Strategy (formerly the MicroStrategy) and El Salvador showed off the massive paper profits from Bitcoin Holdings after flagship cryptography surged to a new all-time high of over $124,000.

Strategy’s Bitcoin Holdings reach ATH

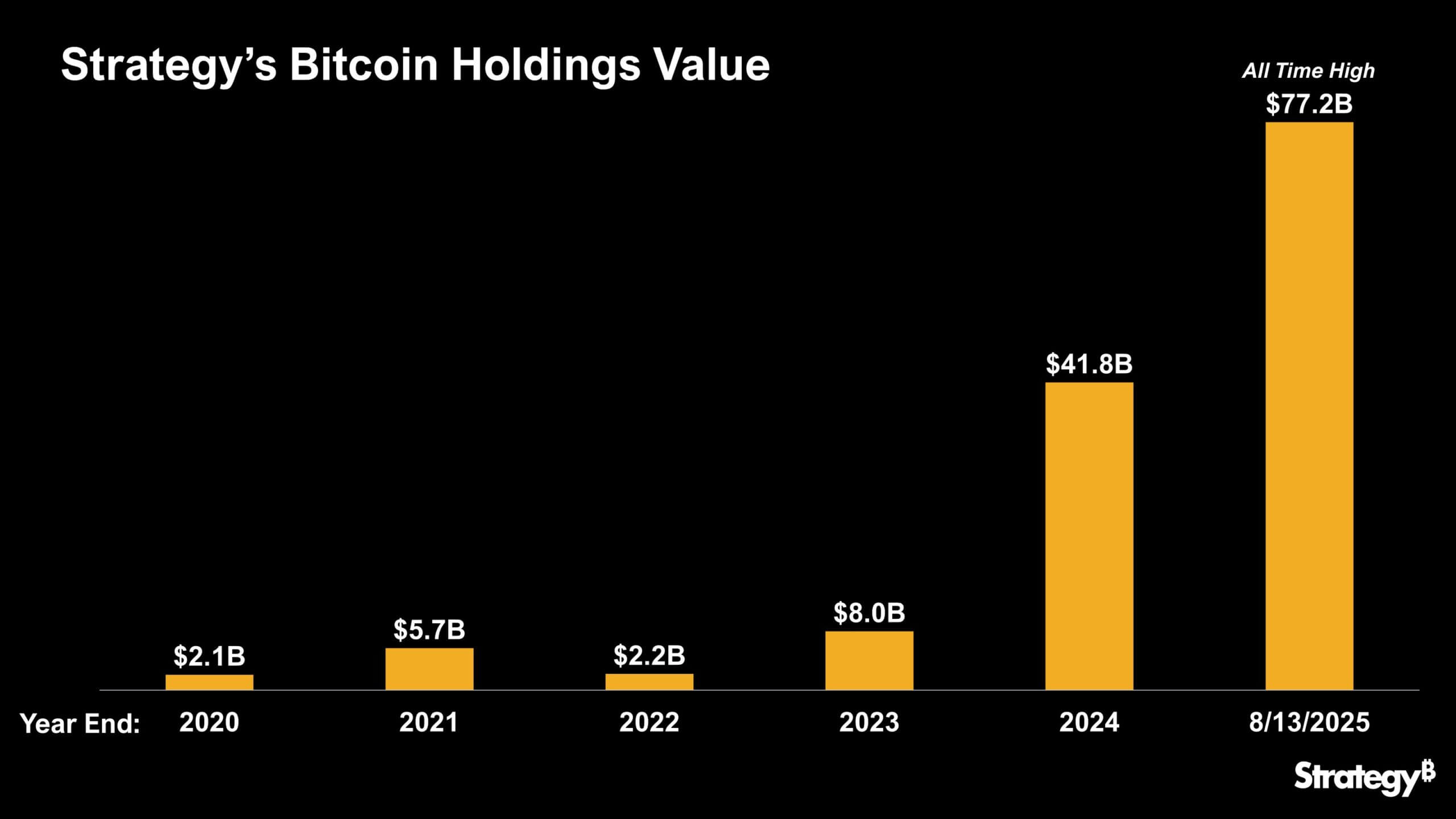

On August 13th, Strategy Chairman Michael Saylor announced that its Bitcoin portfolio had hit a record high of $77.2 billion.

This almost doubles the valuation of $41.8 billion recorded in 2024, a staggering 40-fold increase from the $2.1 billion that I invested when I began accumulating BTC in 2020.

Saylor Tracker data shows that it currently has 628,946 BTC. This is worth around $76.52 billion at current market prices. Holdings leads to more than $30 billion in paper profits as the strategy invested around $46 billion in crypto at an average price of $73,301 per coin.

In particular, Saylor’s accumulation strategy faced initial skepticism from critics who questioned the risk of such a heavy exposure to unstable assets.

However, the BTC rally has proven this approach and strategizes its biggest companies in the world.

Based on this momentum, the company is expanding its Bitcoin-centric products. To attract additional investments and further expand Bitcoin reserves, it launched a suite of BTC-backed financial products.

El Salvador shows off

El Salvador is simultaneously celebrating its own Bitcoin stairwell amid the current bull market situation.

On August 13, President Nayib Bukele shared data showing that the country’s holdings had grown from an initial investment of $300 million to $768.88 million. This represents a profit of approximately $468.3 million, or 155.82%.

For many years, Central American countries have supported the adoption of Bitcoin by using a disciplined dollar-cost average approach to implement daily purchases.

Investors replicating El Salvador’s daily purchasing strategy would have resulted in a 115% return, according to blockchain analytics firm Lookonchain.

Meanwhile, El Salvador is also moving forward with plans for a dedicated Bitcoin bank, further integrating top crypto into the broader financial system.

However, the country is facing a major pushback from institutions such as the International Monetary Fund (IMF) over the adoption of Bitcoin.

The IMF has consistently warned against further BTC purchases, and recently proposed that reported acquisitions could reflect internal wallet transfers rather than new Bitcoin purchases.