Bitcoin (BTC) has been consistently hit the new all-time high (ATH) recently. In line with this surge, the difficulty of Bitcoin mining has reached record highs, reflecting the development of the network.

Overall, the combination of BTC ATH, increasing difficulty in mining, and long-term holders (LTH) behavior remains risky, but it draws an optimistic picture.

AS Pricing, Difficulty of Asmining

According to data from BlockChain.com, the difficulty of Bitcoin mining increased by 7.96%, reaching 126.27 T, with an average network hashrate over the seven days of 908.82 EH/s. This diagram shows miners’ computing power is increasing, particularly as Bitcoin prices have recently reached $122,000.

If this trend continues, it could reduce the efficiency of miners, especially given that the results of the June mining have not deteriorated.

The difficulty of the Bitcoin network. Source: Blockchain

However, a notable adjustment for the future is the next change in the difficulty of Bitcoin mining, which is projected to decrease by 6.69% on July 27, 2025. This is a positive signal for miners and could optimize operational efficiency.

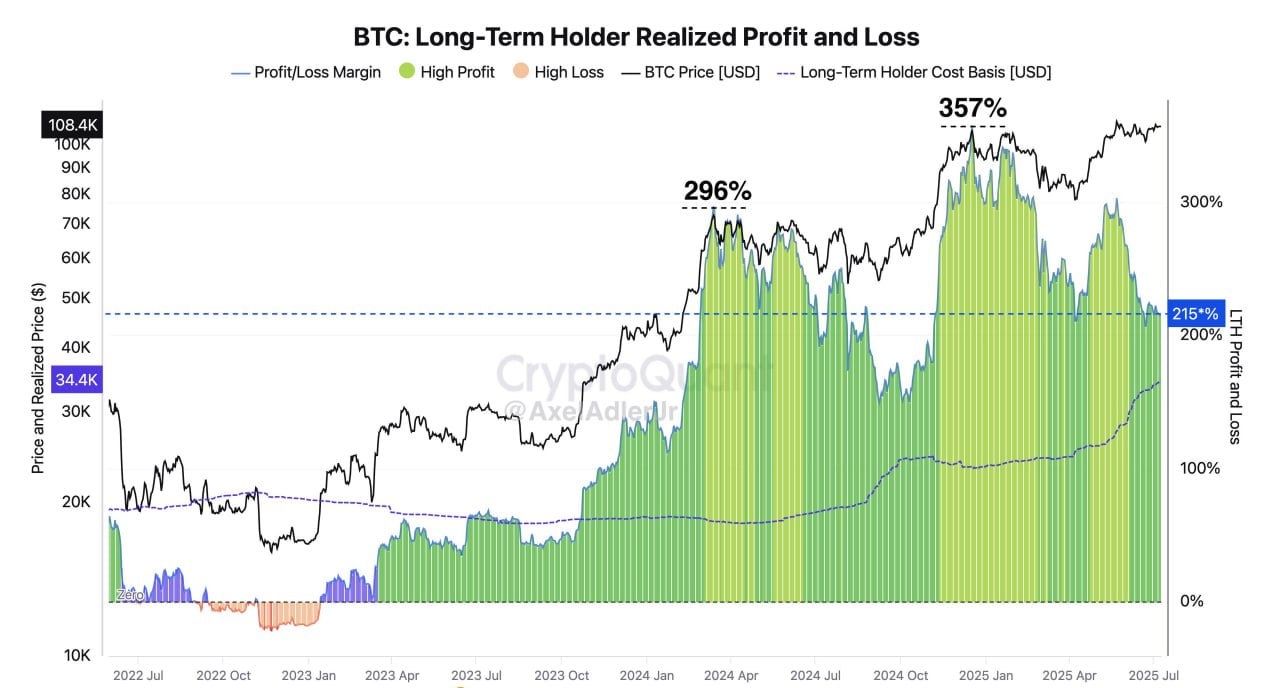

Additionally, the GlassNode chart shared by X’s Nekoz provides deep insight into the behavior of long-term holders (LTH). Their realised profits had a profit margin of 357% in July 2025, and their average cost base remained significantly lower than current prices, with profit margins surged to $108,400.

Long-term holder behavior (LTH). Source: Nekoz

This suggests that even if BTC reaches Ass, most LTH are not going to sell out. From 2022 to the present, the chart shows that the for-profit stage (such as 296% in mid-2024) often involves sustainable price increases. This reinforces the view that the current market is still not saturated.

