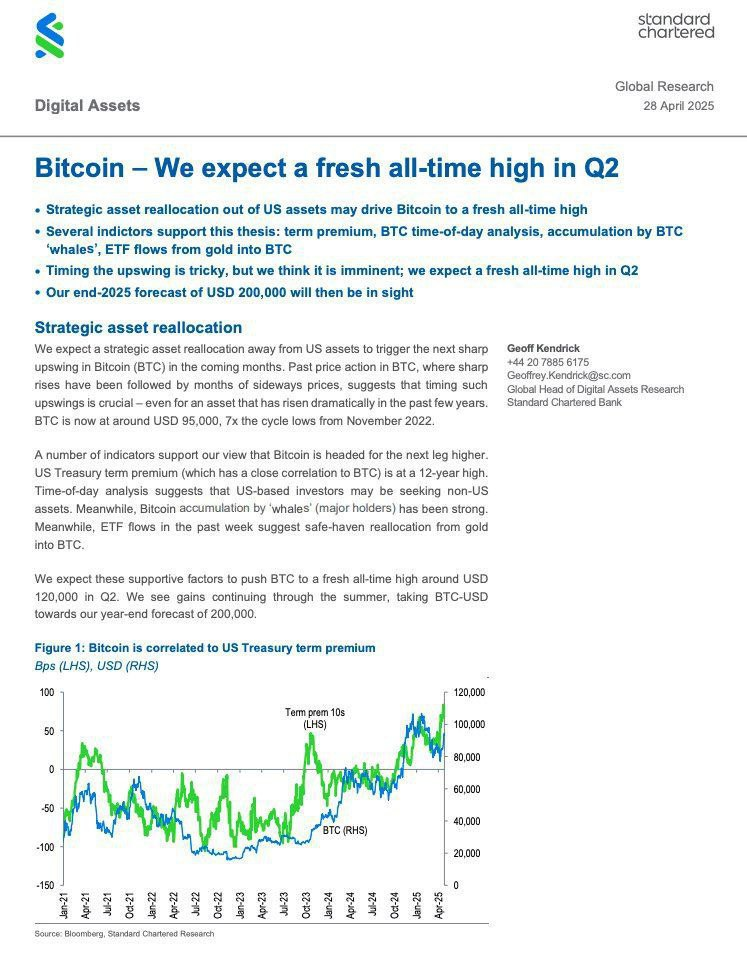

Second, the US Treasury’s extra yield compared to short-term debt, the US Treasury’s long-term premiums, is at a high of 12 years, historically tied to Bitcoin rallies.

Third, the significant inflows into Bitcoin ETFs, coupled with the outflow from gold funds, indicate traditional safe shelter to crypto reassignment, based on recent ETF data, labeled “Gold to Gold to Gold to BTC Secure Relocation.”

Finally, according to Kendrick’s findings, large Bitcoin holders, or large Bitcoin holders with over 1,000 BTC, or “whales” with over 1,000 BTC are steadily buying during market dips, reducing the available supply and supporting higher prices. These factors bring together Standard Chartered’s bold price forecasts.

Together, these drivers draw pictures of increased demand and constrained supply. They echo points from other analyses. For example, the US Treasury Term Premium in the purchase of a high and powerful whale in 12 years was one of the factors that made Bitcoin seem like a better hedge than gold.

Bitcoin price forecast: a broader market context

The outlook for Bitcoin also relies on broader macroeconomic conditions. On the one hand, Bitcoin’s spring rally coincides with hopes to ease trade tensions and lower interest rates.

For example, on April 5, 2025, the White House announced temporary tariff exemptions for Mexico and Canada. This is news that helped free the assets and codes.

Global liquidity remains sufficient, with major Bitcoin ETFs drawing inflows. Bloomberg analyst Eric Balknas noted that Bitcoin was one of the top-performing assets in early 2025, surpassing Laguards like the US Treasury.

This suggests that many investors view Bitcoin as an attractive risk-on asset or even an inflation hedge that begins the year.

Meanwhile, a strong US dollar or Treasury yield rise could ease the progress. Analysts often observe that surges dollars make dollar-price assets like Bitcoin more expensive for foreign buyers.

In fact, in November 2024, the dollar index reached 13 months (approximately 107.15), even if Bitcoin hit a new high of nearly $99,000.

Some strategists who see Bitcoin as declining correlation with stocks over time warn that it remains sensitive to global risk sentiment.

BTC/USDT Price Chart | Source: TradingView

Like the Singapore-based QCP Capital Note, Crypto still tends to move along with stocks, saying, “crypto is closely related to stocks, and there is price action that reflects wider economic changes.”

In reality, this means that changes in the Fed’s policies, trade news, or sudden drops in liquidity could put the brakes on Bitcoin’s execution.

In summary, Standard Chartered’s Bitcoin price forecast is at the confluence of positive factors, including expected turnover from US assets, supportive bond market signals, heavy whale accumulation and robust ETF inflows.

Historic seasonality also provides a constructive background, and in many cases the second quarter is a strong quarter for crypto. However, the outcome depends on whether these drivers outweigh traditional headwinds like dollar strength and high yields.

As always, there is uncertainty in forecasting. Still, the bank’s analysis provides a clear story about why some analysts see Bitcoin on a steep upward trajectory in 2025.