This is a segment of the Forward Guidance Newsletter. To read the complete edition, Subscribe.

No one will be surprised, but the Fed was stable at the FOMC meeting in June.

As with this modern monetary policy, actual rate decisions were well integrated and did not drive the market.

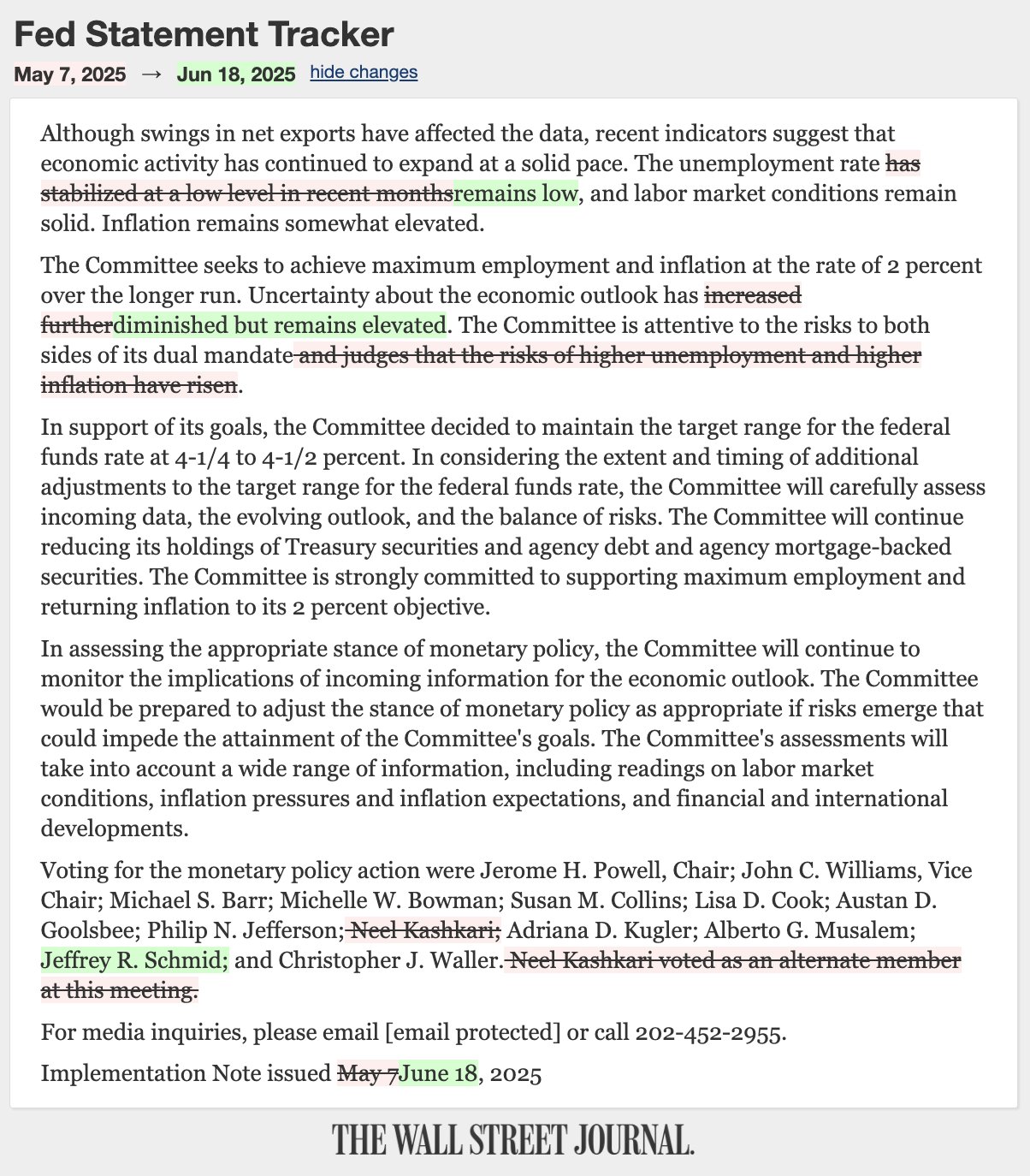

Regarding what did Move the market… The FOMC statement saw minor changes in the language, but generally rarely collected by market participants.

