Analysts have derived a provocative comparison between Ethereum and Nokia, the once dominant tech platforms that could not adapt quickly enough to a competitive market.

This comparison comes in the ongoing Ethereum vs. Solana debate. It goes back many years and reflects the deeper tension between legacy domination and next-generation performance. It concerns which platforms are suitable for being the backbone of Web3, Defi, NFTS, and the broader crypto economy.

Analysts compare Ethereum and Nokia

Analysts warn that, like Nokia, Ethereum could decline slowly, just like the old mobile phone makers that Apple overtaked in the late 2000s.

“Ethereum = Nokia,” writes analyst Crypto Curb.

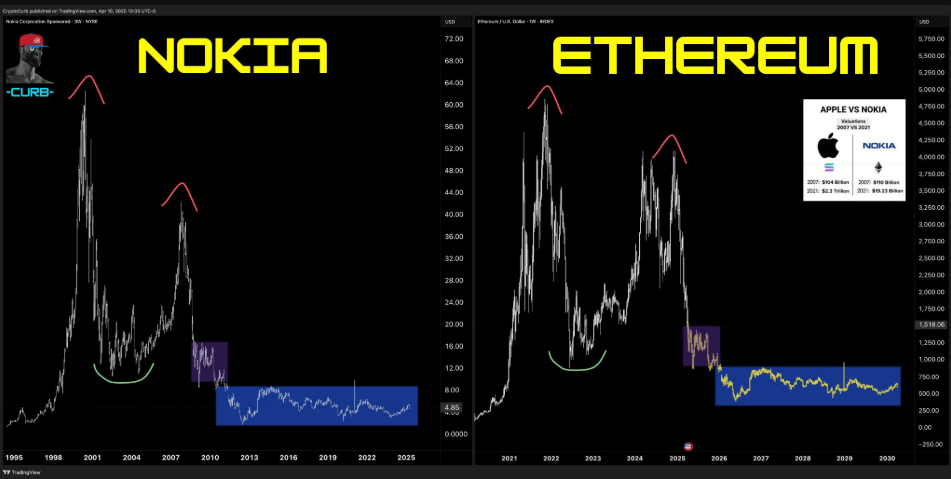

Analysts shared two charts. Nokia’s stock price collapsed from its peak in 2007, and Ethereum’s market capitalization has fallen from its high in 2021.

Analysts compare Ethereum to Nokia. Source: x’s code curb

The analogy is rooted in more than just a market chart. Curb argues that Ethereum’s aging architecture and scalability limitations reflect the downfall of Nokia’s Symbian OS, which failed to compete with Apple’s iOS and Google’s Android.

Statista data shows that by 2013, Nokia’s mobile market share had collapsed to 3.1% from a peak of 49.4% in 2007.

