Ethereum prices were in a tough range this week as bystander investors remained on the sidelines this week, and the outflow of funds trading on the exchange rose.

Ethereum (ETH) was trading at $1,580 on Friday. It rose 14% from this month’s lowest point.

Ethereum continues to face increasing competition, particularly with Layer 2 networks such as Base and arbitrum (ARB). Other layer-1 networks, such as SUI (SUI) and Solana (SOL), continue to gain market share in industries such as decentralized finance and gaming.

Most importantly, Spot Ethereum ETF continues to flow assets this year. These funds raised zero inflows on Thursday following a seven-day straight net outflow.

You might like it too: Bitcoin prices are still bullish, with long-term charts showing

They have now experienced spills for eight consecutive weeks, bringing cumulative net spills to $2.24 billion.

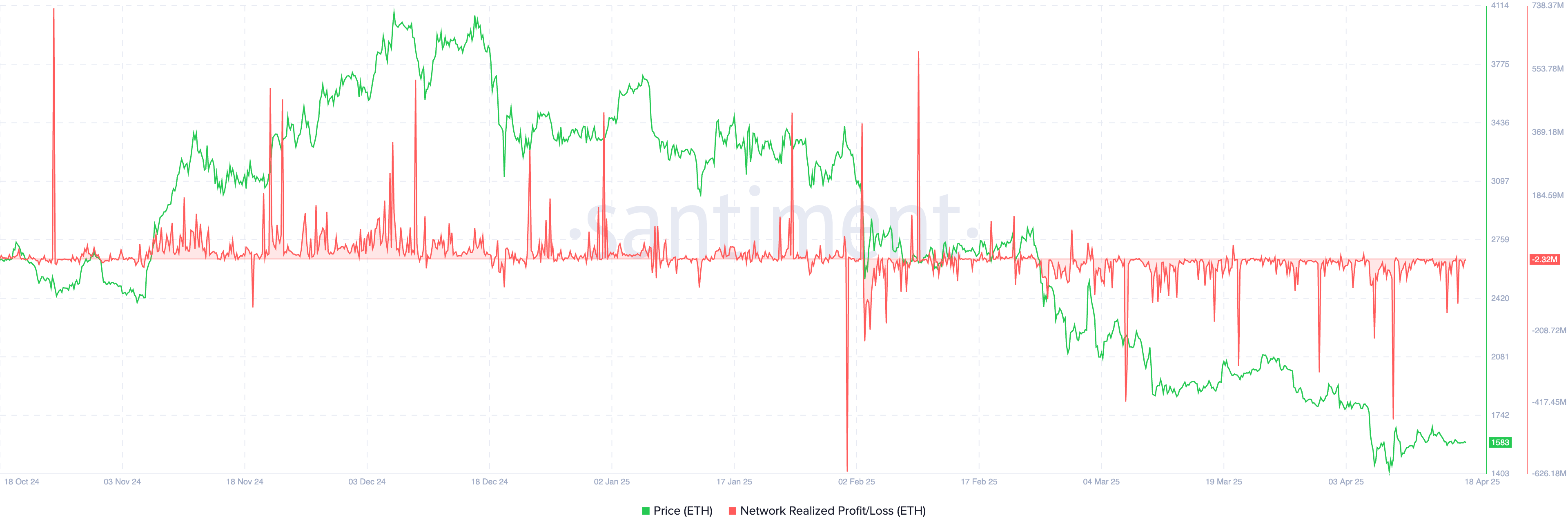

Further data shows that some Ethereum investors are beginning to surrender by selling at a loss of their holdings. The chart below shows that the profits/losses recognized by the network remain in red for some time. This metric measures the net profit or loss of all coins that have been moved on the blockchain.

ETH NRP data | Source: Santiment

Ethereum price technology analysis

ETH Price Chart | Source: crypto.news

The daily chart shows that Ethereum remains in a strong bearish downtrend after peaking at $4,100 last year. We continue to trade key support levels below $2,140 for both the 50-day and 200-day exponential moving averages. This support is worth noting because it was a triple-top pattern neckline on the weekly chart.

On the positive side, Ethereum formed a bullish divergence pattern as the two lines of the MACD continued to rise. Additionally, the relative strength index is slightly above the downtrend line.

The coin also formed a huge falling wedge pattern containing two descending and converging trend lines. As these lines approach convergence, there is a possibility of a strong bullish breakout in the short term. If this happens, the next level to watch is $2,140, the lowest swing in August and September last year. This target is about 35% above the current level.

You might like it too: Solana prices are stable and charges jump on top of the main support as active addresses