The Federal Reserve called for risky investments in stocks and real estate on Friday, dropping the warning a day after loosening the grip on the crypto rules.

The Fed’s financial stability report said asset prices remain “prominent” despite some markets hit earlier this month.

“Even after the recent decline in stock prices, prices remain higher than analysts’ earnings forecasts, and are adjusting slowly than market prices,” the report also revealed that Treasury yields stay over all maturities, close to the highest level anyone has seen since 2008.

The Federal Reserve also pointed out that it would use the market as a major issue, saying the risks of funding still appear to be serious. The report covering the market situation through April 11th said the funding market remained strong through a rough patch in early April, but that didn’t mean that everything went well.

The central bank noted that the losses in the fair value of fixed-rate assets remained “substantial” for some banks, and that these losses are highly sensitive to changes in interest rates.

The Federal Reserve leverages asset prices, liabilities and troubles

The Financial Stability Report solved how bad things can be seen in four larger areas. Starting with an asset valuation, he said the Federal Reserve remains expensive compared to revenues after the sale in April.

The Treasury yields remained stubbornly high, and spreading between corporate bonds and finances remained moderate. It had accumulated by the end of March and worsened in April, but the trading was still working.

On the real estate side, home prices remained high, and household price ratios hovered near record peaks. The commercial real estate index, tailored to inflation, showed some indications of leveling, but the Fed warned that the need for refinance could quickly cause problems.

The debt didn’t look that good. Business and household debt as a share of GDP fell to its lowest point in 20 years. However, business leverage remains high and private margin trading continues to rise.

Source: Federal Reserve System

Household debt was tamed compared to recent history. Most mortgages have fixed interest rates, low profit margins, and overall debt service ratios are a little better than before the pandemic. Still, the Fed has flagged an increase in credit card and car loan delinquency, especially for people with non-prime credit scores and low incomes.

When it comes to leverage, the Federal Reserve said banks still look healthy and capital levels are above the regulatory minimum. However, losses on fixed-rate assets continued to attack some banks strongly. Some banks, insurance companies and securitization stores also continued to pile up on commercial real estate.

The Fed said bank lending to banks to financial companies continues to climb thanks to better tracking methods. Hedge fund leverage is nearing the highest level of the past decade, with mostly more funded. Some leveraged investors have begun dumping positions to cover margin calls during volatility in April.

The Federal Reserve is flagging on financing risk and ongoing market vulnerabilities

The Federal Reserve said the risk of funding has slipped to moderate levels over the past year but has not disappeared. Liabilities like operational money remain near historic median and still pose long-term threats. Banks have reduced their reliance on uninsured deposits since the 2022 and 2023 highs.

Prime Money Market Funds looked good, but other cash vehicles with the same risk continue to grow. Bonds and loan funds saw a larger than usual outflow during market stress in early April, holding assets that could change illiquidity under pressure.

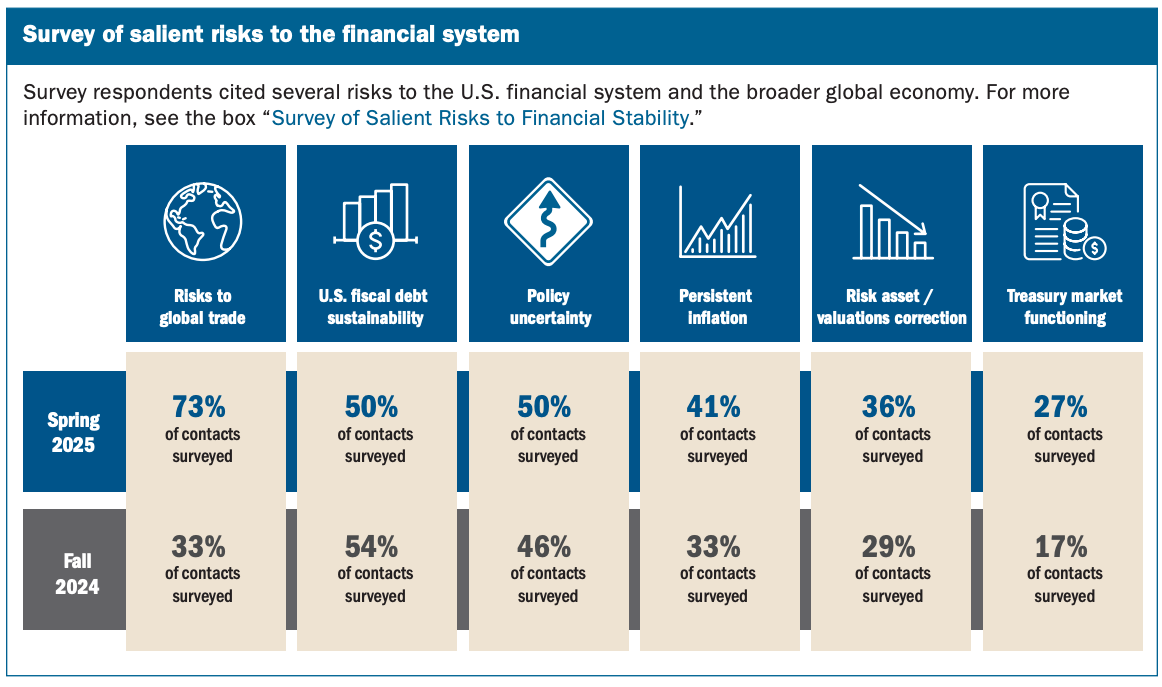

The Financial Stability Report also states that global trade risks, debt concerns and inflation are exacerbated. “Many respondents cited sustained inflation and correction in the asset market as a significant risk,” adding that most feedback was collected prior to April 2nd.

Just a day before it blasted stocks and real estate, the Federal Reserve repeated years of crypto restrictions. I removed the previous rules that told the bank to get pre-approval before doing anything with crypto. In an announcement Thursday, the Federal Reserve said, “These actions will ensure that board expectations are alongside evolving risks, further supporting innovation in the banking system.”