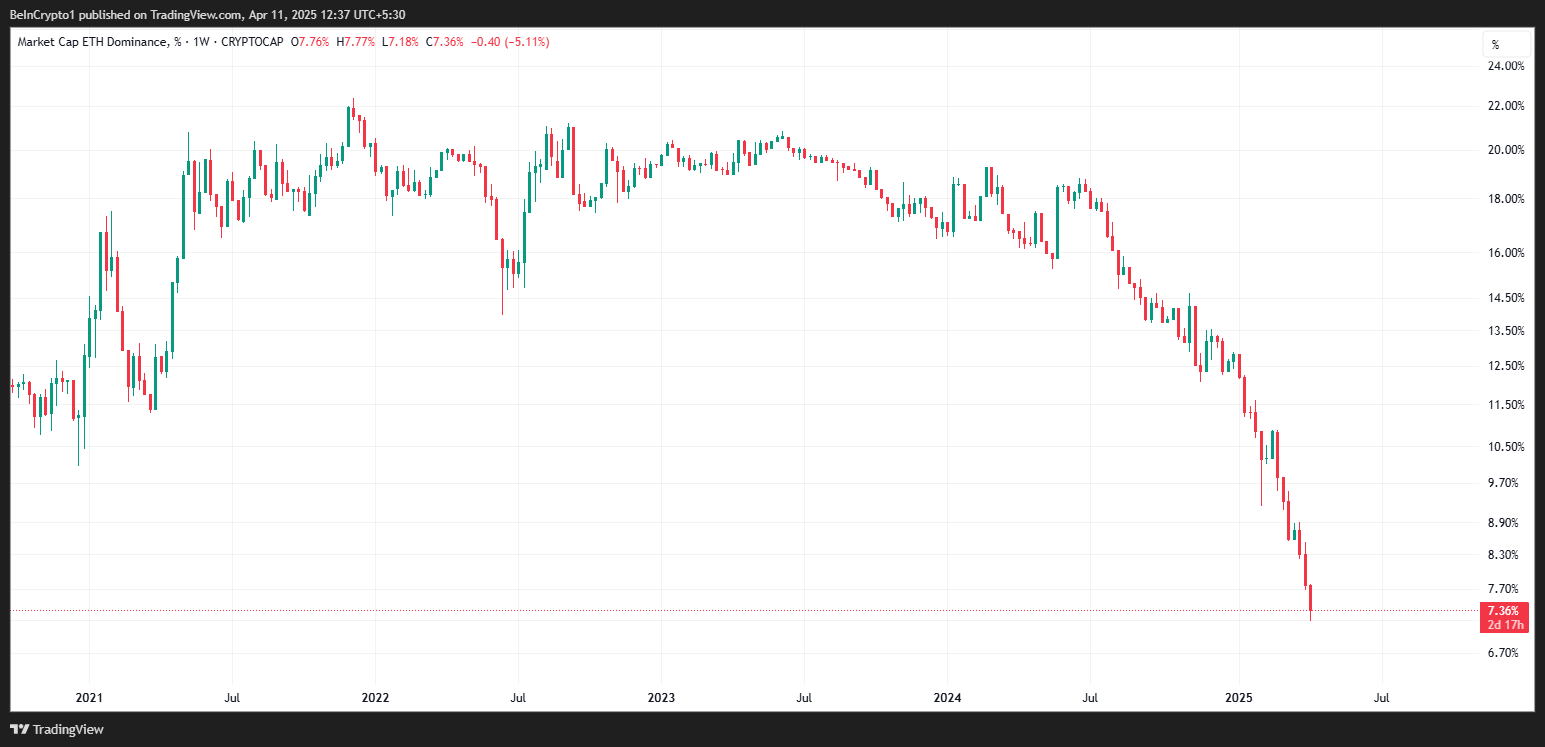

Meanwhile, TradingView data shows that Ethereum, which once led more than 20% of the market capitalization of the Qing Po, holds less than 10% at the time of this writing.

Ethereum Dominance Chart. Source: TradingView

This post means that, like Nokia, Ethereum may be slowly losing its connection among its faster, more scalable competitors, Solana among them.

On the other hand, Solana’s rise is difficult to ignore. Between October 2023 and November 2024, Sol surged from $23 to $264, growing to nearly a third of Ethereum’s market capitalization.

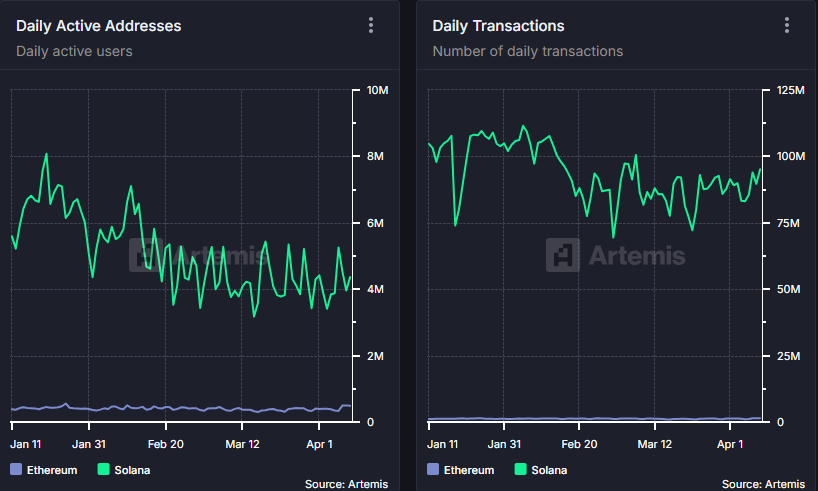

According to on-chain data, Solana is superior to Ethereum in some important metrics. Among them are daily active addresses and daily transactions, highlighting their appeal to developers and users.

