Virtuals Protocol (Virtual) is one of the hottest recovery tokens and boosts several other AI agents. However, on-chain data shows that Virtual has shifted to whales’ wallets, which control most of their supply.

Virtuals Protocol (Virtual) has seen more funds from whales and has signaled accumulation in the past few weeks. Virtual recovers along with other AI agent tokens, falling approximately 63% from its peak after weeks of influx of smart money.

Virtual purchases have led to the concentration of tokens in the hands of top traders and whales. Based on Solana on-chain data, approximately 93% of virtual tokens are held in the top 100 wallets.

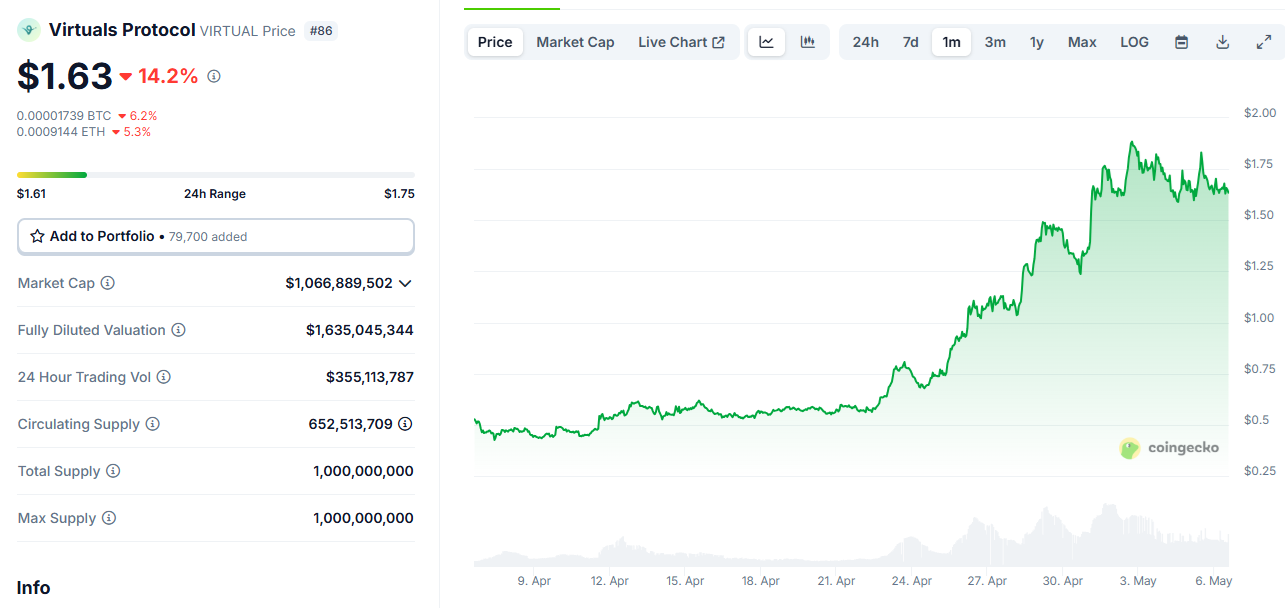

Virtual trading is close to the top range of the past month, with an increasing number of open interest in derivatives markets and spot accumulation from whales. |Source: Coingecko

Bubblemaps on-chain data also shows its growing Activities Gate.io Exchange has a cluster of wallets linked to a centralized market for high frequency transfers.

Virtuals Protocol is becoming more open

Virtuals Protocol is drawn on a smart money wallet, further strengthening the whale’s position. A total of 63.7% of virtual tokens are unlocked, leaving a significant part in the big wallet prepared for long-term unlocking and community rewards. Over the past few weeks, the accumulation of new whales has shifted token distribution towards larger wallets.

Virtuals Protocol raised $16.6 million in various funding rounds, earning the largest share of Fjord Foundry’s fundraising in the form of IDOs. Additionally, the protocol hosted several small VC-funded rounds, with no important teams or contributor allocations.

Virtual has pushed its price to a month’s height above $1.80 after a period of increased purchase rights. The token returns to $1.66, still leading the general recovery of the AI agent story.

From its recent $15 million low, virtual derivative trading has rose for the past month. The derivative position is currently worth more than $111 million, indicating a new bet on the performance of the token.

Currently, there have been attempts to shorten assets, but the long positions are slightly dominant. Derivative trading has nothing to do with virtual accumulation. Traders are making speculative bets that the platform will recover and trade to a higher range.

Virtual Rose with increased activity in April

Over the past month, activities at Virtuals Protocol have been featured after two months of very low activity.

Activities in Solana remained little different, but the basic users took it again. In April, active wallets for creating and interacting with agent tokens reached 10k each day.

The AI Agent Ecosystem is also focused on several top projects, including AIXBT, Game, Sam, Vader, and Luna. AVA is another trend token despite its small market capitalization. In total, the value of the AI agent token is back to above $5.7 million.

AI Agent Tokens are also relatively concentrated in small communities. Despite being similar to memes, a much smaller circle of owners is purchased on these assets.

On-chain data shows only 9,792 individual wallets holding AI agent tokens, suggesting accumulation of whales and insiders. Virtuals Protocol aims to expand the ability to create agents, but the ecosystem appears to be built on large projects and is also controlled by whales.