But the thought-provoking factor is Google’s low interest in searching for Bitcoin. This remains restrained and has little improvement compared to the previous bull market. This could potentially shift from lost (FOMO) horrors to a long-term strategy rather than short-term speculation, reflecting investor maturity.

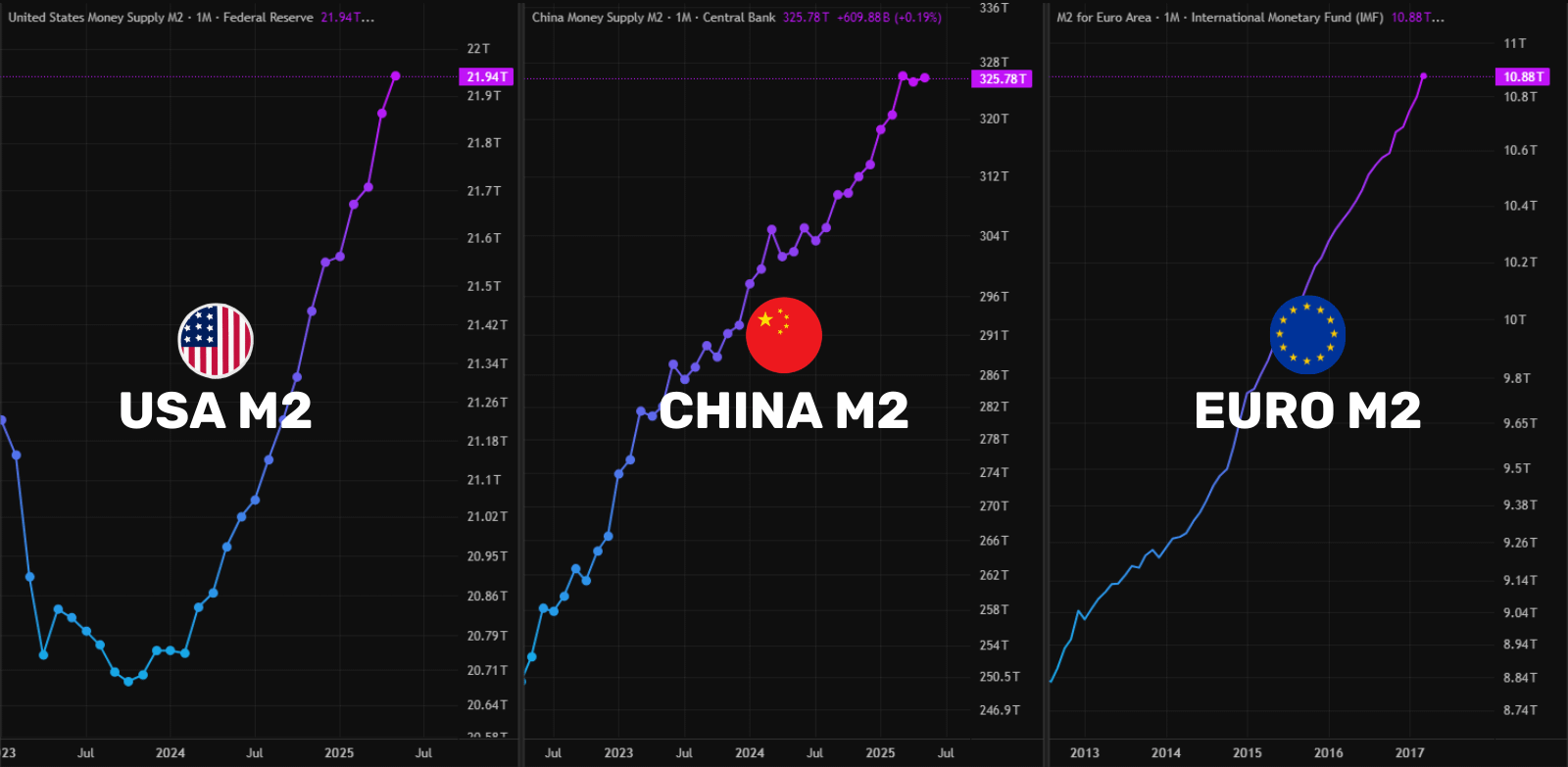

Overall, the ATH synergy of BTC’s ATH, the high degree of bitcoin mining difficulty, and the LTH Holding Behavior create encouraging but dangerous outlook. With global liquidity rising (US, China and Europe M2s also hit ATH), Bitcoin holds a huge short-term potential.

Global liquidity. Source: Rekt Fencer

However, investors should closely monitor key metrics such as hashrate, adjusting the difficulty of Bitcoin mining, and market sentiment to mitigate risks from potential price adjustments.