This is a segment of the Forward Guidance Newsletter. Subscribe to read the full edition.

He’s old enough to remember just a few months ago when the Trump administration spoke about cutting the deficit to 3% of GDP.

However, since the pivoting day of release, the Trump administration has been in the 180s with its goal and is now pushing for new ways to manage the US debt situation. It’s making it hot.

In many cases, the instantaneous period can be easily encapsulated by memes.

Last week, Treasury Secretary Scott Bescent hinted at the pivot in a CNN interview.

“There is potential growth in debt, but more importantly, it’s about growing the economy faster. I’ve inherited a 6.7% deficit as a percentage of GDP, and I’m trying to beat it by reducing spending, increasing revenue, and making GDP faster than debt.”

Read between the lines of Bessent quotes. You are aware of the impact on US Treasury owners.

Luke Gromen said that was the best:

This is financial oppression. By making bonds lower than the economic growth rate, we expand our way out of rising debt/GDP ratios.

For example, if bond yields remain fixed at 4%, but the economy grows nominally at 6%, revenues are fixed, which means that the higher the debt, and the lower the burden, the lower the burden.

I am sympathetic to the ideas that became clear during the interview. The White House wants to cut spending and increase revenue. However, I rectified the idea with House Tax and Expenditure Bills and just passed it overnight. You will not pass the Sniff test.

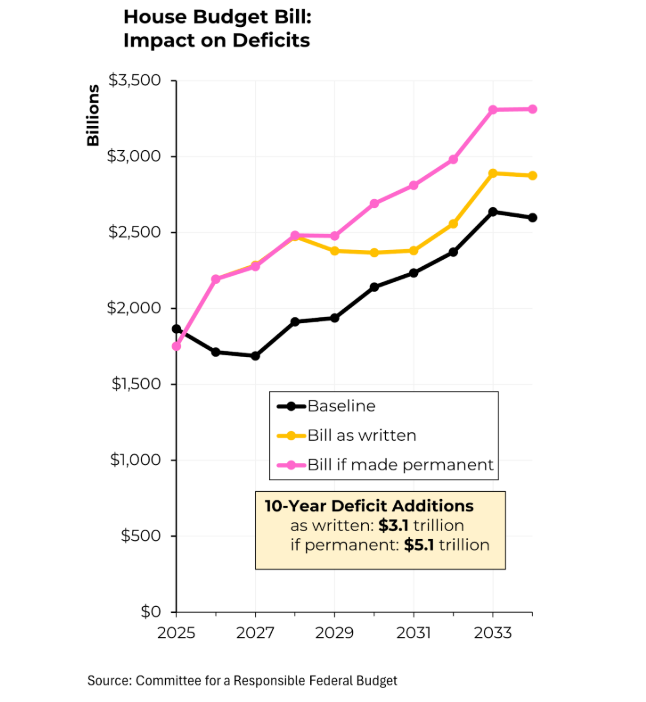

The new bill will increase the deficit nearly $3 trillion over the next decade.

Decomposition of calculus means a significant amount of bill spending must be funded by higher debt issuance.

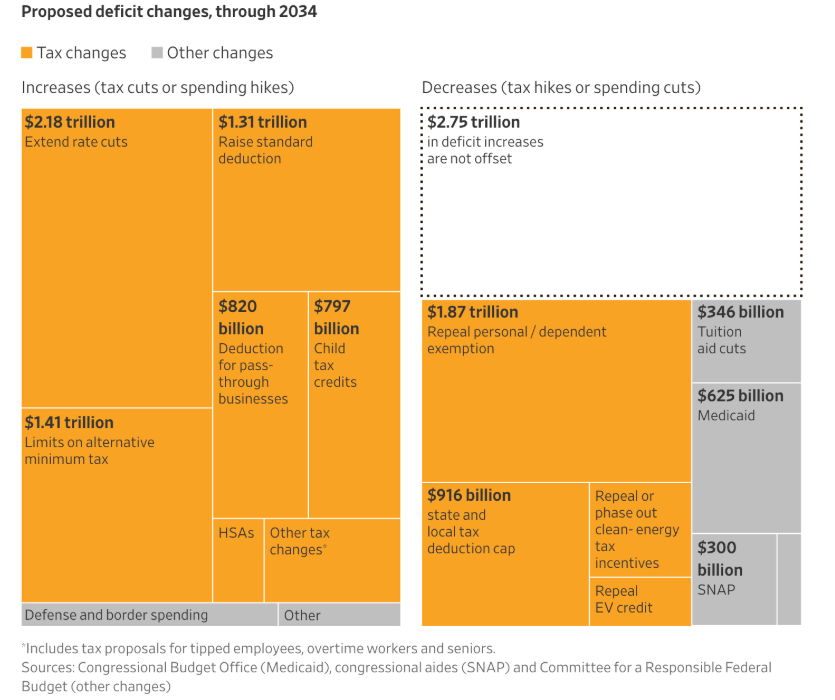

Source: Wall Street Journal

There is a contradiction to be accepted in the scoring and measurement of this bill to play the devil’s advocate.

