Ethereum has been trading firmly above $2,600 after a surge in pressure purchases over the past few days, indicating a strong change in momentum in the broader market. After months of choppy behavior and bearish feelings, the bull is clearly in control. ETH has confirmed that it recovers several important levels and shows potential continuity to higher targets.

Price action now looks structurally bullish. Ethereum has been pushing through a zone of resistance that has been previously restricted upside down for several weeks. The rally rekindled investor confidence and brought new attention to Ethereum’s medium-term outlook, particularly as Altcoins began to show strength alongside Bitcoin’s recent integration.

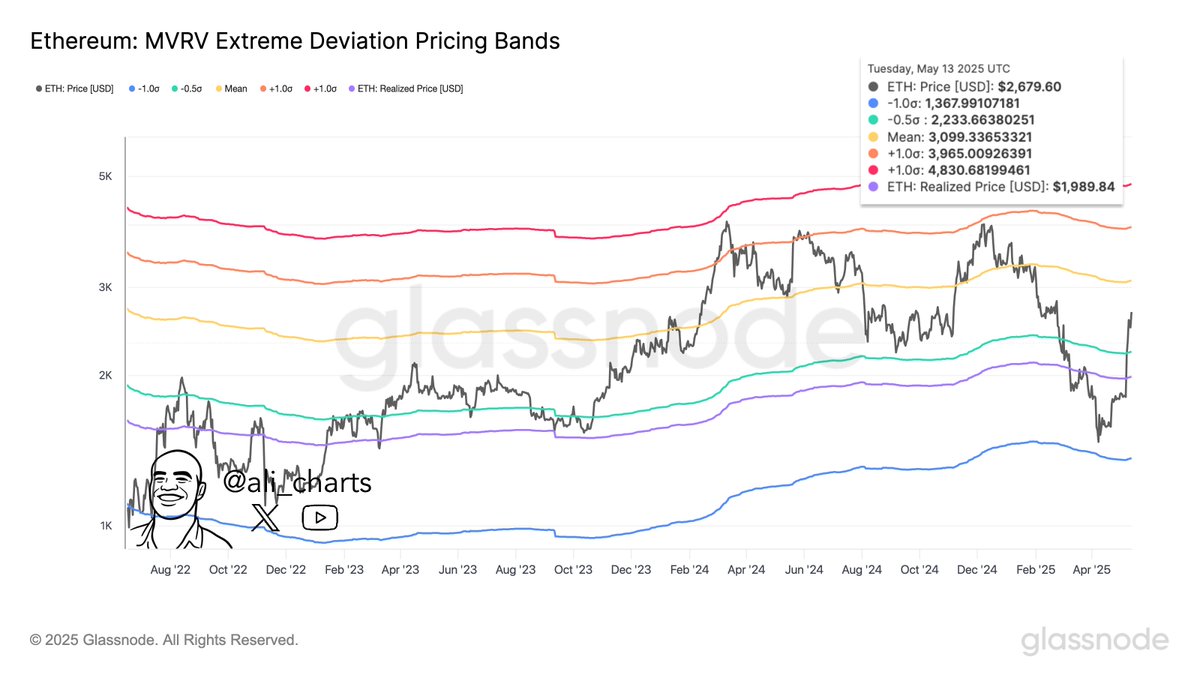

According to fresh data from GlassNode, the next major resistance area to watch is $3,100, and Ethereum could encounter heavier selling pressure. This level, derived from the price range, currently defines the current trading range for Ethereum and may determine price directions in future sessions. When volatility returns and sentiment increases, Ethereum is Critical Breakout Or a retest of decisive support, depending on how the Bulls handle the next leg.

Ethereum approaches critical resistance as Altseason expectations rise

Ethereum has recovered by over 98% since April 9th, marking one of the most powerful recovery in recent years. This explosive move not only overturned feelings from Beash to bullish, but also rekindled speculation around the wider alto season.

After months of intense sales pressure that began in late December, Ethereum is showing sustained strength for the first time. Prices have filled important levels and the momentum continues as traders and investors return capital to ETH and other large Altcoins. Market participants are looking closely to see if Ethereum can maintain this pace and to see a reversal of the long-term trend.

Top analyst Ari Martinez shared Ethereum’s MVRV extreme deviant price band and provided a clear technical framework for: Data shows the next key resistance level is $3,100. This is an area that could serve as a short-term ceiling if pressure fades. On the downside, the main support zone is $2,233, which is a significant level in the event of a pullback.

These levels become more and more important as Ethereum continues to climb. A clean breakout of over $3,100 can open the door to a wider assembly across altcoins, but a rejection or modification could test the market’s true beliefs. For now, ETH remains a bullish structure, supported by growing volume, chain signals and the enthusiasm of new investors. The next few days will be important in determining whether Ethereum will lead prices into the full-scale Alto season.

ETH Price Action: Testing Resistance after a Large Meeting

Ethereum (ETH) currently trades around $2,604, consolidating after a sharp surge that has increased from under $1,400 to under $1,400 to $2,725 in just two weeks. Daily charts show that ETH is currently approaching the 200-day Simple Moving Average (SMA) at $2,702.60. This serves as the main level of resistance. The zone also coincides with recent local highs since early February, making it an area that is important to break to continue further.

The recent rally has brought strong volume and bullish momentum, with ETH closing multiple daily candles at a 200-day index moving average (EMA) of $2,435.66. This is a positive sign of a trend reversal after months of sustained bear pressure. However, today’s pullback shows that the Bulls are losing steam as prices test this important resistance.

If ETH can consolidate the range of $2,500-$2,600 or more and break through 200 days of SMA with a compelling volume, the next upside target will be close to the $3,100 level, as mentioned in recent tech research. On the downside, it is essential to maintain support from over $2,435 to $2,450 to avoid deeper fixes. Over the next few days, we’ll be revealing whether Ethereum can turn this integration into a true breakout, or if more cooling is needed before the next leg goes up.

Dall-E special images, TradingView chart