The world trade war and negotiations are expected to drag longer as China and the US remain in deadlock mode. While China advances negotiations, Europe has found itself on thin ice, but the US has stalled.

On Tuesday, April 15th, EU trade chief Malossyvchovich concluded a two-hour meeting with U.S. Secretary of Commerce Howard Lutnick in the Midwest financial markets.

The euro was won in the US dollar.

Market issues

Long-term trade negotiations have shaking confidence in major stock markets led by the US and Europe. On Tuesday, JPMorgan Chase CEO Jamie Dimon urged the US to engage in China.

“I don’t think decoupling from China should be objective,” Dinom said.

The suspended global supply chain is expected to cause inflation, particularly in the US. Furthermore, the US Dollar Index (DXY) continues to weaken amid declining performance due to major stock indexes led by the Dow and S&P 500.

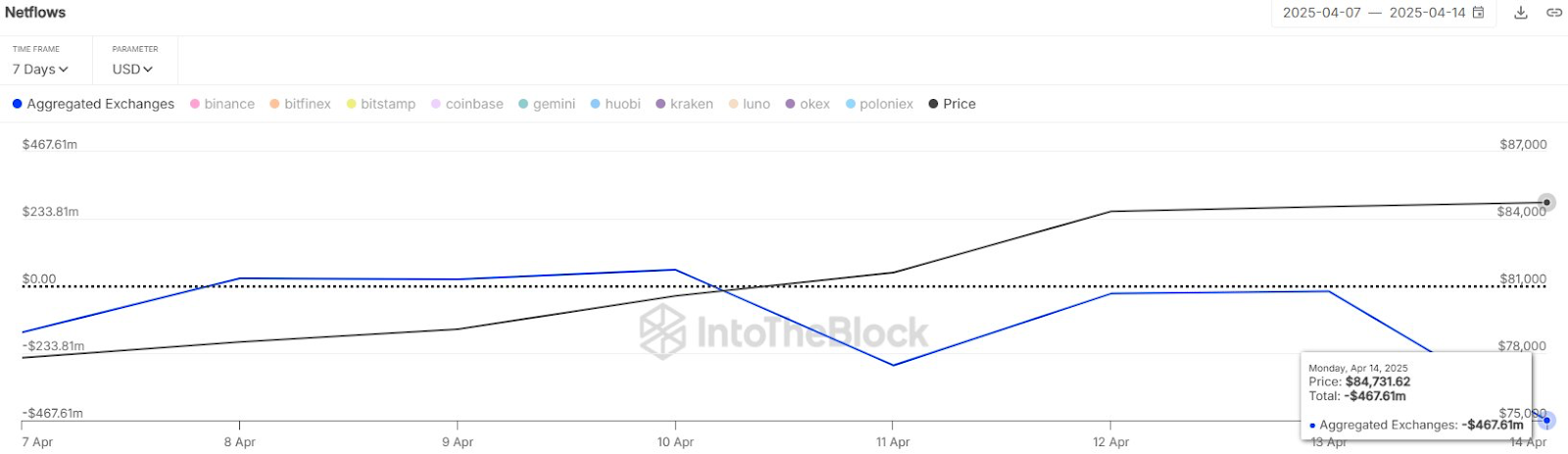

However, the Crypto market has not yet experienced “crazy speculation” as fear remains obvious. Furthermore, well-known trader Peter Brandt is not convinced that reversal of BTC prices is still valid in the daily time frame.

Potential integration could create a reversal pattern, which could possibly lead to bullish emotions in the second half of 2025.