- It does not take into consideration the increase in tariff revenue to partially offset the bill. An effective tariff rate of 15%, wherever the situation is today, would bring $3,000-400 billion a year. This helps partially offset the growing deficit, but it is not perfect. This income certainly wasn’t a golden geese.

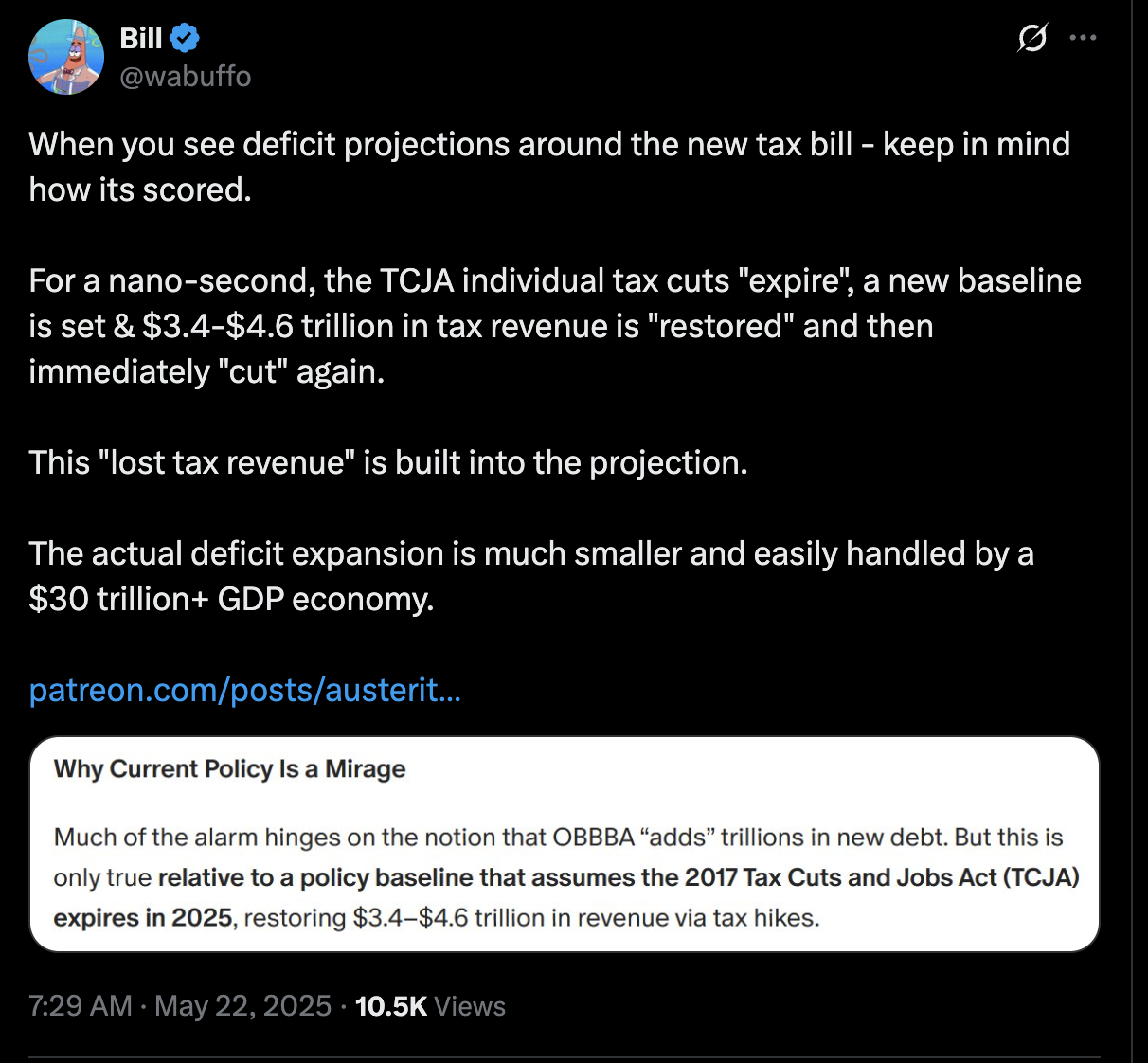

- The bill’s scores anticipate the rapid expiration of Trump’s first term tax cuts, which will then be revived, leading to a superficial surge in tax cuts despite net neutrality.

Source: @wabuffo on x