Solana vs Ethereum is found in daily active addresses and transaction metrics. Source: Artemis data

The similarities are strict. Apple jumped over Nokia with a smoother user interface and a developer-friendly ecosystem.

Similarly, Solana’s technical advantages are positioned as a serious candidate for Ethereum’s dominance in Decentralized Finance (DEFI) and Web3, including higher throughput, reduced fees and improved user experience (UX).

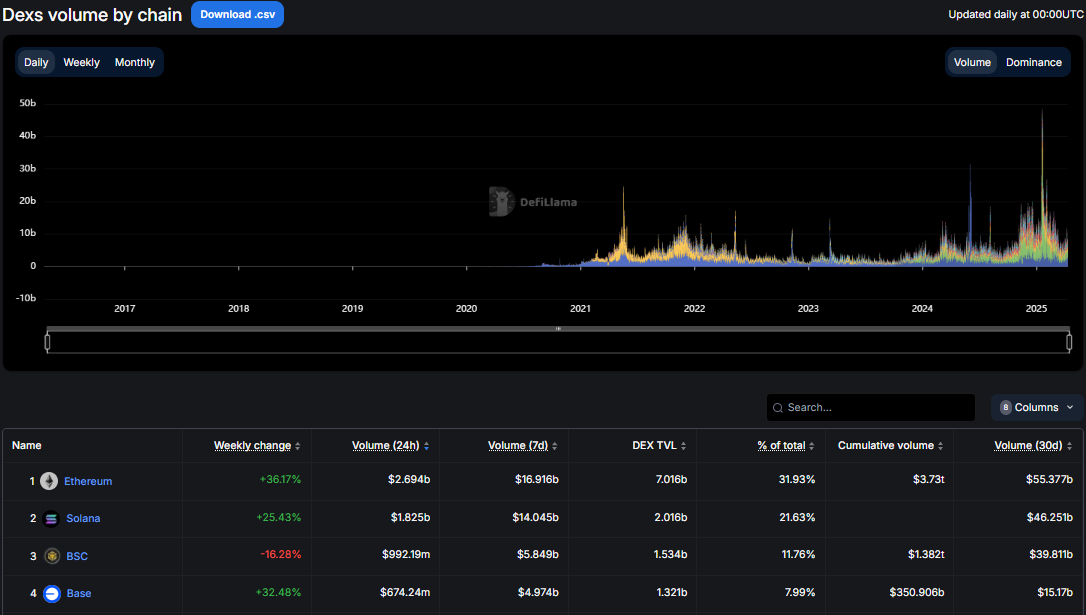

But not everyone is sure that Ethereum days are counted. A week ago, Ethereum overturned Solana with a decentralized exchange (DEX) trading volume.

Beincrypto reported this milestone, but this was the first time in six months. Defilama’s data shows that Ethereum continues to maintain this lead.

Transaction volume per chain. Source: Defilama

This revival in this trading activity suggests that Ethereum remains deeply embedded in the crypto ecosystem, particularly among sophisticated Defi users.

Additionally, some institutional voices remain cautiously bullish in Ethereum. In March, an analyst at Franklin Templeton said Solana’s shortage was impressive and could challenge Ethereum’s market value, but ETH still retains key infrastructure benefits.

“Solana still has a long way to go before it surpasses Ethereum,” an analyst at Intotheblock told Beincrypto.

Similarly, some analysts are considering the potential for a strong Ethereum price rise, citing bullish foundations like Pectra upgrades and Aesthetics ETFs (Exchange-Traded Funds).

Still, the comparison of Curb reflects key moments in Ethereum’s growth. With competitors like Solana moving ahead in usability and performance, Ethereum needs to accelerate its roadmap to ensure it’s not hidden.

