In early May 2025, the Ethereum (ETH) market witnessed contrasting behavior from large investors, commonly known as whales.

These conflicting actions from whales present both risk and opportunity to investors.

Contrasting whale behavior

On the one hand, several Ethereum whales accumulate large amounts of ETH. ETH Whale purchased 3,029.6 ETH, worth $5.74 million. However, the whale is currently facing a temporary loss of $142,000 as its price has dropped to $1,842 per ETH.

On May 1, 2025, Lookonchain reported that multiple whale addresses had accumulated thousands of ETH within two hours. These actions indicate that some key investors are confident in the long-term potential of ETH despite short-term price volatility.

Meanwhile, sales pressure from Ethereum whales is important. On May 2, 2025, Onchainlens reported that the whales deposited 2,680 ETH on Kraken, with an estimated loss of approximately $255,000.

Meanwhile, analysts revealed that another whale had moved 3,000 ETH to Kraken within 10 minutes on the same day, strongly intended to sell.

In particular, whales that received 76,000 ETH during their 2015 ICO sold 6,000 ETH, potentially securing a profit of $109,900.

Additionally, on May 1, 2025, chain data was shown to include a whale that increases its short position by borrowing an additional 4,000 ETH. The whale brings a total short position to 10,000 ETH, worth around $18.4 million.

These moves highlight clear differences in Ethereum Whale Strategies, and accumulation and sales put a great deal of pressure on ETH prices.

Market context and investors’ feelings

The volatility of whale behavior coincides with crypto markets affected by a variety of factors. According to Beincrypto, ETH prices rose 10% in a week, but have dropped slightly in the past 24 hours. It’s hovering for around $1,842. This is a marked decline from the March 2025 peak of $2,500.

Ethereum price chart for the past month. Source: TradingView

Nevertheless, market sentiment shows some positive signs. Ethereum Investment Products also saw an inflow of US$183 million last week after continuing its eight weeks of outflow. The Ethereum Spot ETF had a total net inflow of USD 6.4932 million yesterday. This reflects sustained long-term interest from the agency, even amid short-term sales pressures from whales.

Furthermore, the large 10,000 ETH short position in whales suggests expectations of a short-term price drop, which could amplify downward pressure if market sentiment goes negative.

Meanwhile, retail investors appear to be affected by this uncertainty, with ETH trading volume dropping by 10% over the past 24 hours.

Risks and Opportunities

The whale’s conflicting behavior places investors at the intersection of risk and opportunity. On the risk side, especially given the excessive market situation, sales pressure from whales, particularly the important short positions, could lower ETH prices in the short term.

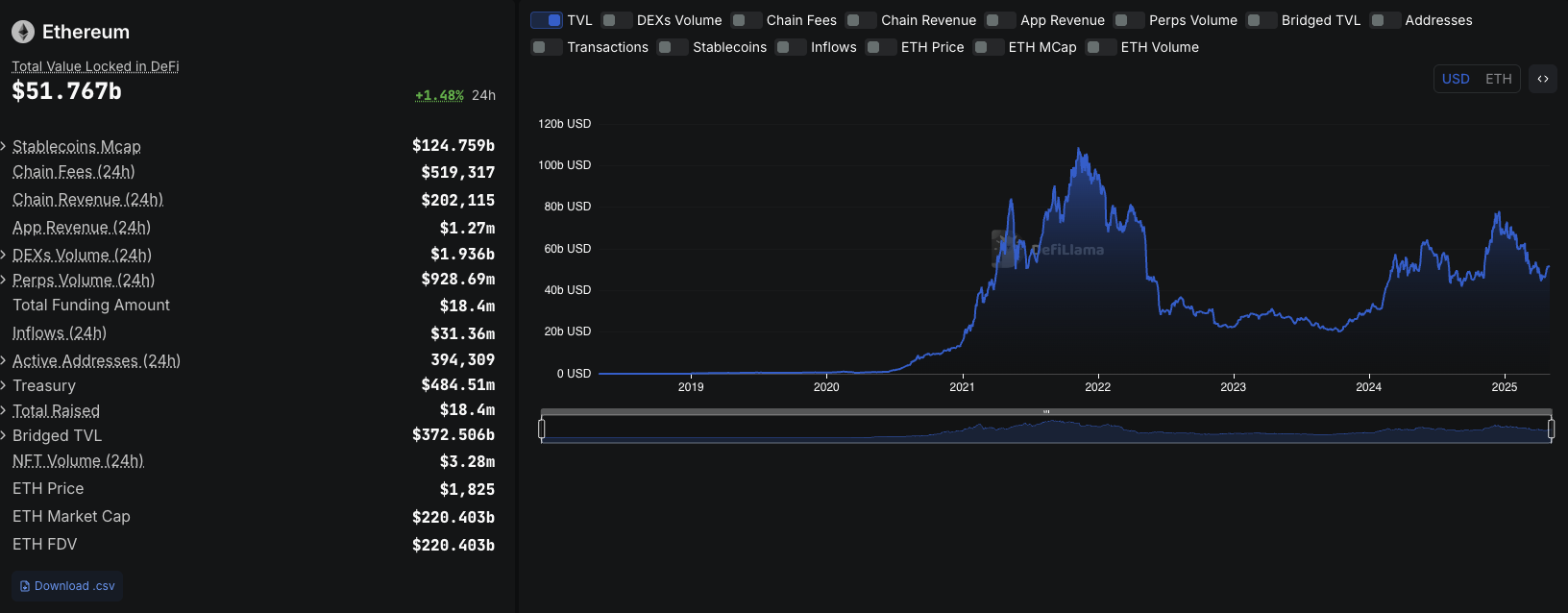

Ethereum tvl. Source: Defilama

But there are plenty of opportunities too. According to Defilama, the accumulation of thousands of whales reflects long-term confidence in the potential of Ethereum, especially as the network continues to lead in Defi, with a total of $52 billion (TVL) locked in May 2025.

