Bitcoin has come a long way from simply a financial experiment to becoming a store of value. Currently sitting at a six-figure rating, the flagship cryptocurrency brings together a horde of investors who actively profit from that direction movement.

Despite all the growth, Bitcoin price action is influenced by moments of frenzy, fear and attention to investors. At this point, on-chain data points out that Bitcoin may be in the stage of being the order of attention. Details of this revelation are as follows:

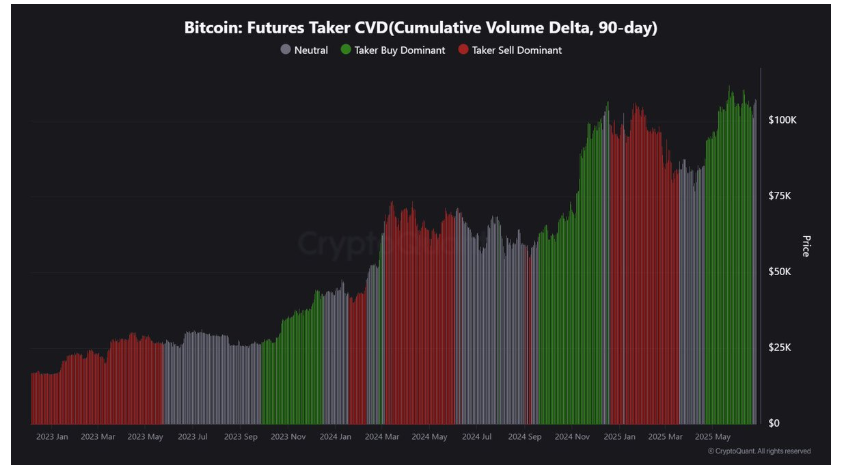

90-day CVD moves to neutral after long-term trends

In a June 27 post on social media platform X, Crypto analyst Maartunn revealed that there had been significant changes in key metrics. The relevant metric here is the 90-day Futures Taker Cumulative Volume Delta (CVD) metric that tracks BTC’s net trading pressures in the futures market.

The positive and rising value of the metric usually means that the futures market is dominated by buyers (takers dominate). On the other hand, if the indicator is negative, it means that the futures market is dominated by short traders (the sales dominated by takers). Source: @ay_mates on x

Source: @ay_mates on x

In a post on X, Maartunn pointed out that the current 90-day CVD is flat. This shows the balance between the bullish and bearish forces of the market. While Bitcoin prices may indicate a reasonable indication of a recovery, this on-chain data suggests that market leaders may return to their consolidated scope.

Bitcoin’s fear and greed index at neutral level

In another June 27th post from X, Crypto Analytics Firm Alphractal made an observation on the chain. This shares similar meanings to Maartunn’s report. The Alphractal revelation was based on Bitcoin: Fear and Greedy Index Heatmap Metric.

The metric ranges from 0 to 100 values. Range 0-24 indicates extreme fear of the market. 25-49 is read as horror, while 50 is interpreted as a neutral level, with a balance of both market emotions. On the other side of the spectrum there is a range of signal greed from 51 to 74 on the market. The 75-100 represents extreme greed in the market, indicating broad optimism that often precedes the top of the market.

According to Alphractal data, the Fear and greedy index is 65, which is still far from the +90 level observed in November and December 2024. This balance between buyers and sellers could suggest that the market will wait for a catalyst such as macro news and on-chain development and break out on both sides of the market.

Due to current uncertainty, traders are encouraged to step into the market carefully. As of press time, Bitcoin is valued at around $107,143, with cryptocurrency down about 0.11% over the past 24 hours.

ISTOCK featured images, TradingView chart

BTC Prices in Daily Time Frame | Source: BTCUSDT Chart in TradingView