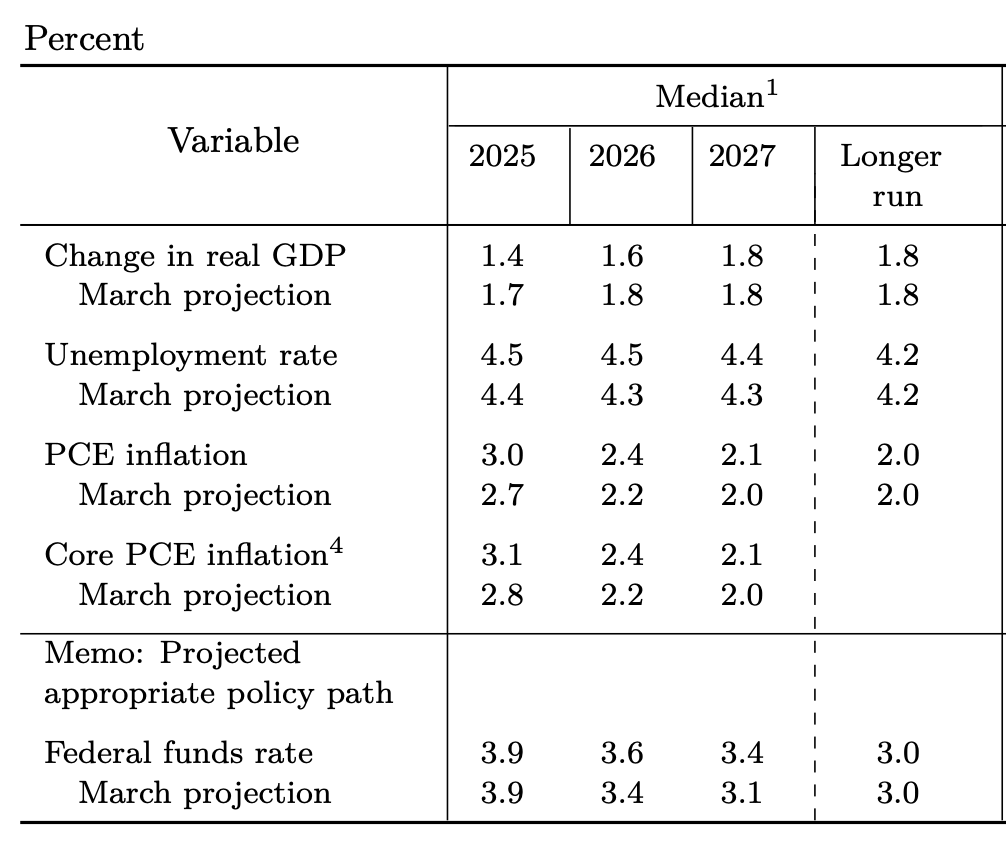

In particular, the updated summary of the economic forecast was substantial compared to the last update in March.

Given how much has changed since March (Liberation Day and the new war with Iran, a few things), it is not surprising that we will see a major change in the way FOMC members see the economy evolve.