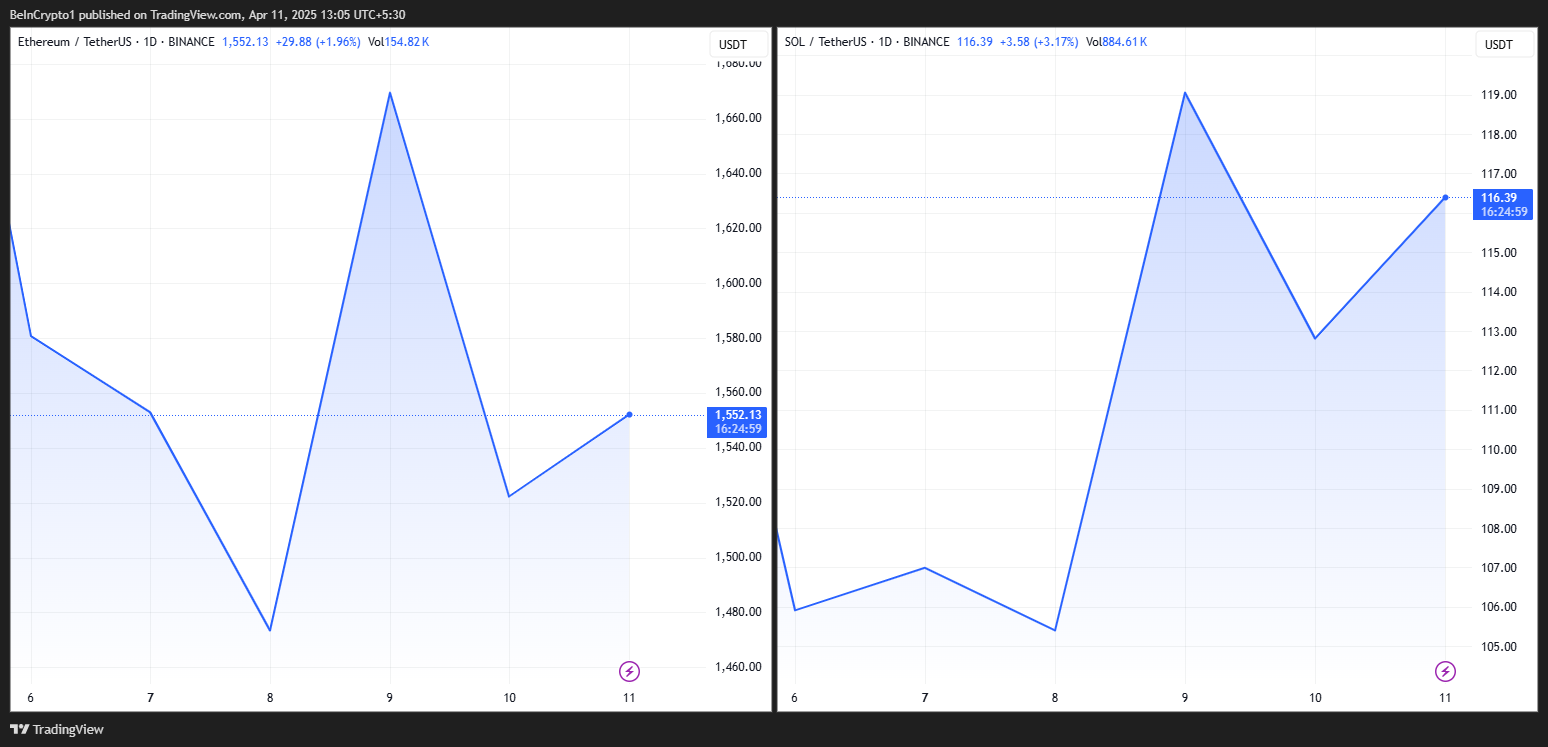

Ethereum and Sora Solana price performance. Source: TradingView

Data shows that ETH has traded at $1,552 at the time of writing, down more than 4% over the past 24 hours. Meanwhile, Solana traded at $116.39, a modest 1.01% surge in one day.