Ethereum began this week with a minor relief bounce after last week’s Flash fell below $1,500. Prices hold support for now, but momentum is weak and on-chain sentiment is still bearish, suggesting that any advantage could be limited unless buyers regain a critical level of resistance.

Technical Analysis

By Edris Dalakshi

Daily Charts

The daily structure of ETH remains grossly awful. The asset continues to fall below the 200-day moving average around the $2,800 mark, and has printed multiple low highs and lows over the past two months. After falling below the $1,800-$2,000 range last week, ETH has struggled to hold its $1,550 support zone.

Additionally, RSI remains restrained, hovering just above oversold levels, and momentum indicators do not show strong bullish divergence. A break below $1,550 opens the doors around $1,300-$1,400 heading towards the next major demand zone, but will have to collect $1,900 to slow down the current bearish trend.

4-hour chart

In the four-hour time frame, ETH recently bounced back from $1,550 support, but now faces a major descending trendline that has served as a dynamic resistance for over a month. Currently, prices are testing the resistance range from $1,650 to $1,700.

A successful breakout and flip of this zone over the trend line could trigger a short-term rally to $1,800. However, sellers continue to operate on all bounces and the market structure still favors a low high unless ETH can hold above $1,700.

Emotional analysis

By Edris Dalakshi

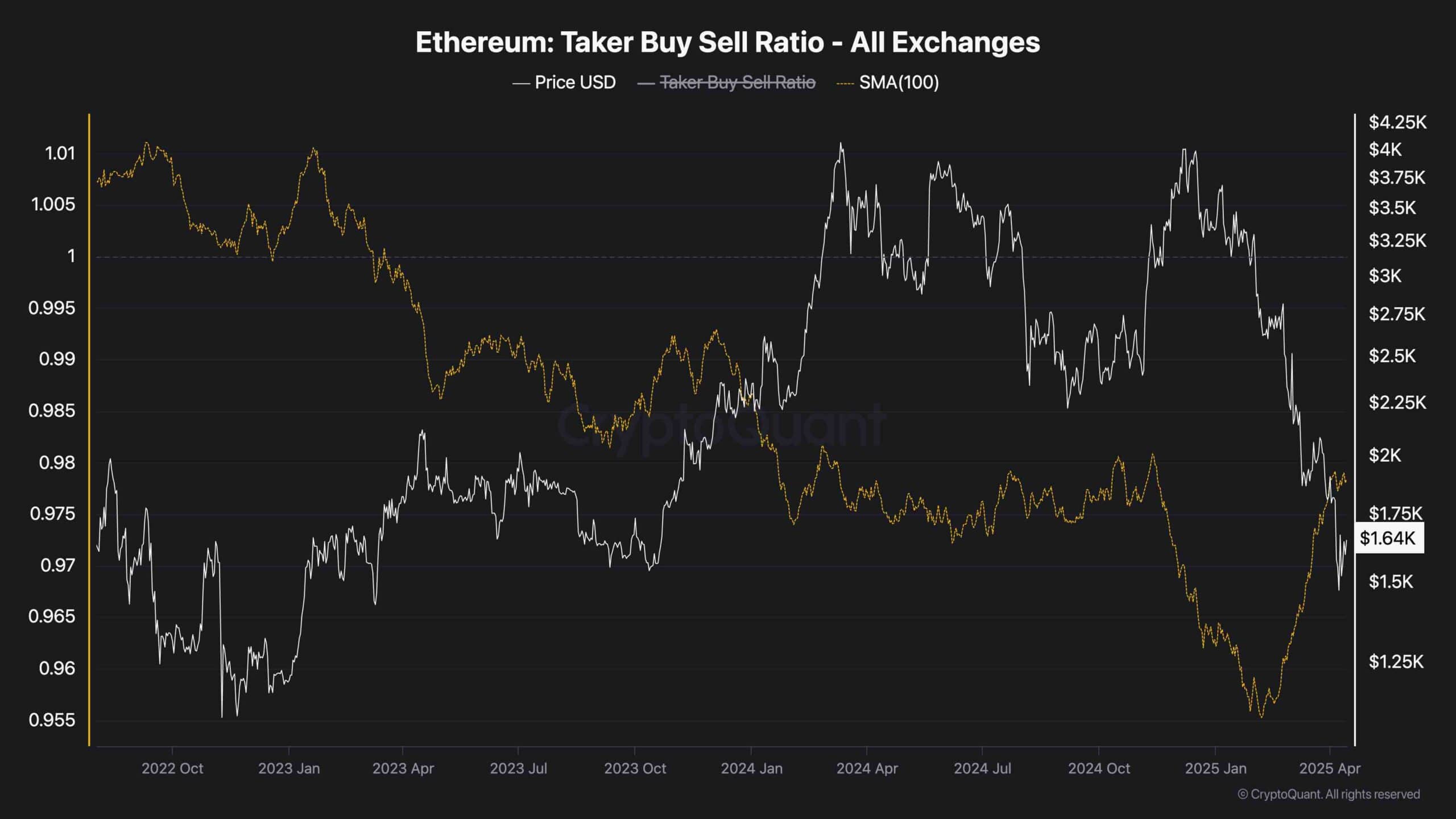

Taker purchase and sales ratio

Taker shows that market orders are primarily sales-driven with purchase and sales ratios for ETH trends below 1. Although there has been an increase recently, the overall trend remains bearish, suggesting that bounce is not supported by strong demand. This coincides with a lack of bullish belief in the chart.

Buyer attacks may remain weak until the ratio is critically maintained above 1. In short, emotions show lingering fear, and the broader trends are facing further downsides, unless buyers are able to force changes in structure and quantity.