Ethereum is in a critical phase as it fights to retain its $2,500 support level after several failed breakout attempts over $2,700 in recent weeks. While the broader market is under pressure, Ethereum remains a focus for analysts who believe a breakout from this range could spark a full-scale alto season. Volatility is still rising, but emotions are slowly changing as activity on the chain and market activity reveals a fostering trend.

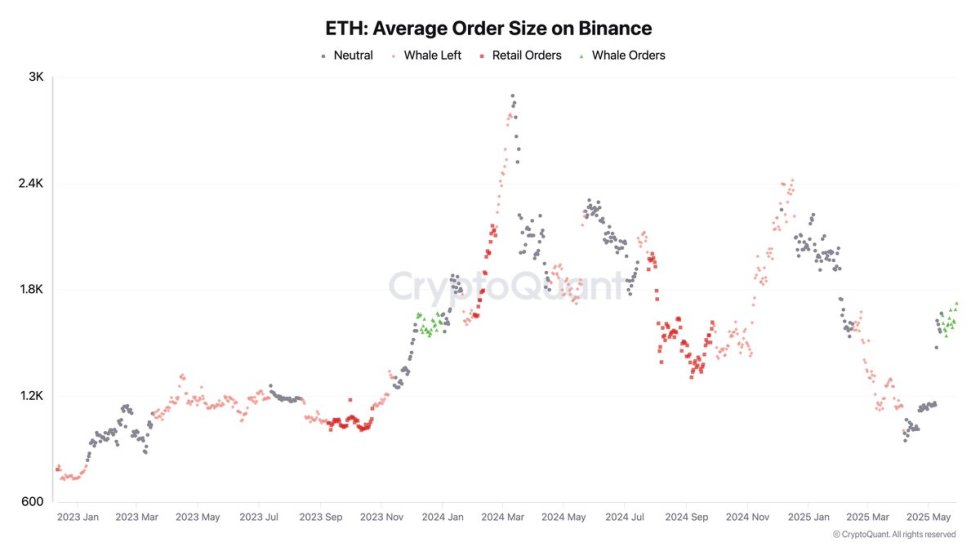

One of the strongest signals comes from the vinanence, where Ethereum whales’ activity is surged again. Recent data shows that large orders have returned to exchanges since May 19th. This is the same signal that precedes the ETH explosive rally in the second half of 2023.

As macroeconomic uncertainty continues to shape financial markets, the ability of ETH above $2,500 could determine the next major movement in the crypto market. If buyers intervene on strength, Ethereum could lead altcoin fees in the coming weeks. For now, all eyes are in price action and whale action, as traders prepare for anything that could become a critical breakout.

Ethereum whales return when bullish signals flash to vinance

Ethereum has struggled to gain momentum and gain momentum as he has chased behind Bitcoin for the past year, facing continuous sales pressure and indecisive price action. While BTC was tied to an all-time high, ETH remained locked in range, with disappointed investors and many questioning Altcoin’s leadership in the field.

However, recent price action talks about something else. Over the past few weeks, Ethereum has entered a more constructive phase. Despite ongoing geopolitical tensions between the US and China, Ethereum is showing resilience and is trying to regain a higher level above $2,500. The emotional change is now strengthened by chains and market data.

Top analyst DarkFost shared an attractive metric that shows that the Ethereum whales are operating on Binance again. His chart combines spot and futures market activity, cumulative volume and moving average to generate rare all-in-one signals. The last time the signal was lit was in December 2023, just before Ethereum exploded from $2,200 to $4,000 in a few weeks.

According to DarkFost, since May 19th, a large purchase order from whales has been in effect at Binance. This surge in massive amounts of activity is a very encouraging sign and could mark an early stage of a new bullish trend.

Ethereum Price Analysis: Bulls protect critical support in range integration

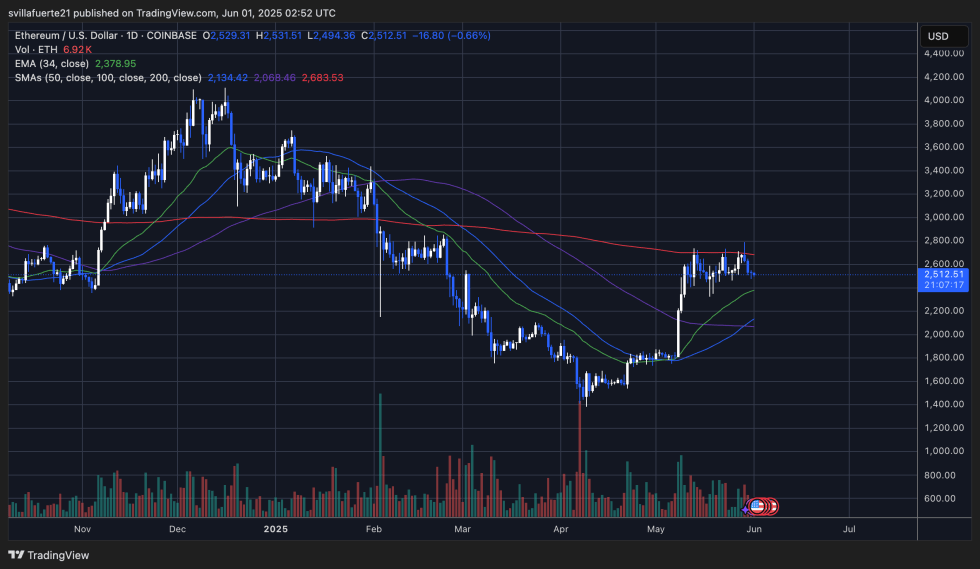

Ethereum (ETH) is currently trading around $2,512 after rejecting a $2,700 resistance zone multiple times over the past few weeks. As seen on the daily charts, ETH has fluctuated between a 34-day EMA ($2,378) and a 200-day SMA ($2,683) and entered a lateral integration phase. Despite the recent pullback, the Bulls still defend the $2,500 area, and are now serving as important short-term support.

The chart shows a clear range formation with volume decreasing, suggesting that the market is waiting for a breakout decision. ETH is above the 34-day EMA and all short-term moving averages (50/100 SMA), indicating that the upward trend structure is intact for now. However, a strong day closure, below $2,480-$2,500, could change momentum and lead to a deeper retracement at $2,350.

To resume bullish momentum, Ethereum must regain a resistance area of $2,700-$2,800 after convictions as this level closes all upside attempts from early May. If successful, the breakout can open the door to pushes that go above $3,000.

Dall-E special images, TradingView chart

Editing process Bitconists focus on delivering thorough research, accurate and unbiased content. We support strict sourcing standards, and each page receives a hard-working review by a team of top technology experts and veteran editors. This process ensures the integrity, relevance and value of your readers’ content.