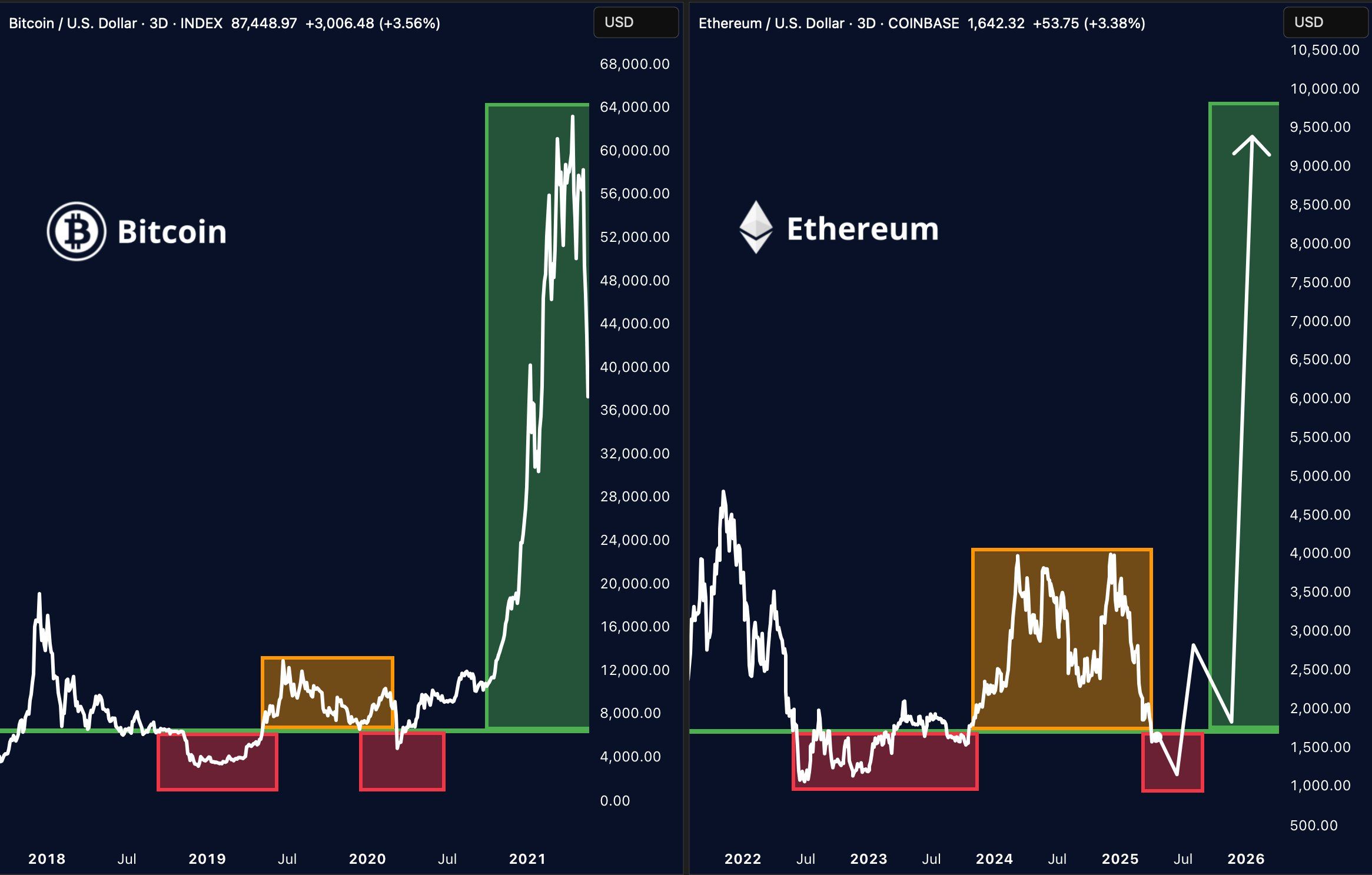

Analyst Merlijn shows that Ethereum’s current price structure is similar to Bitcoin’s 2020 price structure. Therefore, he believes that if history is repeated, Ethereum will witness a strong boom.

Ethereum shows the same structure. Source: Merlin

Ethereum risks losing developers to Solana. This is gaining momentum thanks to improved startup support and a streamlined user experience.

However, technological upgrades like Ethereum 2.0 and growth of layer 2 solutions such as Arbitrum and Optimism also supports the long-term development of ETH.

Investors may view current low price levels as an opportunity to accumulate, but whales’ activity and technical indicators need to be closely monitored to mitigate correction risk.