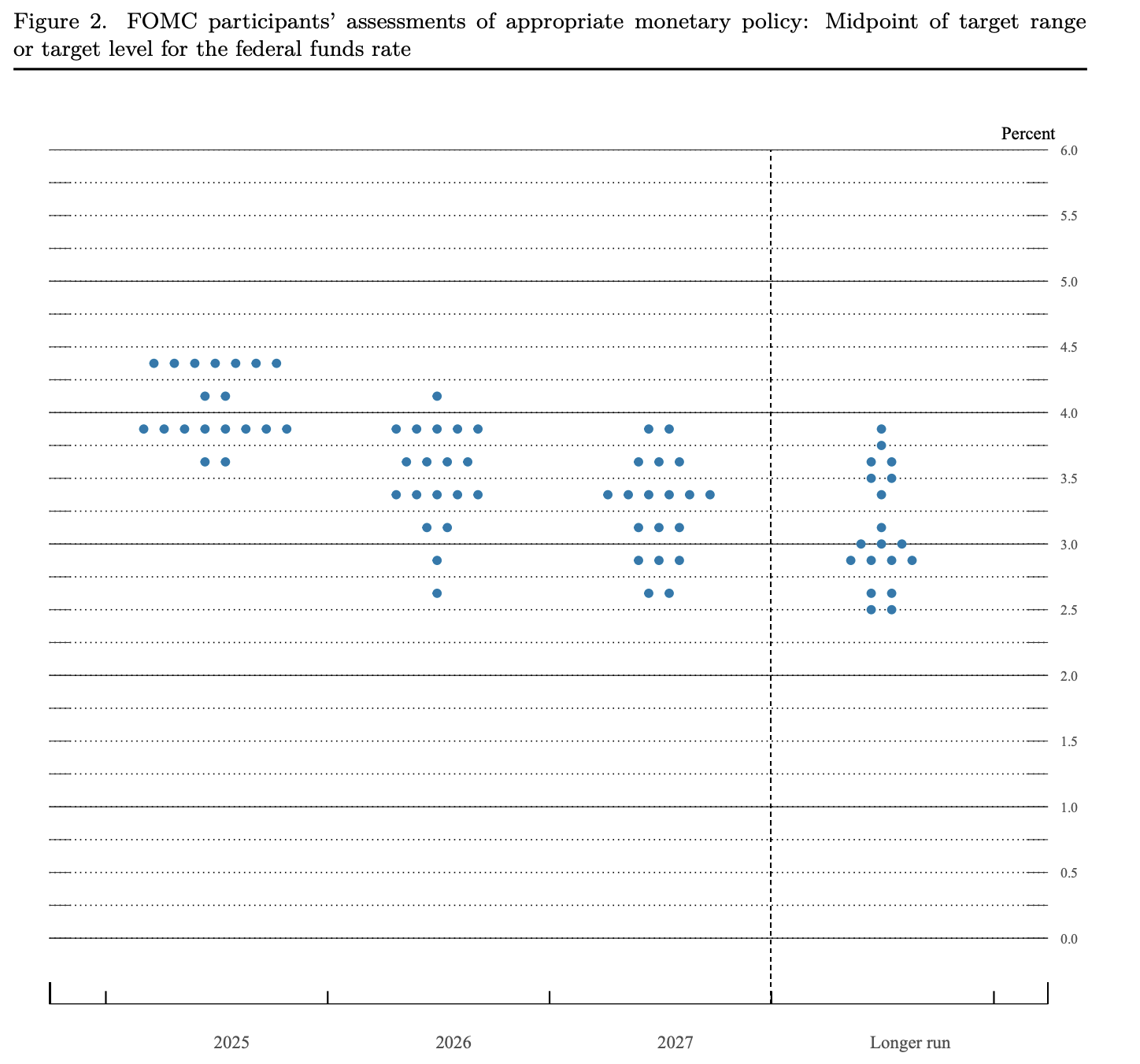

Based on the table below, we can infer it:

- The FOMC believes growth is slower than what committee members expected in March.

- The FOMC expects unemployment rates to rise slightly, but they are not worried about the labor market yet.

- The committee also ratcheted its 2025 inflation forecast from 2.7% to 3%, focusing on the risk of higher tariffs than expected.

Interestingly, one of the things FOMC did do not have The change is the number of rate reductions that will be enacted this year.